As Indian families continue to explore the EB-5 visa as a long-term immigration strategy, one of the first and most important questions is: What does the investment actually cost—and how do I know if it’s safe?

In Part 2 of our EB-5 blog and video series with EduFund’s Anand Patinge, we take a closer look at the true financial commitment of EB-5, what risks families should be aware of, and how to identify credible regional center partners.

The EB-5 Investment: What Does $800,000 Really Mean?

At the heart of the EB-5 program is a qualifying investment of $800,000 USD, when invested in a project located in a Targeted Employment Area (TEA)—which can be either:

- High-unemployment areas, or

- Rural areas as defined by the U.S. government.

Investments outside of these zones require a $1,050,000 minimum, but most Indian investors use the TEA designation to qualify for the lower $800,000 threshold.

It’s important to note: This is not a payment to the government. It is a real investment in a U.S. commercial enterprise—often a job-creating development project facilitated by a USCIS-designated regional center.

What Are the Total Costs?

The $800,000 investment is just one part of the equation. Indian families should also plan for:

- Legal fees

- Administrative or management fees charged by the regional center

- USCIS filing fees and other costs

Nick Buonagurio of CanAm explained it this way:

“Between the legal, administrative, and government fees, families should expect to spend an additional $75,000 to $100,000 on top of the $800,000 investment.”

Estimated Total: $875,000–$900,000 USD

These numbers can vary slightly depending on the attorney, project structure, and currency exchange rates, but they provide a realistic planning benchmark.

Evaluating Risk: How Do You Know It’s a Good Investment?

For most Indian parents, EB-5 isn’t just a financial transaction—it’s a major life decision made for the sake of their children’s future. So naturally, the top concern is risk. How do you know if an EB-5 investment is “safe”?

The answer isn’t simple—but it is manageable.

“Risk is not one data point,” said Nick. “It’s a holistic evaluation that includes the quality of the regional center, the structure of the financing, and where your EB-5 capital sits in the repayment structure.”

Key Questions to Ask:

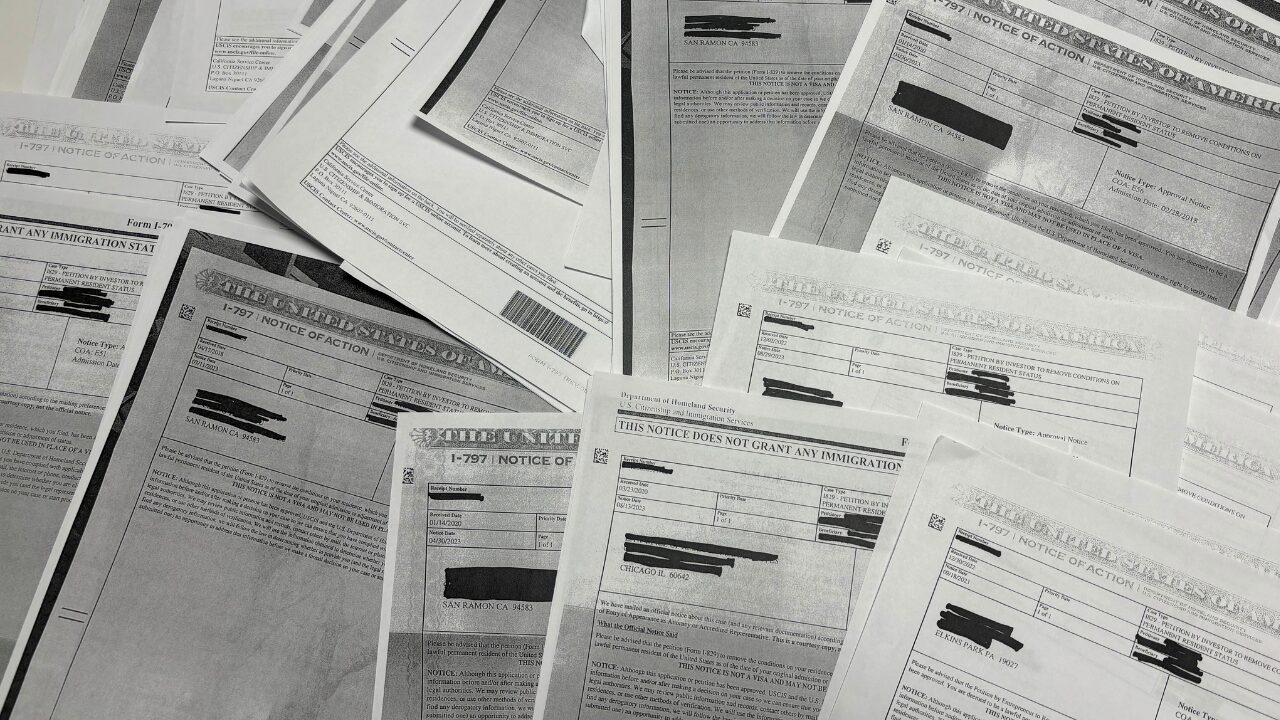

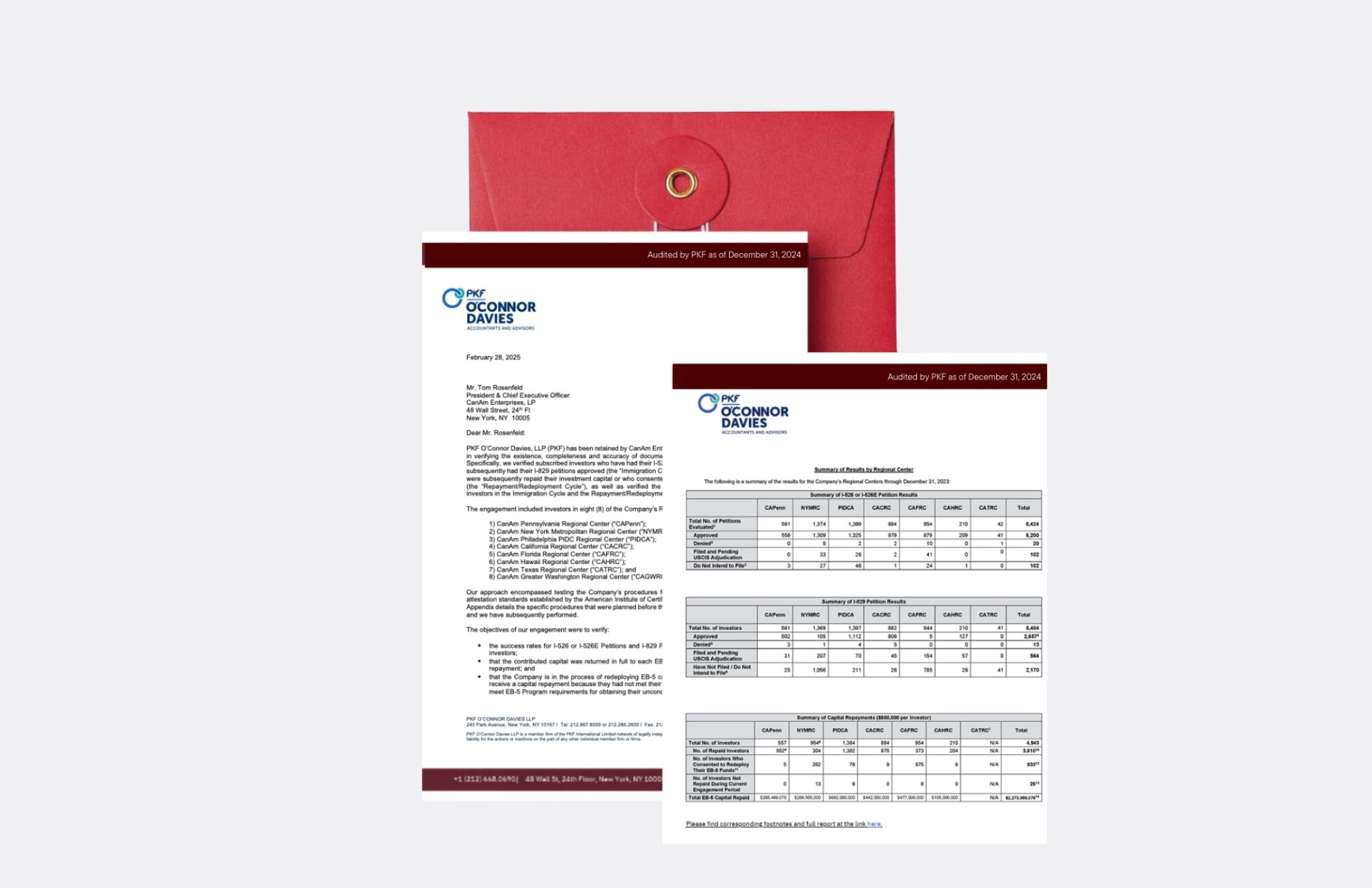

- Track Record: Has the regional center successfully obtained green cards and repaid capital to past investors?

- Project Structure: Is the project already under construction? Are other investors or lenders participating?

- Job Creation Buffer: Does the project create more jobs than required, giving you a cushion?

- Repayment Terms: Is your capital subordinate to senior lenders? When and how is repayment expected?

Why the Regional Center Matters

Most EB-5 investors today go through regional centers, which act as intermediaries—raising and managing the investment, working with developers, and ensuring job creation.

A reputable regional center can make or break your EB-5 experience. Look for one with:

- A long-standing presence in the industry

- A history of successful green card approvals

- A transparent project selection process

- A conservative approach to investor protections

“Families are often investing a significant portion of their savings,” Nick said. “So selecting the right partners—both your regional center and your immigration attorney—is essential.”

Keep in Mind: EB-5 Is Illiquid

One red flag Nick emphasized is overly optimistic promises—particularly around returns and timelines.

EB-5 capital is typically locked in for 5–6 years. During that time, the funds are illiquid and should not be counted on for other purposes like tuition or business expansion.

Returns are also minimal by design:

“After deductions and taxes, realized returns are often less than 0.25%,” Nick noted. “At CanAm, our job is to help investors get their green card and protect their principal—not to chase yield.”

The Bottom Line

The EB-5 program is not without cost or complexity. But for families seeking a more stable and flexible future in the United States, it can be a smart—and strategic—investment in that future.

Understanding the full cost, managing expectations, and choosing the right partners are the keys to success.

Coming Up Next:

In Part 3, we’ll dive into what Indian families need to know about documenting their source of funds, the green card timeline, and how concurrent filing can offer early benefits to students and H-1B visa holders.

Read Part 1 of the series here