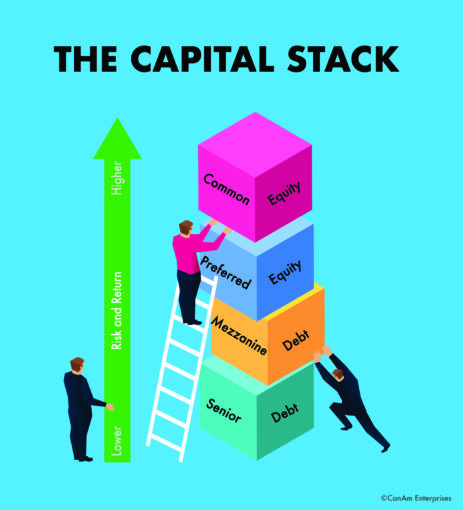

There are several layers of funding that support the financing framework of a real estate investment. When assembled in full, these layers are often referred to as a capital stack. The position of your investment in the capital stack determines the priority of payout and in turn, its relative risk/reward profile — from lower risk layers that deliver more modest returns, to higher risk ones that yield more rewarding ones.

The two primary building blocks of a capital stack are debt and equity. Both debt and equity have their own subsets, with different types of debt and equity available within them for use by investors. A common four-layer stack includes: 1) Senior debt; 2) Mezzanine debt; 3) Preferred equity; and 4) Common equity.

1) Senior debt typically refers to a mortgage lender or other debt holder. Senior debt lenders are paid before any other investor is given a return on their investment.

2) After operating expenses and senior debt payments are made, excess cash is used to pay Mezzanine debt. This is debt secured for the investor by a property lien.

3) Preferred equity is subordinate to debt in the priority of payment in the capital stack. With preferred equity, investors receive a fixed return with limited profit participation. Preferred equity investors are repaid the original amount of their investments at a set date (maturity date) or when the property is sold (see a more detailed explanation below).

4) Common equity holders are paid in the form of a preferred return on their investment once all other parts of the capital stack have been paid. They can also participate in property cash flow distributions.

Preferred equity is a way of investing in real estate without taking on the responsibility of direct ownership.

A preferred equity investment is the most senior equity investment. Investors are repaid sooner than common equity shareholders and bear less risk if a real estate deal underperforms. On the other hand, a preferred equity investment has limited upside potential if a project goes well. Investors will continue to receive an agreed-upon fixed rate of return on their capital with no share of the upside of returns.

A Closer Look at Preferred Equity

Preferred equity and mezzanine debt are similar in structure. Earlier this year, we published a paper comparing these investments: https://canamcapital.com/mezzanine-debt-vs-preferred-equity/

In volatile, uncertain market environments, preferred equity investments tend to be more attractive to investors. They can offer a more secure, stable investment with a fixed rate of return. They tend to have more upside potential than senior debt-based real estate investments and more downside protection than common equity.

As with any investment opportunity, it is important to conduct careful due diligence and work with a trusted advisor to make sure that the return warrants the risk you are taking with your principal. It also is wise to make sure that an investment is a good match for your tolerance for risk, as well as your investment goals and objectives.

This document does not constitute an offer to sell any security and should not be relied upon to make an investment decision.

CanAm Enterprises, with over three decades of experience promoting immigration-linked investments in the US and Canada, has a demonstrated track record of success. With over 60 financed projects and $3 billion in raised EB-5 investments, CanAm has earned a reputation for credibility and trust. To date, CanAm has repaid more than $2.26 billion in EB-5 capital from over 4,530 families. CanAm manages several USCIS-designated regional centers that stretch across multiple states. For more information, please visit www.canamenterprises.com.