By Goldi Chawla

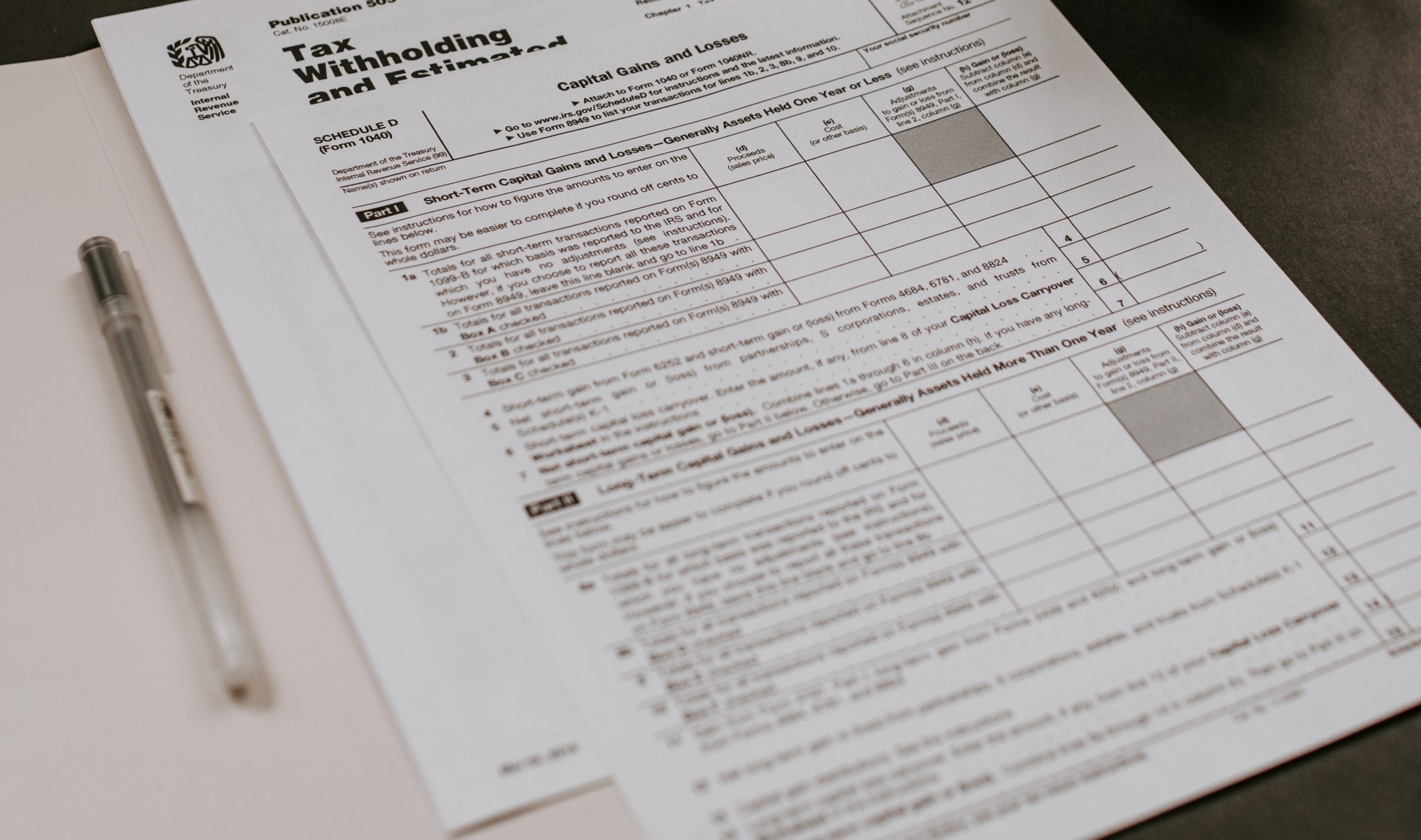

It’s important to note the tax benefits associated with the EB-5 can vary depending on an investor’s circumstances and should be carefully considered in consultation with a qualified tax professional

The EB-5 visa programme is one of the options available for foreign nationals who wish to obtain permanent residency in the United States. It is also known as the “investor visa” because it requires the applicant to invest significantly in a new or existing US business as a criterion for a US green card for themselves, their spouse, and their qualifying children. The popularity of this visa is surging in India, primarily because of the freedoms and benefits it affords to travel, study, and work within the US. But as Indians weigh how and when to send their investment to the US to participate in the EB-5 programme, there’s a new sense of urgency — a proposed tax increase on outbound money transfers.

The EB-5 Path To A US Green Card

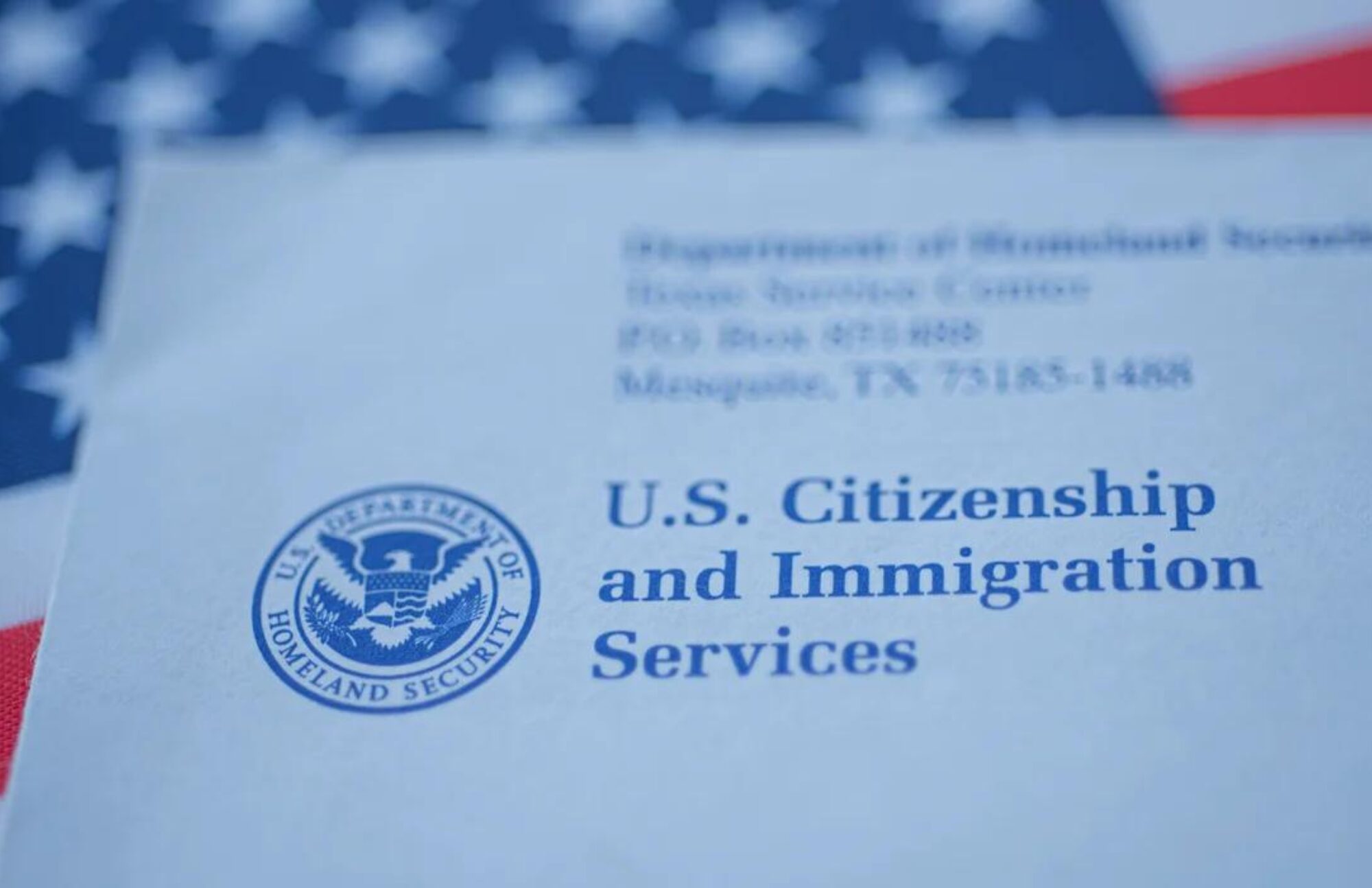

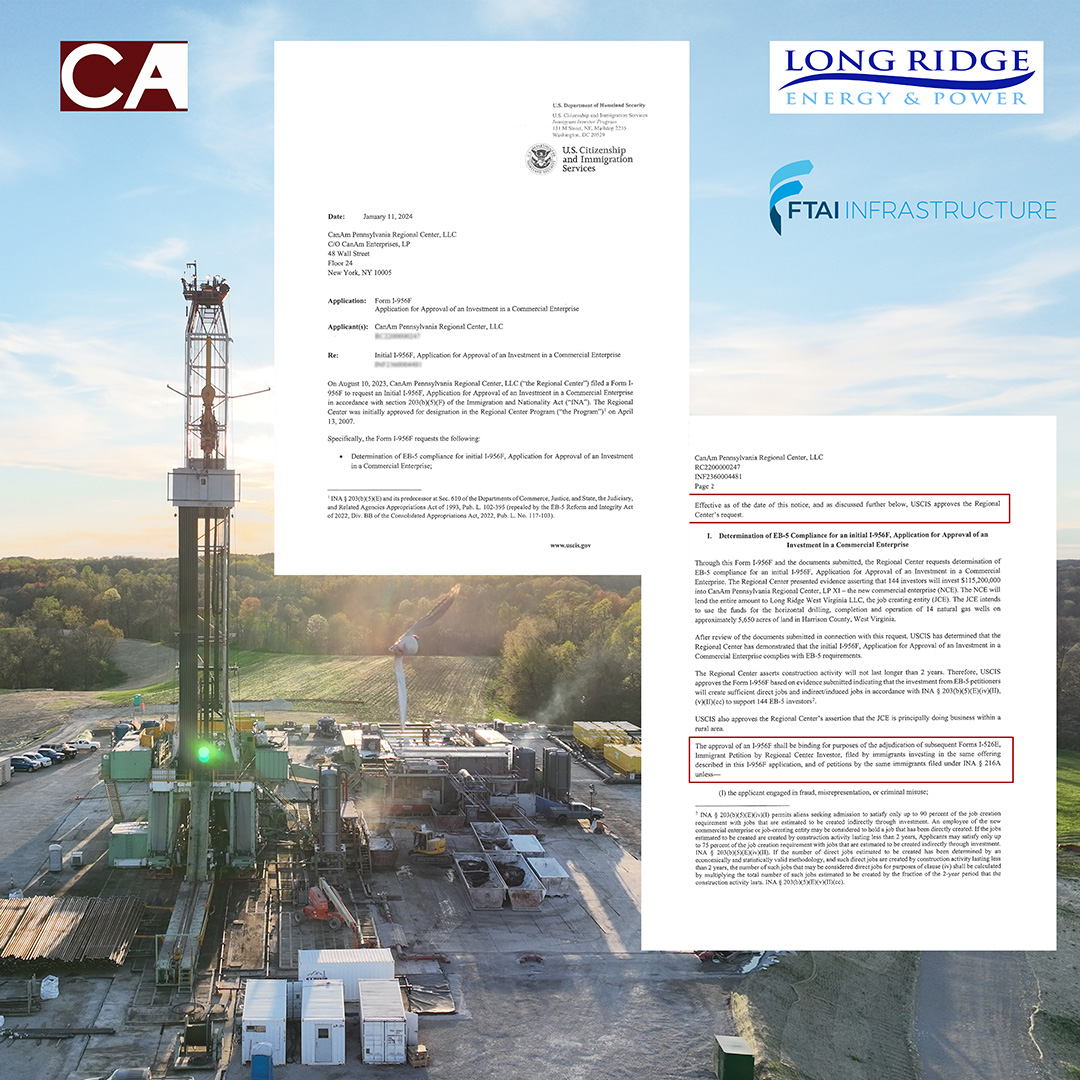

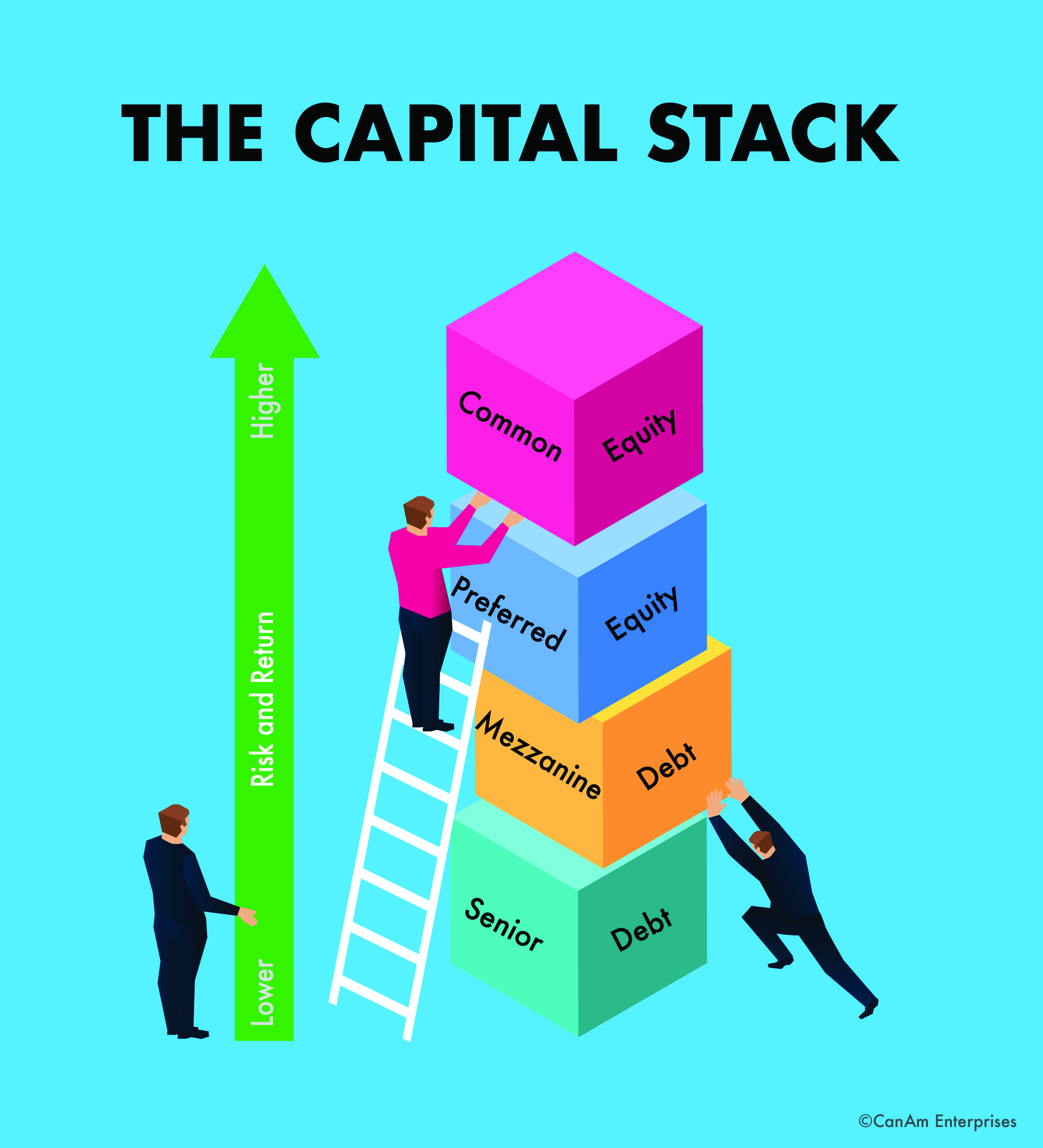

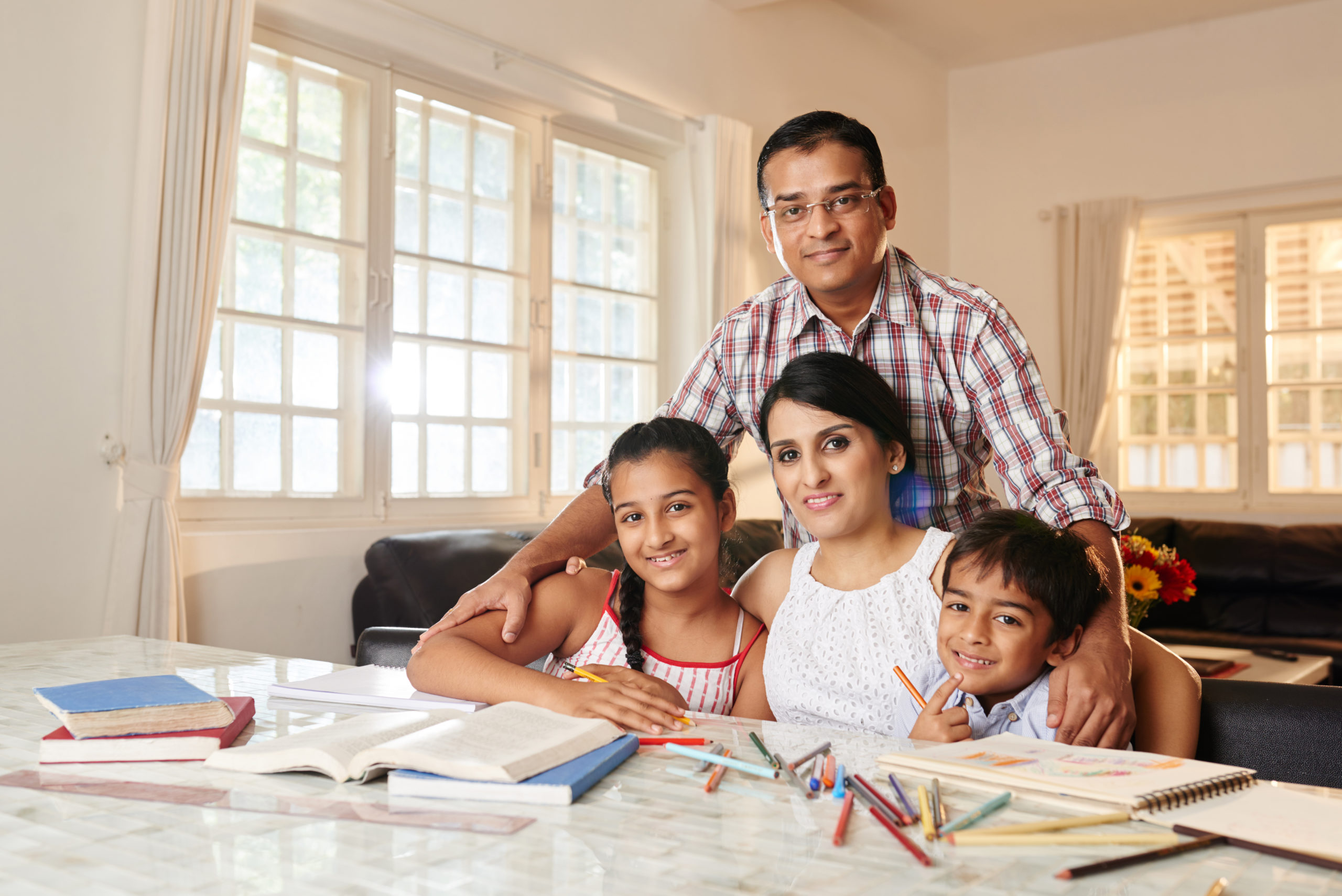

About 95 per cent of EB-5 investments are managed by EB-5 Regional Centers that are designated to assist immigrant investors by the United States Citizenship and Immigration Services (USCIS). The EB-5 Visa allows you the opportunity to invest capital that builds a future for yourself and your family. As an investor, you can bring your spouse and children under 21-year-old to the United States through a conditional green card awarded to you through the program. If you wish to become a US citizen, your two years as a conditional permanent resident is credited towards the five-year lawful permanent residency requirement for US citizenship. You may apply for US citizenship after this five-year period.

The EB-5 visa programme has specific requirements and criteria that must be met, including a minimum investment amount, job creation requirements, and compliance with securities laws. So, investors must always consult with an experienced immigration attorney to understand the eligibility criteria and determine if the EB-5 visa best fits your circumstances.

The Proposed India Tax Impact

The Union Budget 2023 unveiled several new restrictions that would affect EB-5 investments coming through India’s banking system, including higher taxes on outward financial transfers from the nation. After Parliament approved, the central government introduced an income tax on outgoing transfers that would apply to EB-5 investments and include a 20 per cent tax-collected-at-source (TCS). This tax is expected to start taking effect on July 1, 2023. This would be a significant rise compared to the current TCS rate of 5 per cent. The proposed rule states that to enable a net wire of $800,000, one will have to make available an amount almost the equivalent of $1,000,000.

The EB-5 Difference

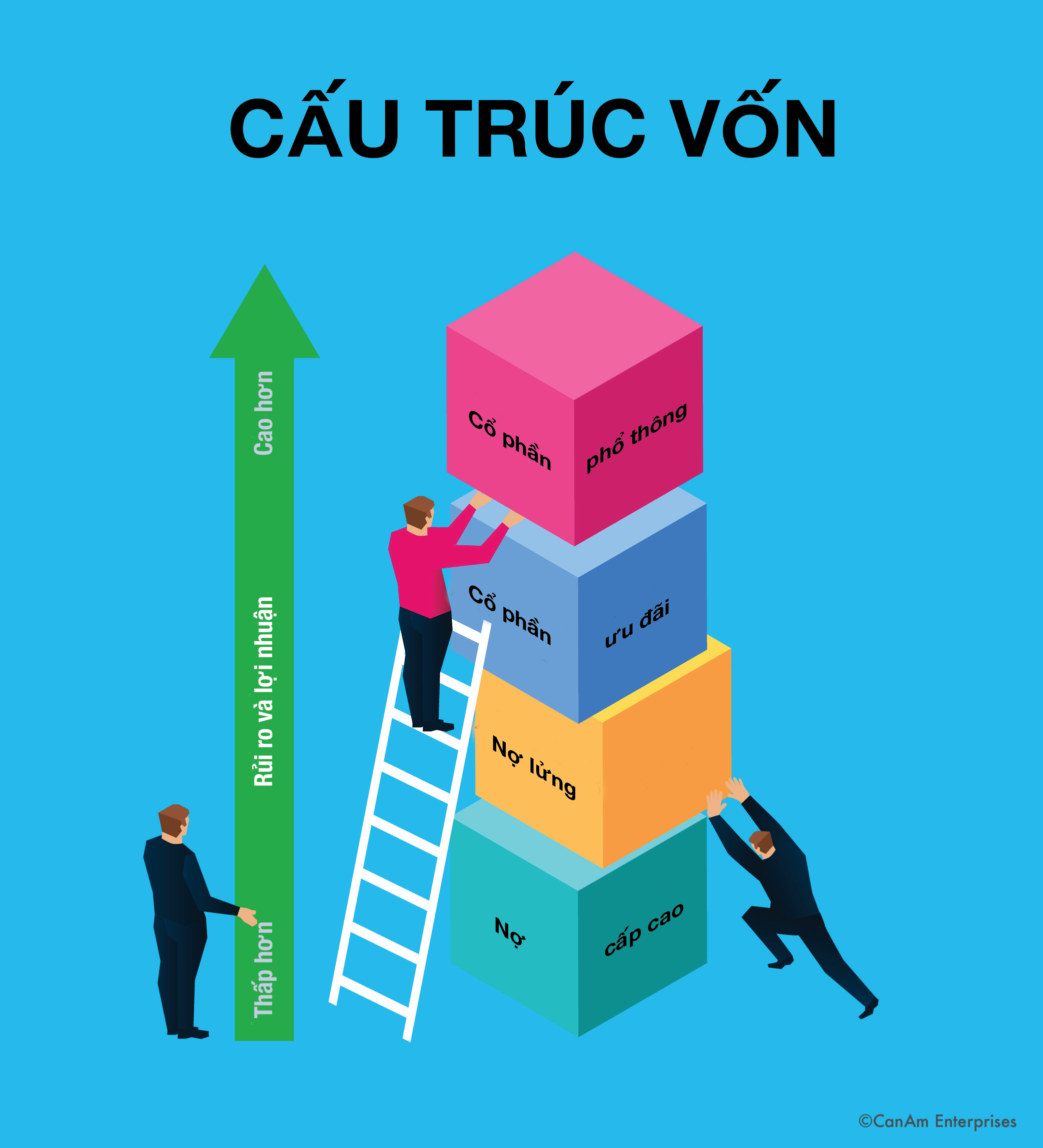

While there is no one-size-fits-all answer to whether the EB-5 visa is the best possible route for US residency, there are several reasons why it can be a desirable option:

- No employment or education requirements: Unlike other visa programs, the EB-5 visa does not require the applicant to have a specific job offer or meet certain educational requirements.

- No sponsorship needed: The EB-5 visa allows for self-sponsorship, meaning the applicant can apply on their behalf, and it does not need an employer or family member to sponsor them.

- Admission advantages and reduced tuition costs available for immigrant investors and family members studying at US universities.

- The EB-5 visa allows applicants to invest in various industries and regions, providing flexibility to accommodate different investor preferences.

- Priority visa processing to applications tied to select project categories, such as projects that meet USCIS criteria for being in a designated “rural area”.

It’s important to note that the tax benefits associated with the EB-5 programme can vary depending on an investor’s circumstances and should be carefully considered in consultation with a qualified tax professional. Additionally, investors should comply with all applicable tax laws and regulations in both countries: US and India.

To be clear, the EB-5 visa programme is not designed to help individuals beat tax increases on outbound money transfers specifically. However, there are some general strategies that EB-5 investors may consider to mitigate the impact of such tax increases, such as an EB-5 investment through a designated Regional Center in advance to the tax increase’s effective date.

Another strategy is to work with an experienced financial or tax advisor who can help the investor structure their investment and transfer of funds tax-efficiently. This may involve specific tax planning tools, such as establishing offshore accounts or utilising tax treaties between the US and the investor’s home country.

More On When and How the Tax Increase is Felt

The outbound money transfer tax can be reclaimed on tax returns, which may look like a prolonged process, but it’s not. Tax Collection at Source (TCS) is a type of advance tax that can be offset against other tax liabilities when you complete your annual tax returns; it is not an additional tax. Rich Indians will therefore need to budget 20 per cent more when sending money for foreign investments beginning July 1, 2023, and be ready to hold onto this 20 per cent sum for a few months until they can recoup it from the tax authorities.

Any EB-5 investor should consider if the TCS payment will be refundable. Again, the best guidance is to consult with an experienced financial or tax advisor, but the answer is yes. You only need to file your tax returns and request an adjustment to the TCS. You can also file for a tax refund if your net liability is negative. The most reliable strategy to avoid the 20 per cent TCS is to start the transfers before the deadline of July 1, 2023. Before the new system takes effect in July, performing these transactions at the current 5 per cent TCS rate might be more effective.

In the months leading up to July 1, 2023, the announcement to raise the TCS on overseas remittances will enhance demand for foreign investment choices like the EB-5 programme. That seems the government is moving in the direction of making international transfers more difficult for Indian investors and will keep doing so in the future. Hence, using the current system while it is still in place makes sense.

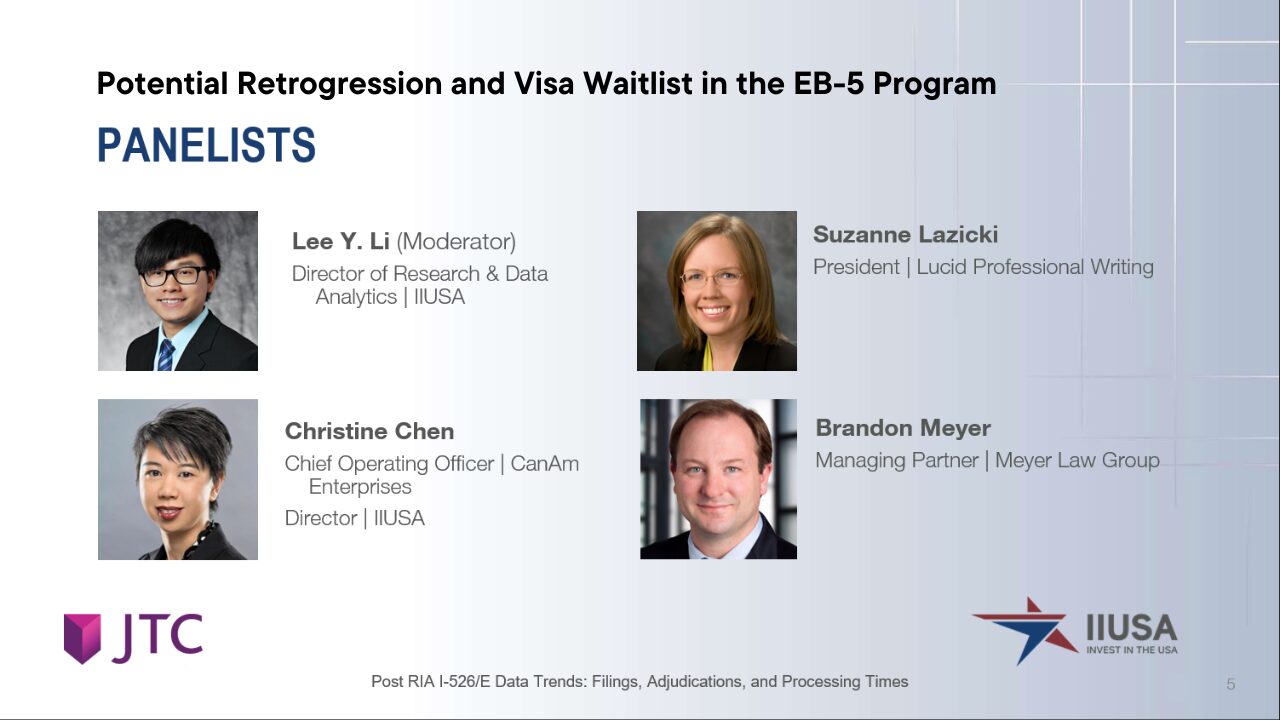

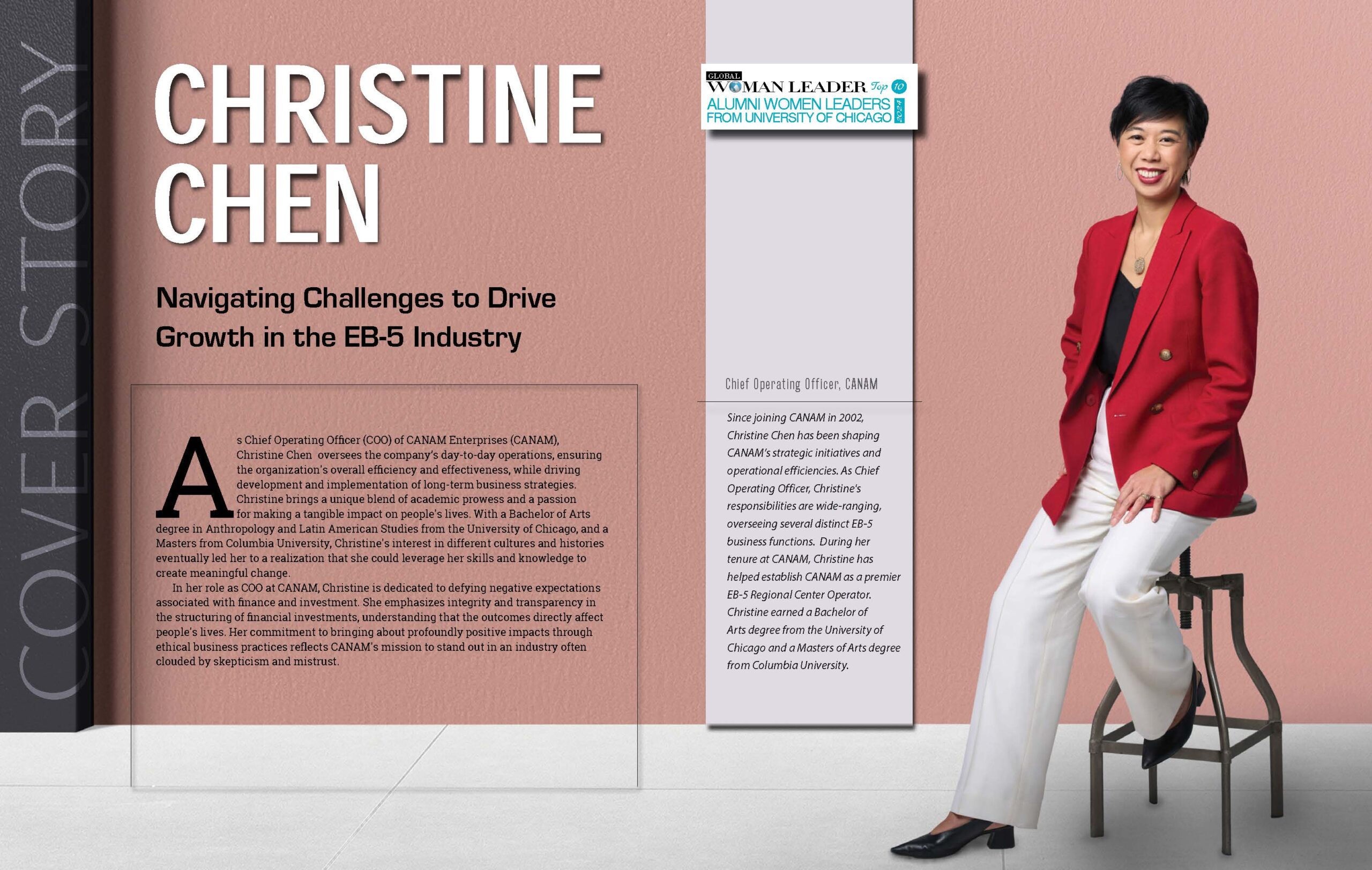

The author is regional representative, India and the Middle East, CanAm Enterprises

[Disclaimer: The opinions, beliefs, and views expressed by the various authors and forum participants on this website are personal and do not reflect the opinions, beliefs, and views of ABP News Network Pvt Ltd.]

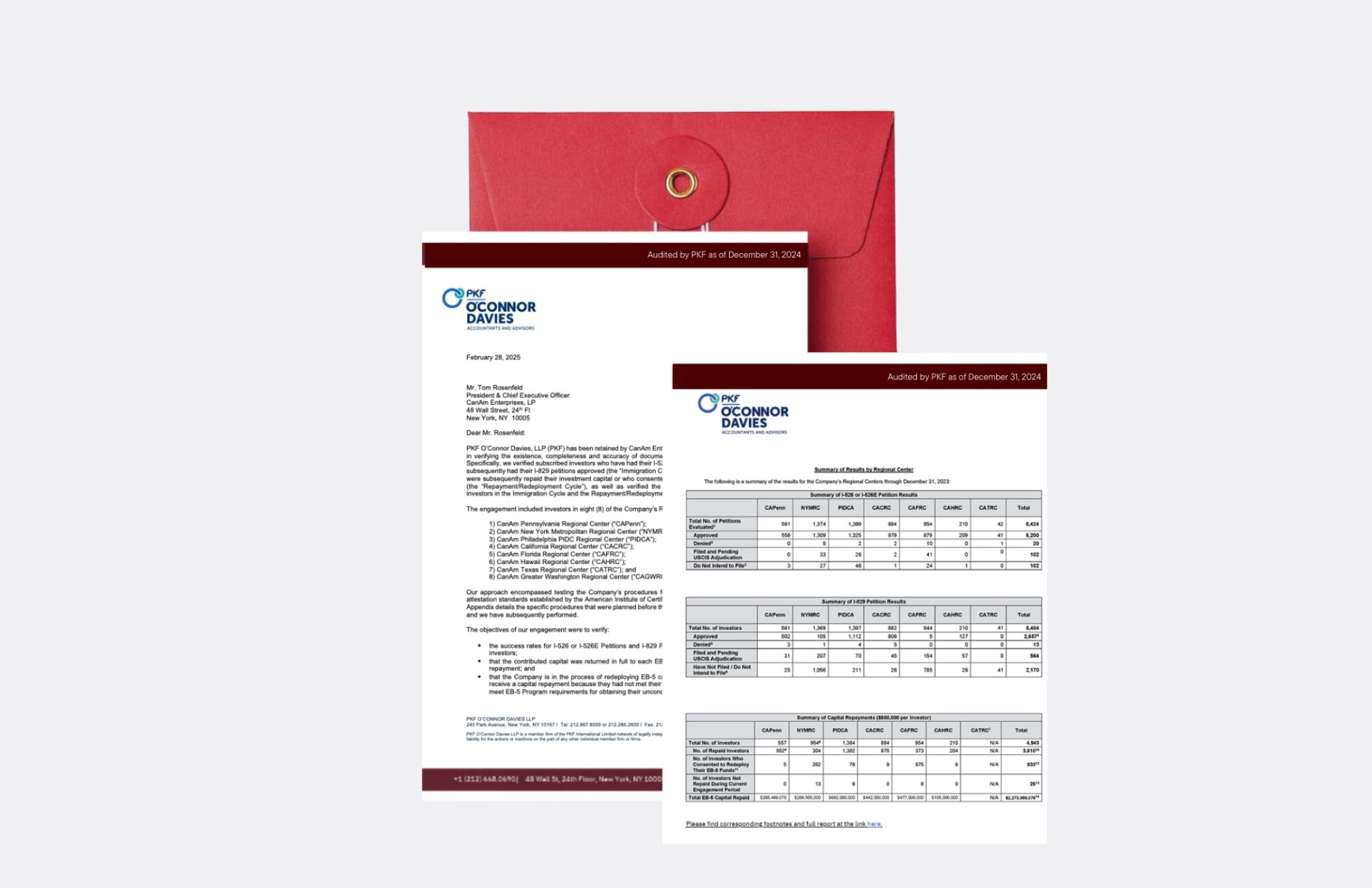

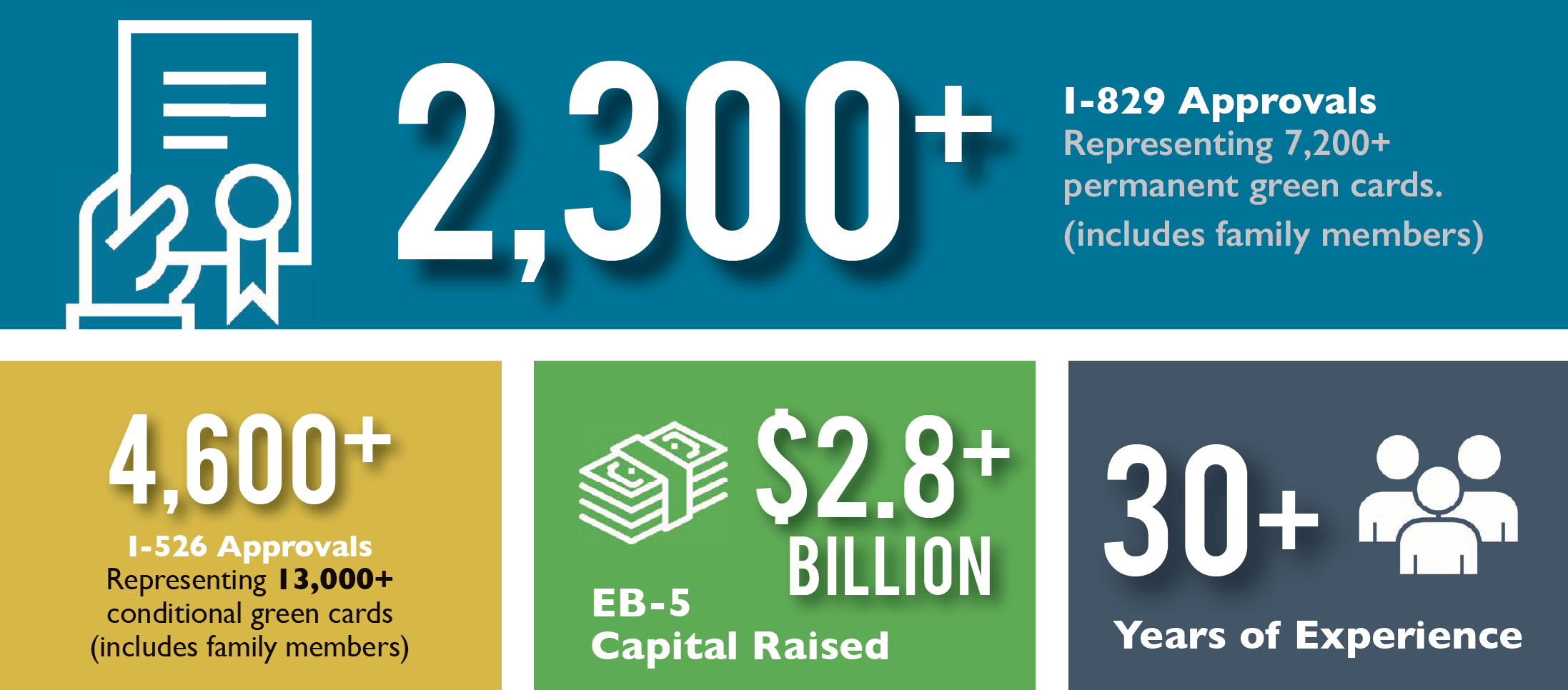

CanAm Enterprises, with over three decades of experience promoting immigration-linked investments in the US and Canada, has a demonstrated track record of success. With over 60 financed projects and $3 billion in raised EB-5 investments, CanAm has earned a reputation for credibility and trust. To date, CanAm has repaid more than $2.26 billion in EB-5 capital from over 4,530 families. CanAm manages several USCIS-designated regional centers that stretch across multiple states. For more information, please visit www.canamenterprises.com.