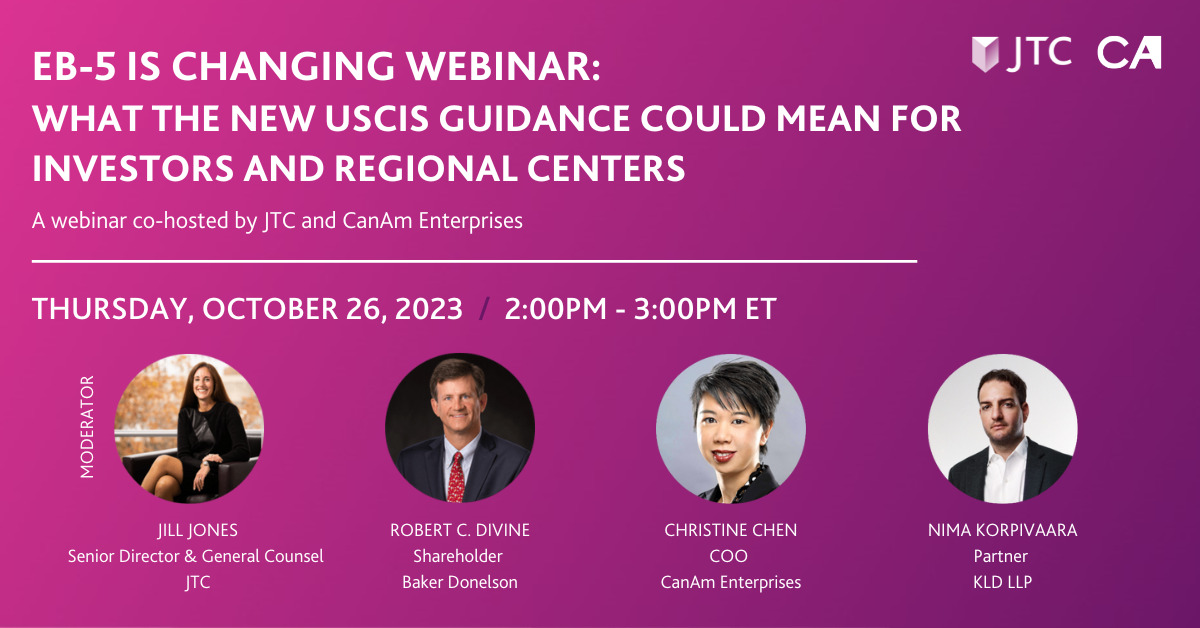

Capital redeployment is one of the most important issues concerning EB-5 investors today. It impacts both existing investors, particularly those subject to EB-5 visa backlogs, and prospective investors, who in addition to evaluating the merits and suitability of an EB-5 investment must now consider the potential reinvestment of their capital following repayment of the original EB-5 investment. This article provides helpful background information regarding current USCIS policy on redeployment and discusses how CanAm Enterprises (“CanAm”), one of the leading EB-5 operators, has established a transparent, investor-focused approach that prioritizes its investors’ specific immigration and financial needs and objectives.

Redeployment in a Nutshell

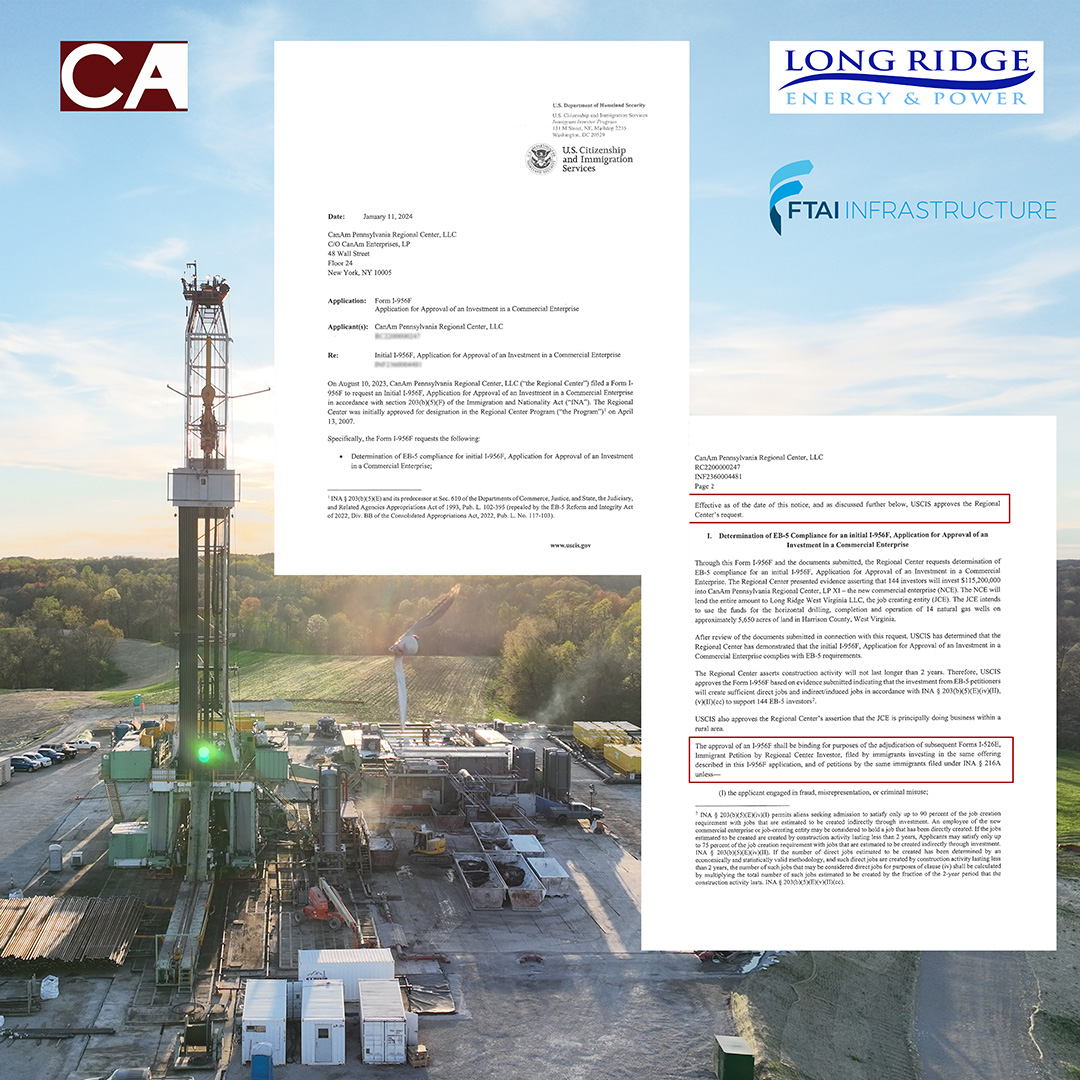

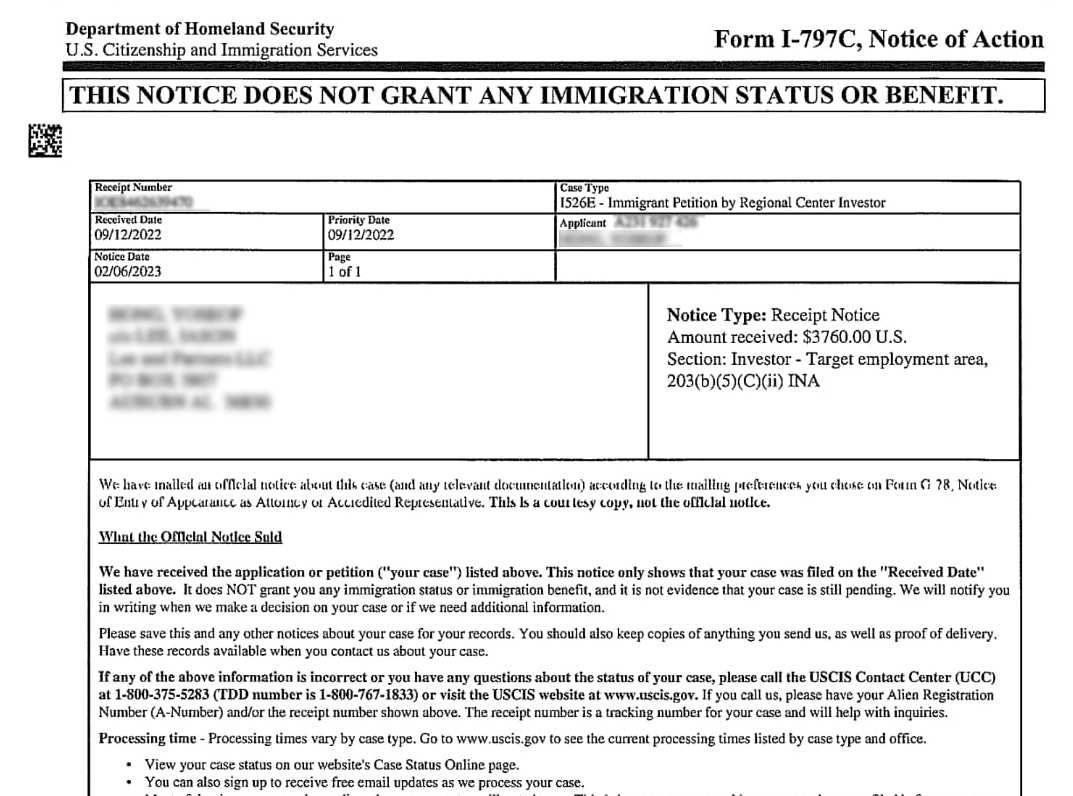

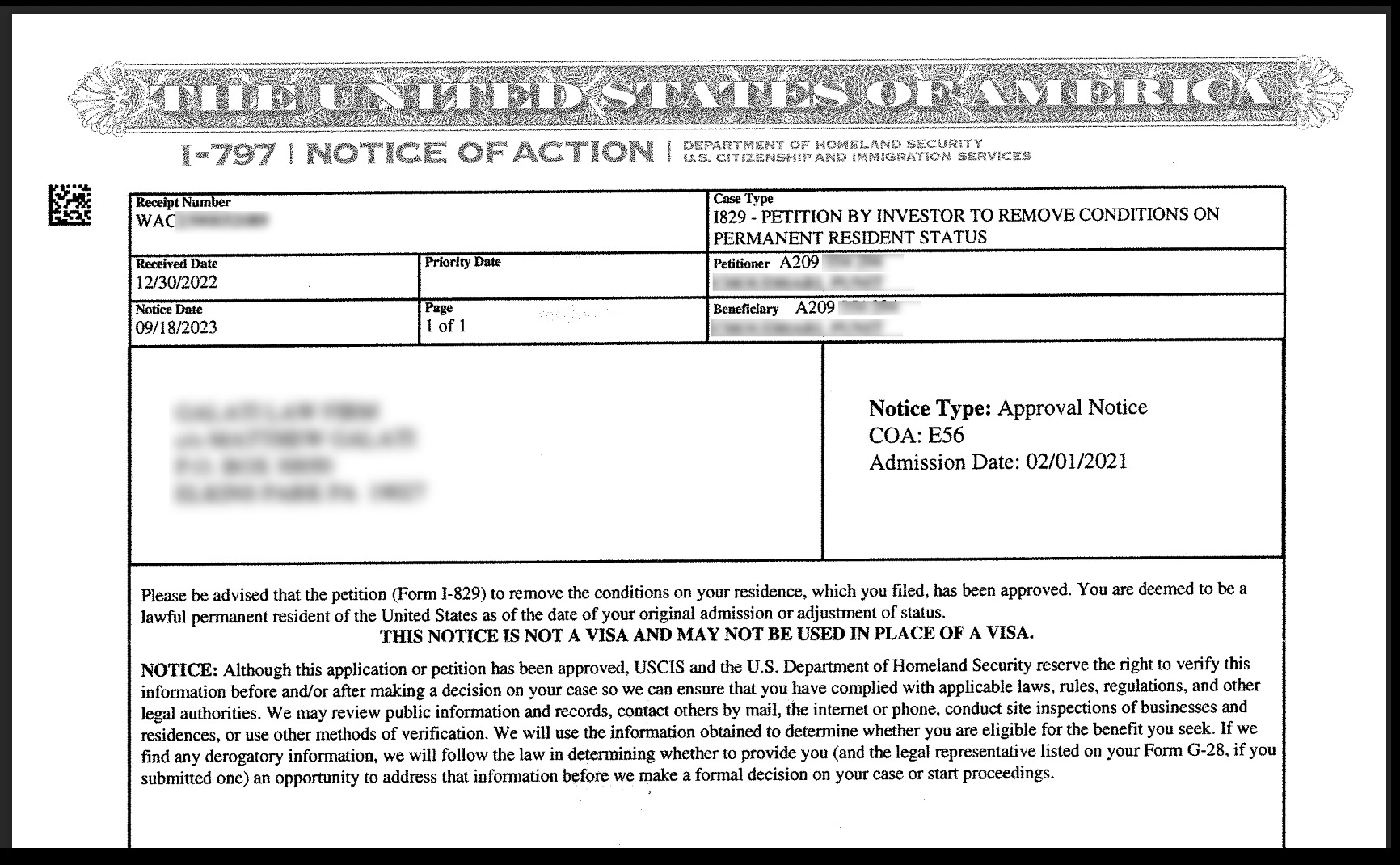

Redeployment involves the reinvestment of all or a portion of capital following the repayment or disposition of the original EB-5 investment made through a qualifying new commercial enterprise (“NCE”) typically structured as a limited partnership. The requirement that immigrant investors maintain their capital investment “at-risk” over the two years of conditional lawful permanent residence (LPR) has always been an essential requirement of the EB-5 Program. The concept of redeployment has now been incorporated into the USCIS Policy Manual to address immigrant investors who have not completed their two-year conditional residence period before the original EB-5 investment is repaid.

EB-5 Redeployment Explainer Video

Why Is There a Need to Redeploy EB-5 Capital?

The Immigration and Nationality Act sets an annual limit on the number of EB-5 visas that may be issued at 10,000. Notably, this number includes both the principal investor and his or her spouse as well as unmarried children under the age of 21. Thus, if every EB-5 petition includes three family members, all 10,000 EB-5 visas would be used up by some 3,300 EB-5 petitions each year. In addition to the overall annual limit of 10,000 EB-5 visas, there is also a per-country cap of 7%, or 700 EB-5 visas. When it appears that the 10,000 EB-5-visa limit will be met in a given fiscal year, and also that a country will use up its individual 700 EB-5 visa allocation, the U.S. Department of State will impose a “cut-off” date for the issuance of EB-5 visas to immigrants from that country. This is called retrogression.

Historically, the overwhelming majority of the 10,000 annual EB-5 visas (likely over 90%) were allocated to immigrants from mainland China notwithstanding the 7% per country cap. This was possible because global demand for EB-5 visas outside of China was relatively minor, so any “unused” or “leftover” visas from other countries were allocated to Chinese immigrants. As the popularity of the EB-5 Program skyrocketed within China over the last five years, and also grew significantly in other countries such as Vietnam, Korea, and India, the global demand for EB-5 visas has far exceeded the 10,000 annual limit, leading to retrogression being announced for mainland China starting in May 2015 and Vietnam in May 2018.

When there were no EB-5 visa backlogs and I-829 Petition adjudication times were relatively short, it was reasonable to expect that the EB-5 capital would still be in use to the job-creating enterprise (“JCE”) at the time that an EB-5 investor completed his or her two-year conditional residence period and/or received an I-829 Petition approval.

However, as I-526 Petition adjudication times have increased (now 21-27 months) and with retrogression causing EB-5 visa backlogs in major markets such as China and Vietnam and projected for other countries in the coming year, the original EB-5 investments will be repaid before some immigrant investors have completed or even begun their conditional residency periods. These immigrant investors, according to the USCIS Policy Manual, must continue to keep their capital “at risk” by having the NCE reinvest the investor’s capital into another investment that meets certain criteria described below.

Overview of USCIS Policy Guidelines on EB-5 Redeployment

In June 2017, the USCIS updated the Policy Manual to clarify that even after the required number of jobs have been created by the original EB-5 investment, an investor must sustain the investment throughout his or her conditional LPR period. In this regard, redeployment, or “further deployment” in another investment as it is called in the Policy Manual, may be used to satisfy the capital-at-risk requirement. The Policy Manual further states that any redeployment of capital after satisfaction of the job-creation requirement must have the following three “at-risk” components:

- The immigrant investor must have placed the required amount of capital at risk for the purpose of generating a return on the capital placed at risk;

- There must be a risk of loss and a chance for gain; and

- Business activity must actually be undertaken

Clearly, a number of investments may meet these three “at risk” requirements. The Policy Manual provides only two examples – namely a redeployment into another construction project or new issue municipal bonds, such as for infrastructure spending – but USCIS has yet to provide additional guidance or further clarification on its redeployment requirements. While the EB-5 stakeholder community is presently advocating for USCIS to confirm that the scope of permissible redeployment vehicles (for example, to include any investments in marketable securities) is broader than these two examples, the USCIS has yet to do so.

What Redeployment Options Are Currently Available in the EB-5 Marketplace?

With this lack of clarification, it is not surprising that most of the current EB-5 redeployment platforms mirror the two examples that are explicitly mentioned in the USCIS Policy Manual – namely, investments into real estate assets and/or investments in municipal bonds.

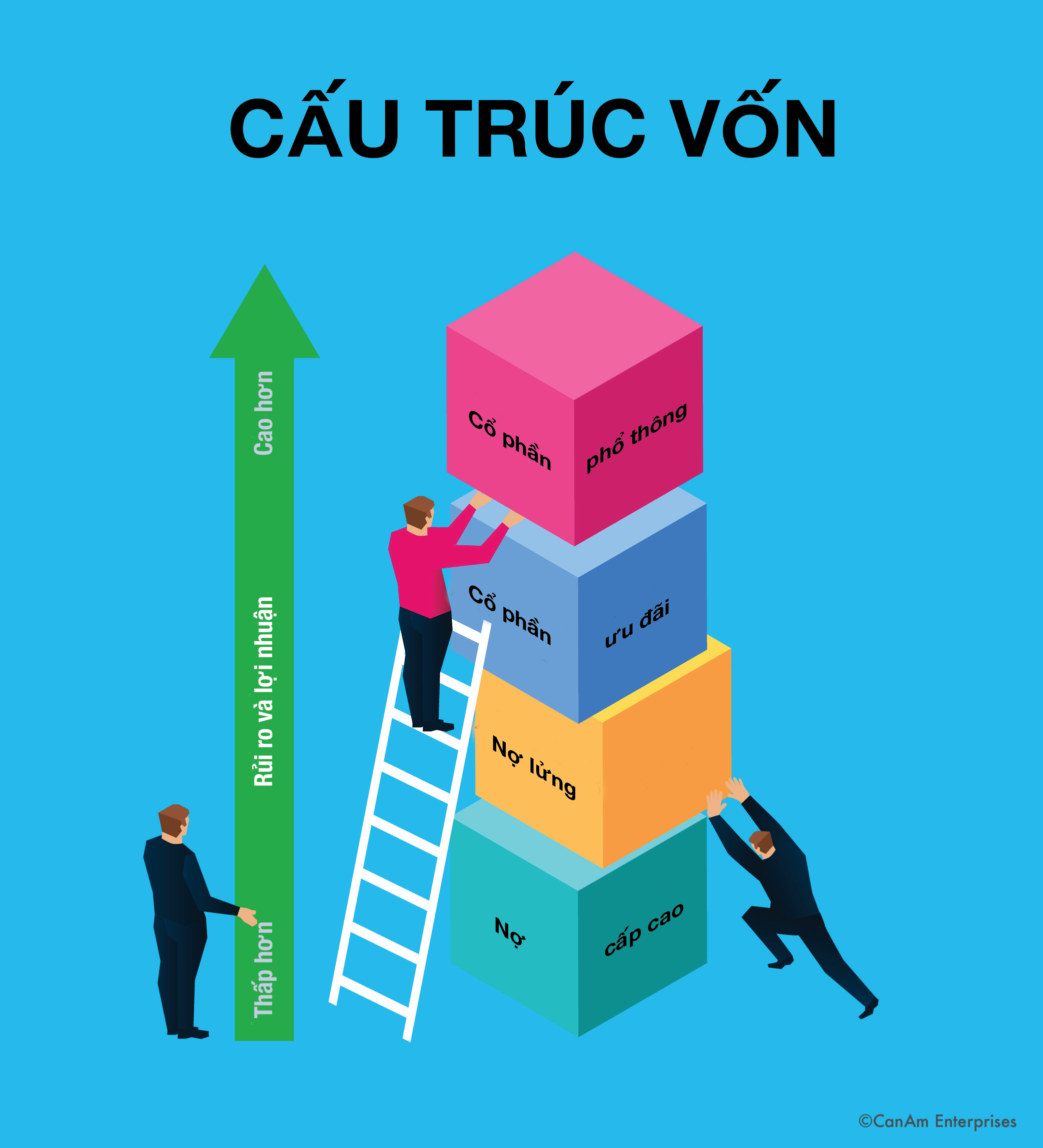

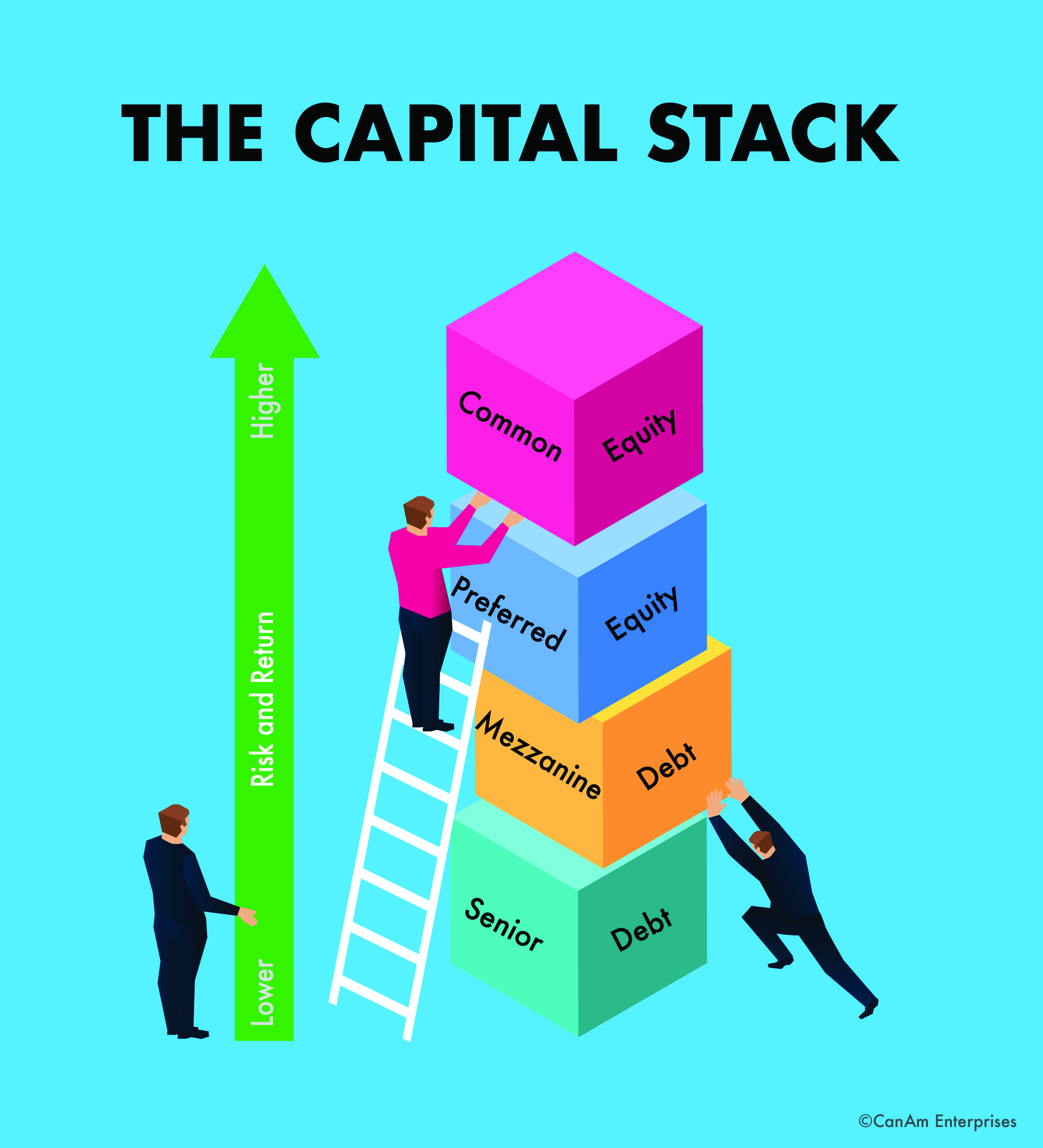

Redeployments into real estate assets can take several forms – for example, as short-term bridge loans; as longer-term debt arrangements; or as equity investments. Because each of these options entail capital lockout periods, investors should take into consideration the timeframe of their respective redeployment periods when evaluating a particular real estate reinvestment. Real estate investments can also offer higher yields (which some investors may prefer), however they can also carry the same, if not greater, amount of risk as the original EB-5 investment. As such, it is important that EB-5 investors closely evaluate and perform due diligence on any real estate-based redeployment vehicle to understand its terms and assess its financial viability. It may be lucrative for EB-5 regional center operators to redeploy investors’ capital into another EB-5 project for 5-7 years at the expense of investors’ interests; however, this practice is not required by the USCIS guidelines.

Municipal bonds are another example of a permissible redeployment vehicle according to the USCIS Policy guidelines. Municipal bonds are issued by local governments, territories, or their agencies. They are generally used to finance public projects, including schools, airports, roads, utilities, and other infrastructure-related repairs. While municipal bonds may offer lower yields as compared to a traditional real estate investment, municipal bonds nevertheless tend to entail less economic risk and are usually more liquid. Municipal bonds are therefore one of the suitable options for investors seeking capital preservation and repayments shortly following their satisfaction of EB-5 Program requirements.

It is also important to note that because many NCEs were formed prior to the issuance of the USCIS’s policy guidance on further deployment in June 2017, it is very likely that any redeployment contemplated under the NCEs organizational documents is either not described with the requisite specificity and/or not entirely reflective of the specific guidance and examples in the Policy Manual. Therefore, it is very likely that NCEs will need to properly describe the redeployment investments and seek investor approval in order to redeploy their repaid capital. In these instances, EB-5 investors should always compare the pros and cons of any proposed redeployment vehicle to evaluate whether it suits their specific immigration and financial goals, and regional centers should be prepared to explain and thoroughly document each proposed reinvestment. The main priority for both investors and regional centers should always be securing immigration benefits and preserving redeployed capital in accordance with EB-5 Program requirements.

CanAm’s Investor-focused Approach to Redeployment

CanAm’s philosophy throughout its nearly 30 years of operations has always remained the same: to ensure that investors complete their immigration goals and preserve their capital investments. This same “investor-first” mindset has guided CanAm’s approach to developing its redeployment strategies. CanAm has worked closely with experienced immigration counsel and investment advisers to identify and structure a conservative redeployment platform, which provides different investment options intended to suit the needs of its specific investors but still meet USCIS requirements.

CanAm understands that optionality is important to its investors and their families, each of whom have different immigration and investment preferences and risk tolerance. Therefore, recognizing that some investors simply may not wish to pursue redeployment following the disposition of the original EB-5 investment, CanAm offers such investors the opportunity to withdraw and receive a capital repayment. Alternatively, for investors who elect to redeploy and for whom liquidity is the most important criteria, CanAm’s redeployment platform offers new issue municipal bonds that mirror key characteristics of the original EB-5 investment. Finally, for redeploying investors who prefer higher returns, CanAm’s redeployment platform offers the opportunity to invest in conservatively-structured mezzanine loans to qualifying real estate developers or longer-term preferred equity real estate investment offerings, depending on an individual investor’s redeployment period. Consistent with CanAm’s business philosophy in selecting EB-5 projects, it will seek out conservatively-structured investments that will best protect its investors’ capital. Under no circumstances will it be offering EB-5 projects as redeployment investments to its investors.

“As far as CanAm is concerned, our investors already created the required jobs in their original EB-5 investment. USCIS does not require their capital be redeployed into another EB-5 project. CanAm seeks to present market-rate investment projects to our investors who need to redeploy, opportunities that provide quality returns but at much less risk than their original EB-5 investment and that still meet the USCIS requirements for redeployment so that their I-829 Petitions are protected. We have no interest in locking-up EB-5 capital for unnecessarily long periods of time in order to reap fees,” said Tom Rosenfeld, President and CEO of CanAm Enterprises.

“CanAm’s approach to redeployment is thoughtful and cautious. Compliance and investor capital preservation are foremost considerations,” said Carolyn Lee, Founder, Carolyn Lee PLLC.

CanAm also has the flexibility to offer other redeployment investments once USCIS provides more policy guidance regarding what is permissible to meet the redeployment requirements. CanAm will continue to closely monitor all legislative and policy changes/updates, which will inform our redeployment strategies in the future. Regardless, CanAm will offer options that are the most suitable and safe redeployment investments to our investors.

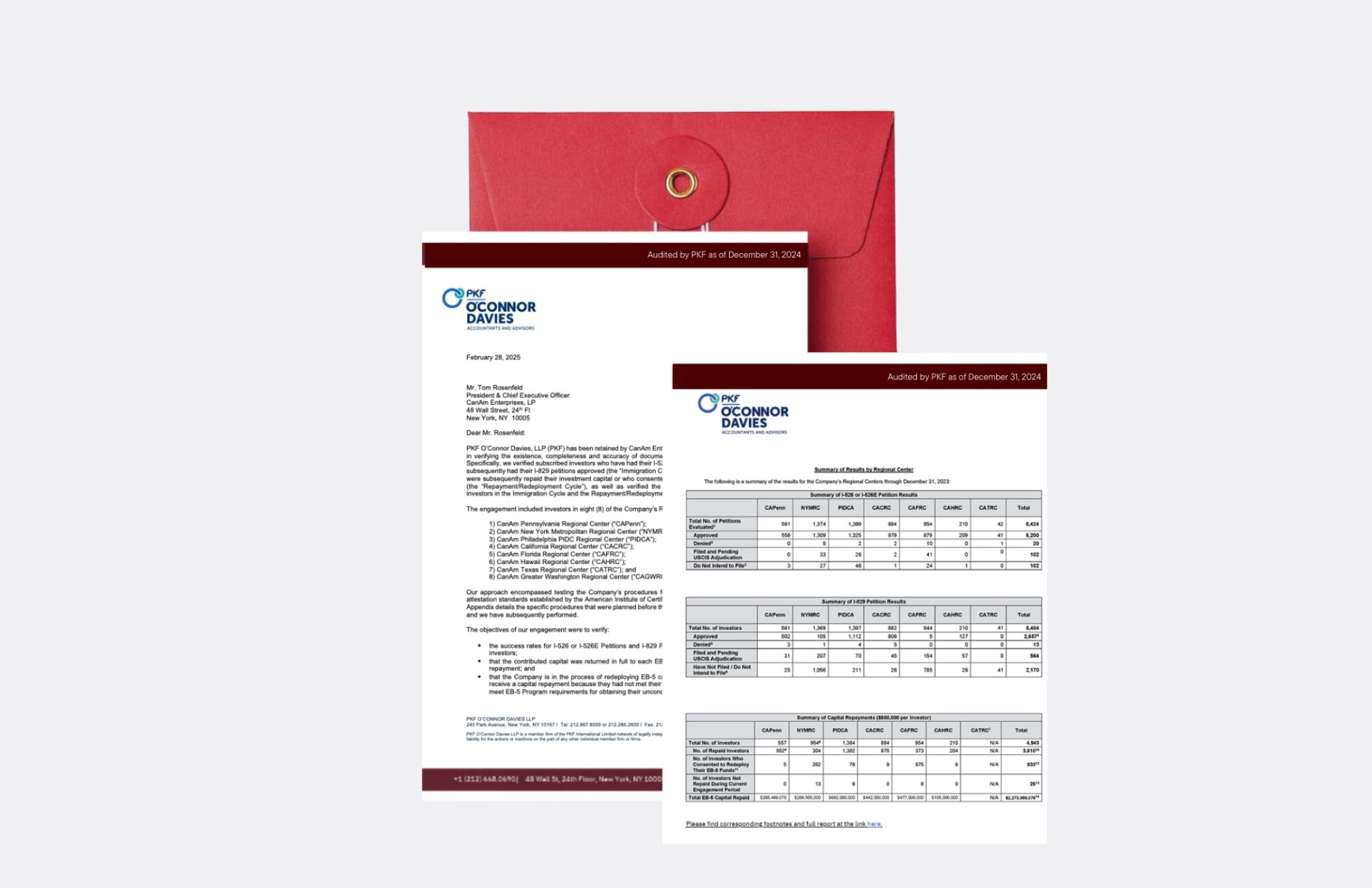

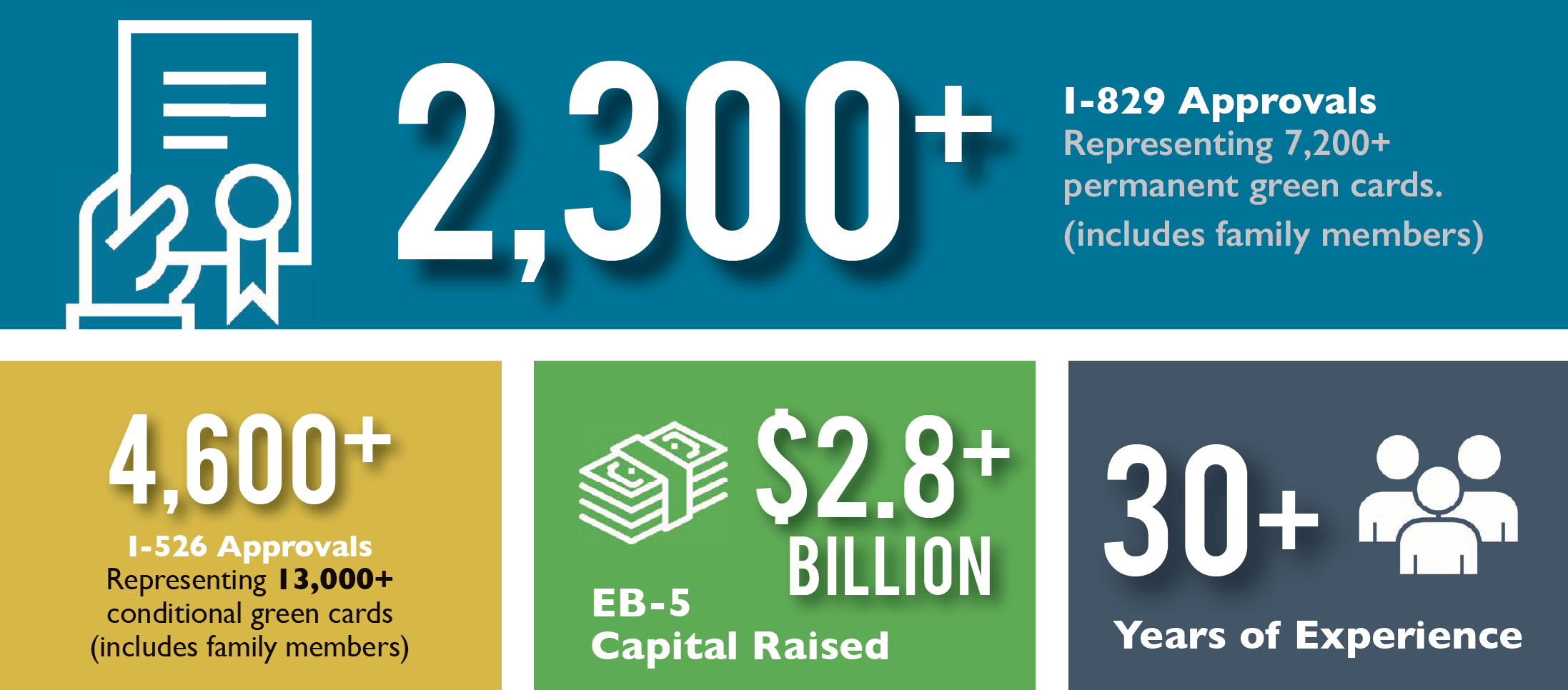

CanAm Enterprises, with over three decades of experience promoting immigration-linked investments in the US and Canada, has a demonstrated track record of success. With over 60 financed projects and $3 billion in raised EB-5 investments, CanAm has earned a reputation for credibility and trust. To date, CanAm has repaid more than $2.26 billion in EB-5 capital from over 4,530 families. CanAm manages several USCIS-designated regional centers that stretch across multiple states. For more information, please visit www.canamenterprises.com.