Paying taxes and filing the necessary tax returns is a necessity. Yet, for many people, maneuvering the U.S. tax system can be a daunting and stressful task – even for experienced tax filers. Individuals can follow some fairly simple steps to make preparing personal income taxes a much smoother process. The best advice is to simply get organized and start the process early rather than waiting until the last minute. Here are 10 suggested tips that can help individuals better prepare for the looming tax filing deadlines.

1) When is my tax return due?

The deadline to file individual tax returns, and importantly, make any payments for taxes owed for calendar year 2019 is April 15, 2020. Returns must be filed electronically before midnight on that date. If mailing returns and payments, returns must be officially postmarked (date stamped) at a U.S. Post Office no later than April 15th.

2) What is my tax bracket?

There is no single standard tax rate. The U.S. tax authority, the Internal Revenue Service (IRS), uses seven different tax brackets or levels based on income that are assessed at different tax rates. Tax brackets are based on an individual’s or married couple’s adjusted gross income (AGI), which is the equivalent of income minus any eligible deductions. Tax rates range from a low of 10% to a high of 37% for the top bracket of earners.

3) What’s new for 2019?

The Tax Cuts & Jobs Act created some important new rules for taxpayers. Most of those new rules went into effect in tax year 2018. However, some changes to be aware of for 2019 are:

- The “Obamacare penalty” that charged a penalty fee for individuals who did not secure personal health insurance coverage was eliminated starting in tax year 2019 and going forward.

- The foreign earned income exclusion rose slightly to the amount of $105,900.

- Retirement contributions also increased slightly for 2019. 401(k) and 403(b) contributions are up to $19,000 for 2019, with a $6,000 catch up contribution allowed for those 50 and over. SEP IRA and Solo 401(k) contribution limits increased to $56,000 for 2019.

4) What are eligible tax deductions?

One of the biggest changes that affects individual taxpayers is a sizable increase in the standard deduction. In a move that was aimed at simplifying the process of filing annual tax returns for many Americans, the U.S. government nearly doubled the amount of the standard deduction, which for 2019 is set at $12,200 for single filers and $24,400 for married couples.

Personal expense deductions are used to offset or reduce taxable personal income on an individual tax return. So, for those taxpayers who report personal deductions that exceed the minimum threshold, it can be worthwhile to create an itemized list of eligible deductions that can help to save money by reducing the amount of taxable income. Some examples of eligible deductions include:

- Contributions to retirement investment and savings accounts

- Medical expenses

- Charitable contributions

- Property taxes

- Investment losses

5) Do I need help preparing my taxes?

One of the goals of the Tax Cuts & Jobs Act was to simplify the tax filing process. However, it is debatable on whether that goal was achieved as wading through the myriad of changes, even two years later, is no easy task. In addition, the IRS continues to make slight annual adjustments to income thresholds, eligible deductions and contribution amounts to retirement savings account. So for many taxpayers, it is still advisable to seek guidance from a trusted accountant or financial advisor.

6) What documents do I need to provide to my tax preparer?

Generally, the start of a new year comes with a flurry of tax forms that are either mailed or available to download. Individuals need to make sure they are gathering all of the official tax documents on both the income and expense side to support any claims for eligible tax deductions. Some examples to watch for include:

- W-2s: These forms provided by an employer show wages earned and any federal, state and local taxes that have already been paid.

- 1099s: These forms show a variety of income earned from various sources.

- 1099-MISC: These forms show miscellaneous wage income earned, and are commonly used to show payments made to independent contract workers

- 1099-INT and 1099-DIV: These report your interest income and dividend income from bank and investment accounts.

- 1099-S: This form reports any income you may have received through U.S. social security payments.

- K-1s: The K-1 form is used if you have income from a partnership, small business or trust.

- Mortgage interest statements: These forms are typically provided by the mortgage company.

- Documentation of other state and local taxes paid, such as property taxes or sales tax on a large purchase as with a car or boat.

- Payment receipts, credit card statements or check stubs that verify payments made for eligible deductions, such as educational expenses or annual statements for charitable giving.

7) Review Before Signing

Before signing a tax return, the taxpayer should always review it carefully for errors or omissions before signing and filing it. Once they sign the return, taxpayers are accepting responsibility for the information on it.

8) Never Sign a Blank Return

Taxpayers should not use a tax preparer who asks them to sign a blank tax form.

9) Should I e-file?

The quickest way for taxpayers to get their refund is to electronically file their federal tax return and choose the direct deposit

10) How long should I keep tax records?

The IRS recommends that individuals keep records for 3 years from the date you filed your original return, or 2 years from the date you paid the tax, whichever is later. In addition, it is advised that you keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

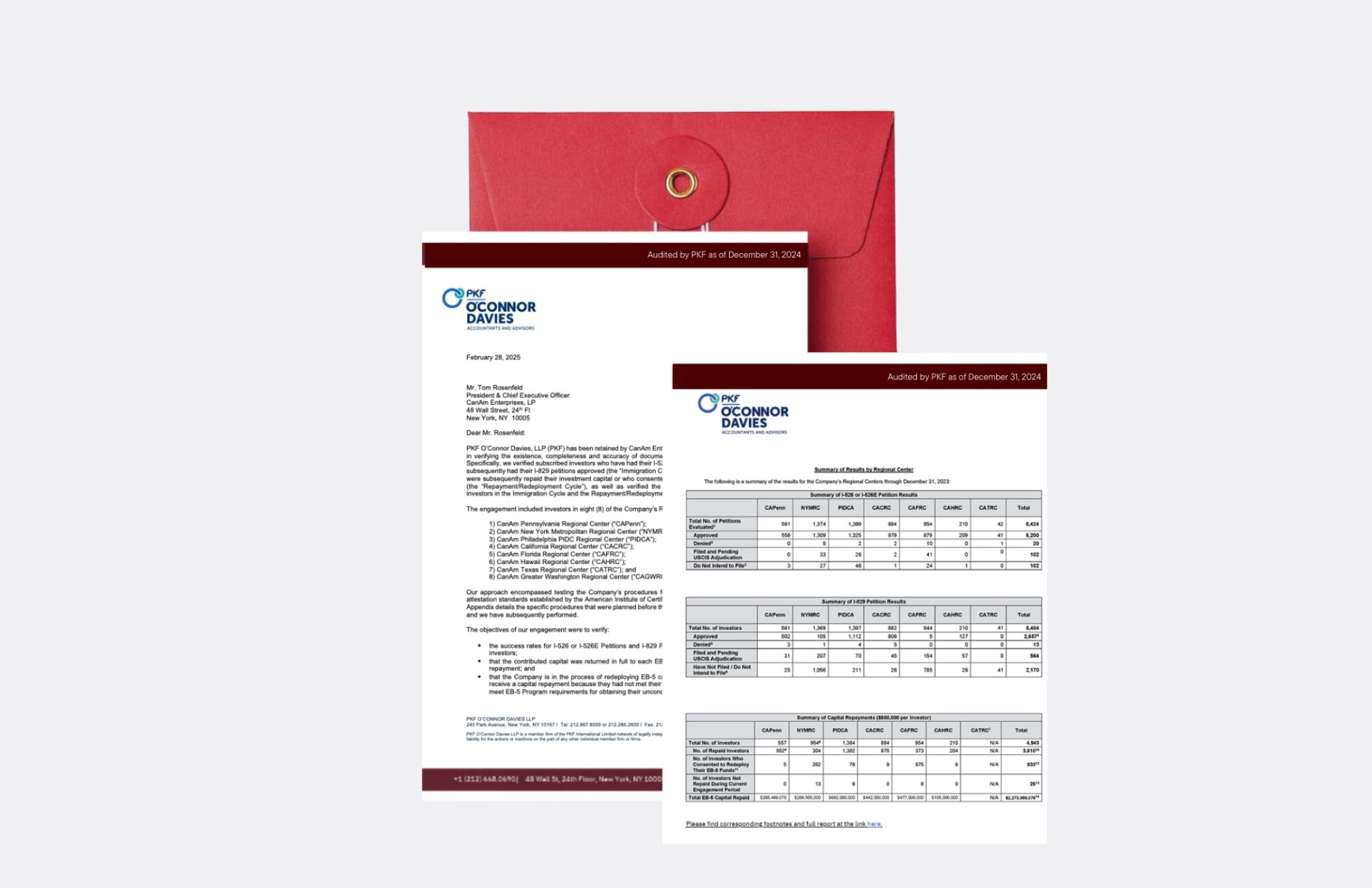

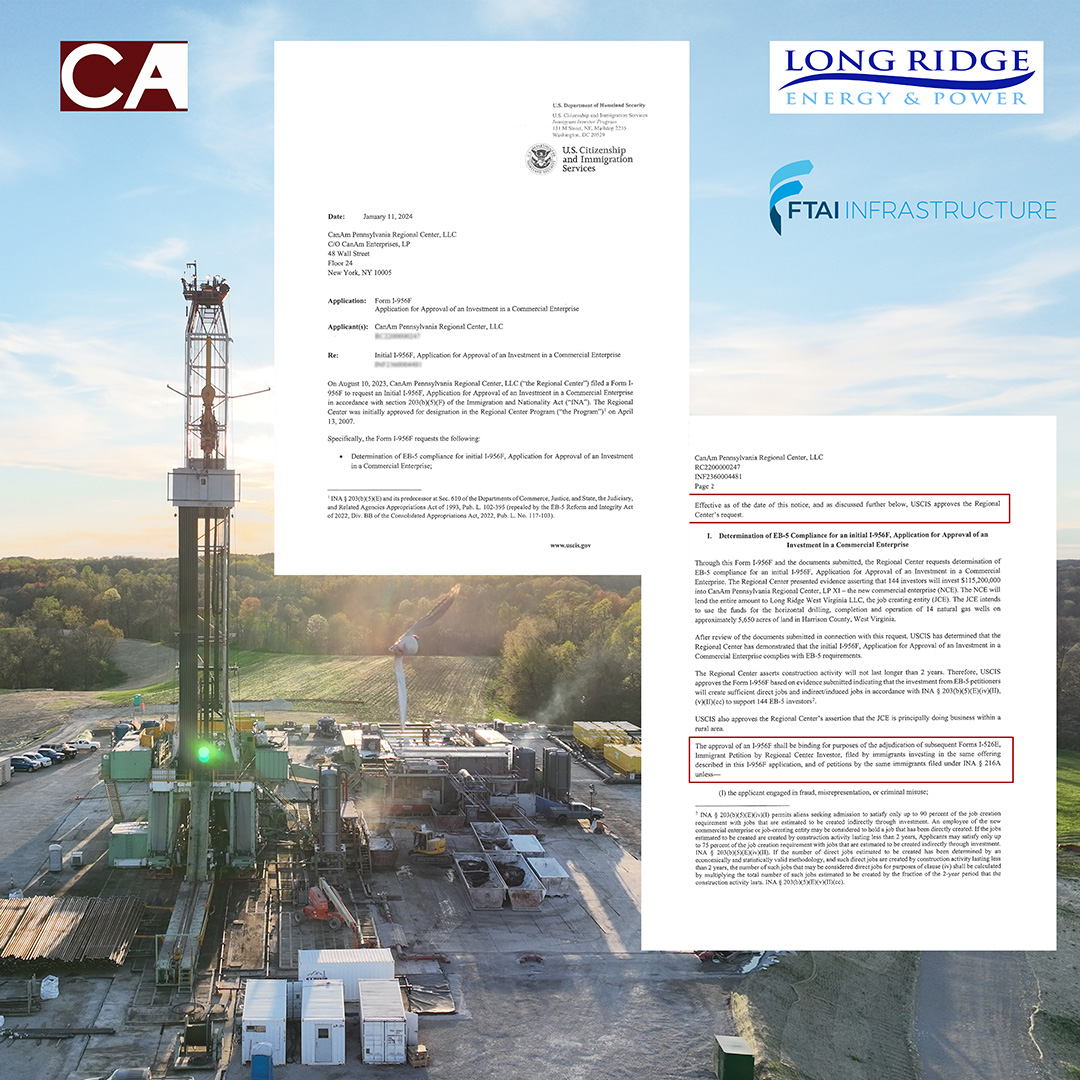

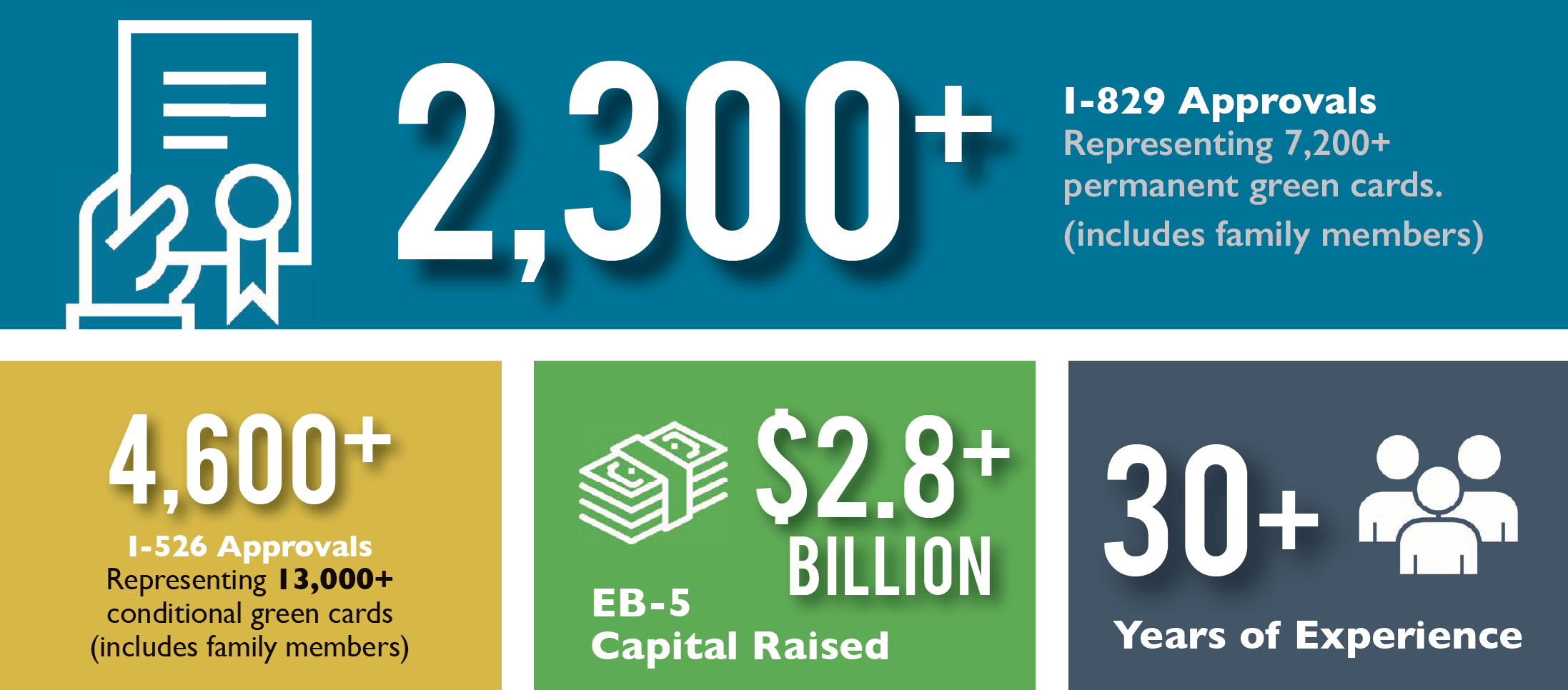

CanAm Enterprises, with over three decades of experience promoting immigration-linked investments in the US and Canada, has a demonstrated track record of success. With over 60 financed projects and $3 billion in raised EB-5 investments, CanAm has earned a reputation for credibility and trust. To date, CanAm has repaid more than $2.26 billion in EB-5 capital from over 4,530 families. CanAm manages several USCIS-designated regional centers that stretch across multiple states. For more information, please visit www.canamenterprises.com.