By Goldi Chawla

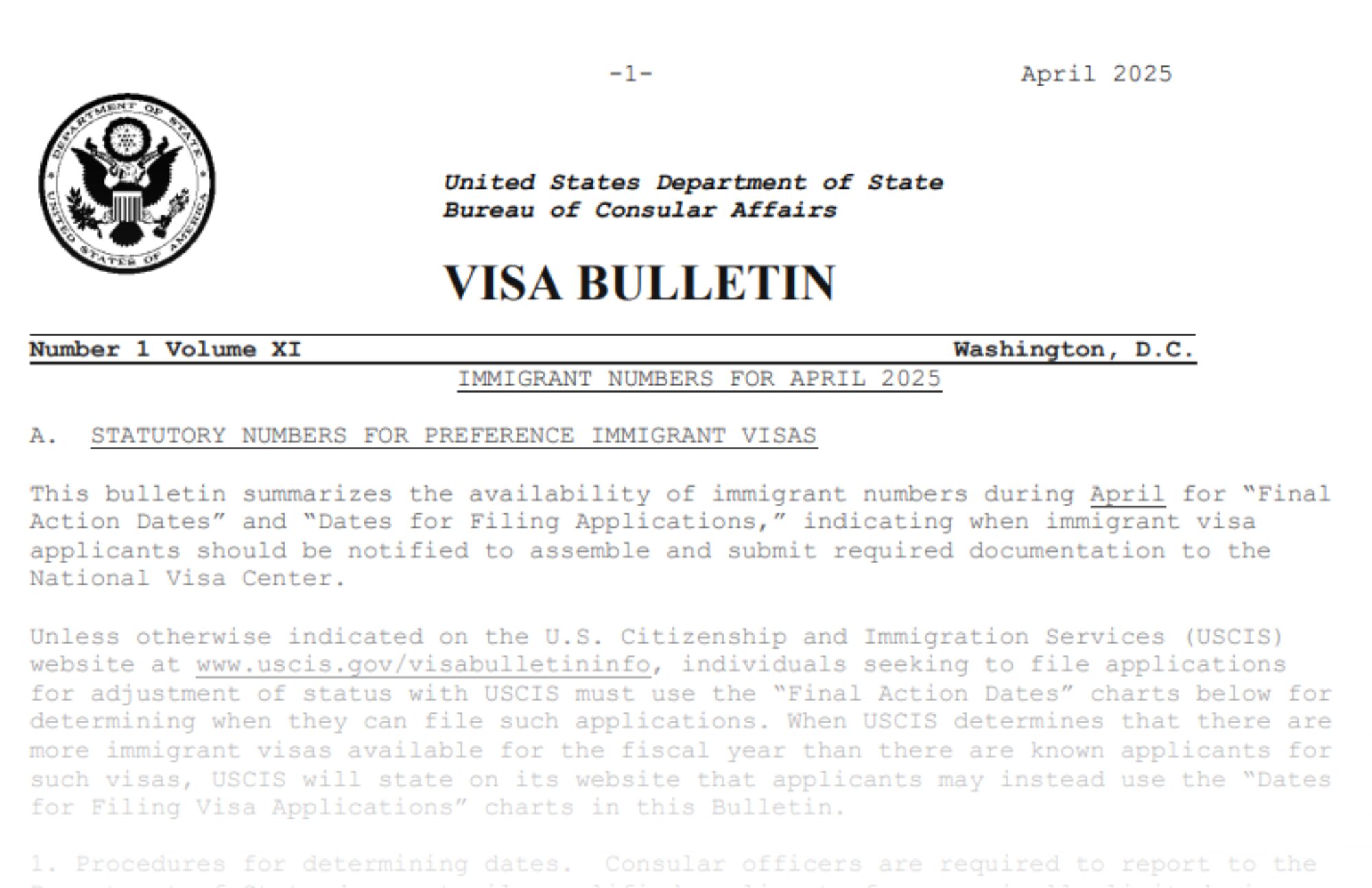

If you have been keeping a watchful eye of interest on the EB-5 — the U.S. green card by investment program – it may be time to keep an eye on the calendar, as well. That’s because under the proposed Union Budget 2023, several new restrictions could take effect on July 1 and impact EB-5 investments that must be processed through India’s banking system, including higher taxes on outward financial transfers from the nation.

If you have been keeping a watchful eye of interest on the EB-5 — the U.S. green card by investment program – it may be time to keep an eye on the calendar, as well. That’s because under the proposed Union Budget 2023, several new restrictions could take effect on July 1 and impact EB-5 investments that must be processed through India’s banking system, including higher taxes on outward financial transfers from the nation.

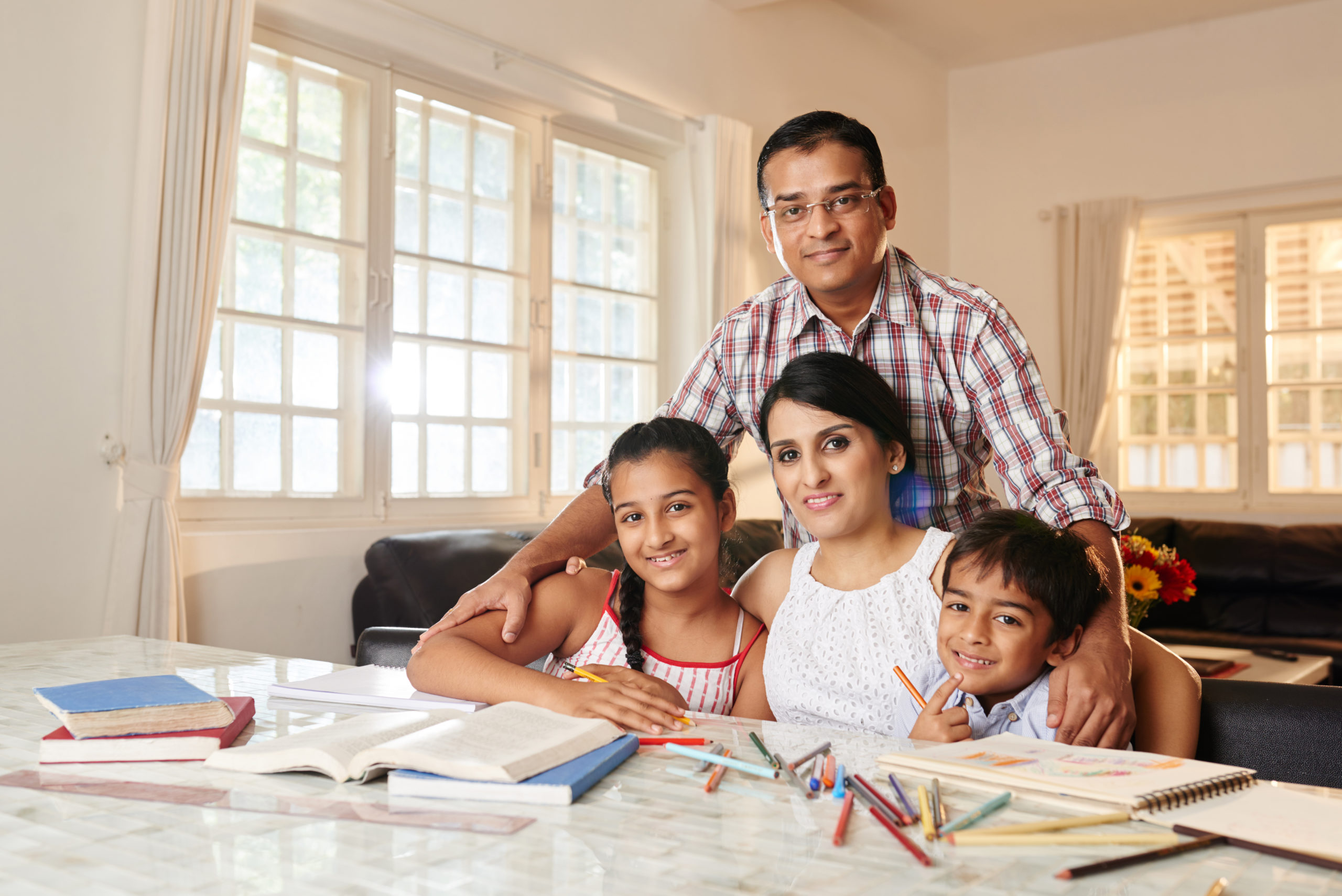

The EB-5 program is popular in India, mainly because this visa doesn’t have the restrictions that other U.S. visas have on where and when you — as a foreign national — can work, study live, and travel. As recent as FY 2019, Indian nationals had the second largest number of EB-5 visas granted (760) among all other countries. As an investor, you can bring your spouse and children under 21 years old to the U.S. through a conditional green card made available through the program. Parents in India value the world-class and Ivy League education that the U.S. colleges offer, and they can leverage the EB-5 visa to access tuition discounts at these U.S. institutions for their children. It’s no wonder that according to Money Control Magazine, Indian students constitute about 18% of the international student population in the U.S.

But an upcoming tax increase could influence the timing and momentum of India’s EB-5 opportunities. The central government proposed during the budget session an increase in the Tax Collected at Source (TCS), from 5% to 20%. The increase, which would take effect July 1, 2023, would add significant upfront costs on outbound cash wire transfers. For example, the proposed rule states that to enable a net wire of $800,000, one will have to make available an amount almost the equivalent of $1,000,000.

Why EB-5?

While there is no perfect visa option for everyone, the EB-5 visa offers a direct route to U.S. residency, and there are several reasons why it can be the preferred visa option, including:

• No employment or education requirements.

• No employment sponsorship necessary.

• Reduced tuition costs available at U.S. colleges for immigrant investors and family members.

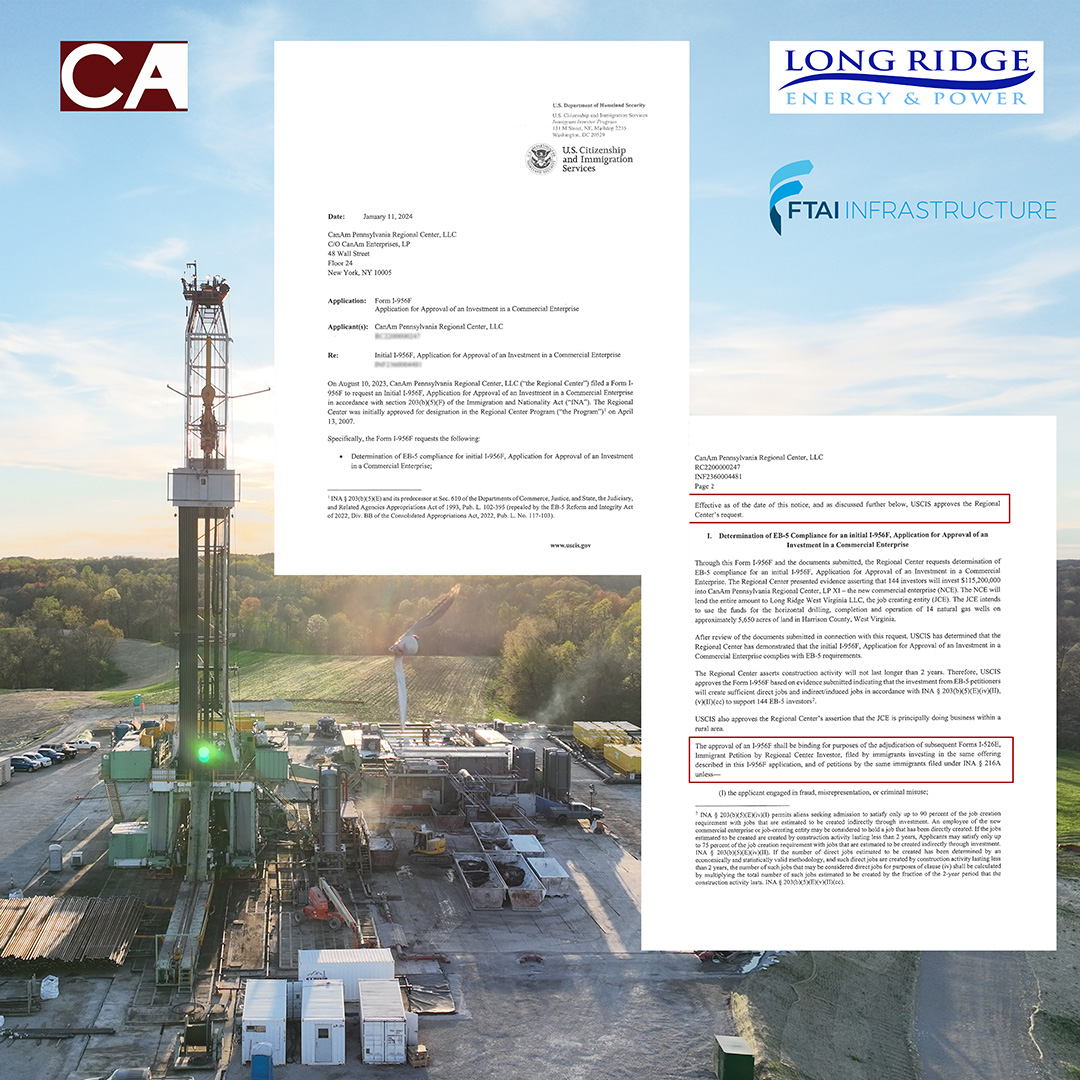

• Priority visa processing for projects that meet USCIS set-aside criteria, such as those in a designated “rural area”.

It’s important to note that the tax benefits associated with the EB-5 program can vary depending on an investor’s circumstances and should be carefully considered in consultation with a qualified tax professional. Additionally, investors should comply with all applicable tax laws and regulations in both countries: U.S. and India.

More Tax Facts

The outbound money transfer tax can be reclaimed on tax returns, which may look like a prolonged process, but it’s not. TCS can be offset against other tax liabilities when completing your annual tax returns; it is not an additional tax. So, wealthy Indians will need to budget 20 percent more when sending money for foreign investments beginning July 1, 2023, then hold onto this 20 percent sum for a few months until they can recoup it from the tax authorities.

Any EB-5 investor should consider if the TCS payment will be refundable. Again, taxpayers should consult with an experienced financial or tax advisor, but, yes; you only need to file your tax returns and request an adjustment to the TCS. You can also file for a tax refund if your net liability is negative. The most reliable strategy to avoid the 20% TCS is to start the transfers before the deadline of July 1, 2023. This way, one would perform these transactions at the current 5% TCS rate.

In the months leading up to July 1, 2023, the announcement to raise the TCS on overseas remittances will enhance demand for foreign investment choices like the EB-5 program. But the message seems to be that the government is moving in the direction of making international transfers more difficult for Indian investors and will keep doing so in the future.

Goldi Chawla is Regional Representative – India and the Middle East, CanAm Enterprises

Disclaimer: All content in this article is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in this article constitutes professional, legal, investment, and/or financial advice, nor does any information herein constitute a comprehensive or complete statement of the matters discussed or the law relating thereto.

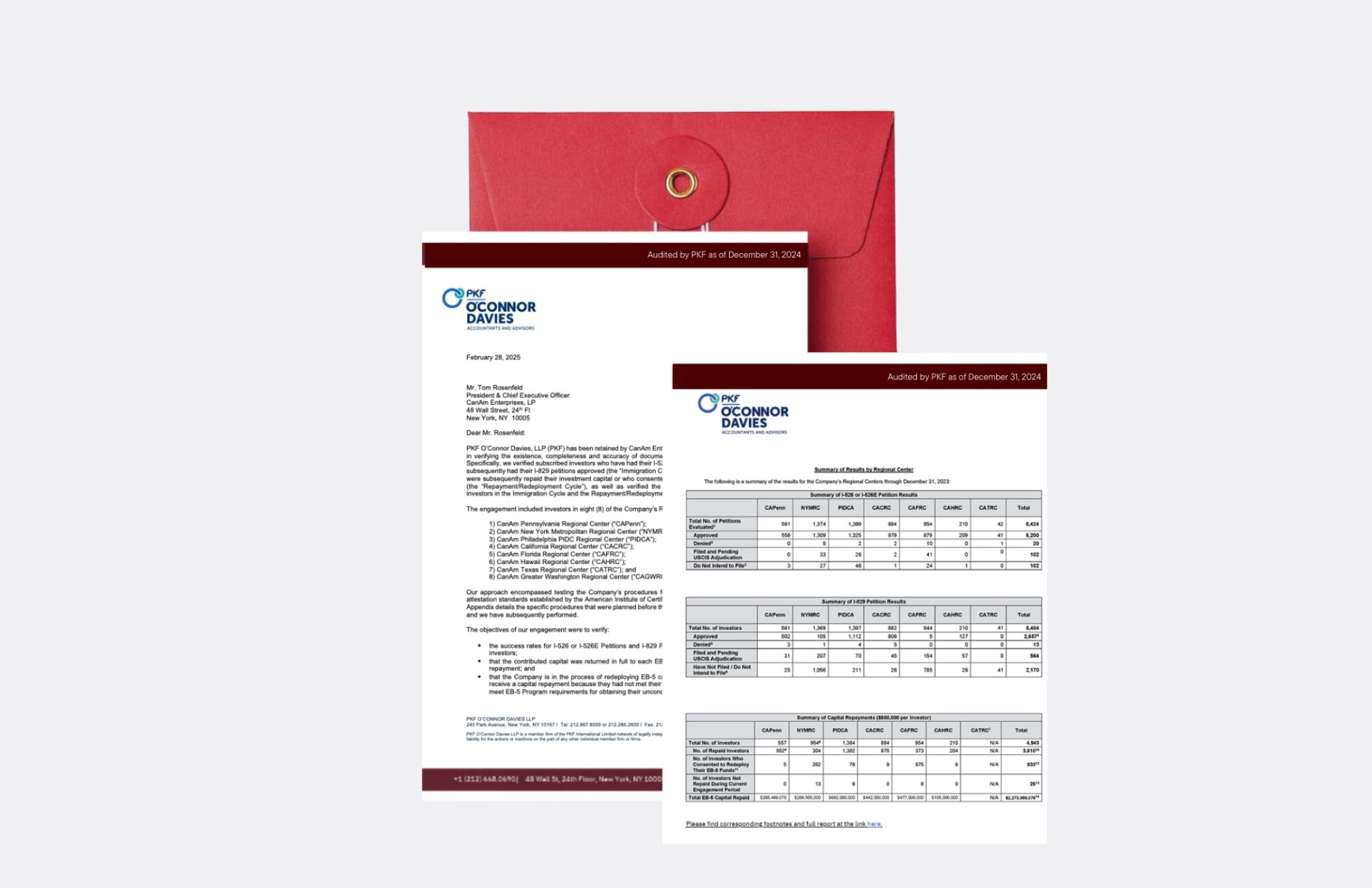

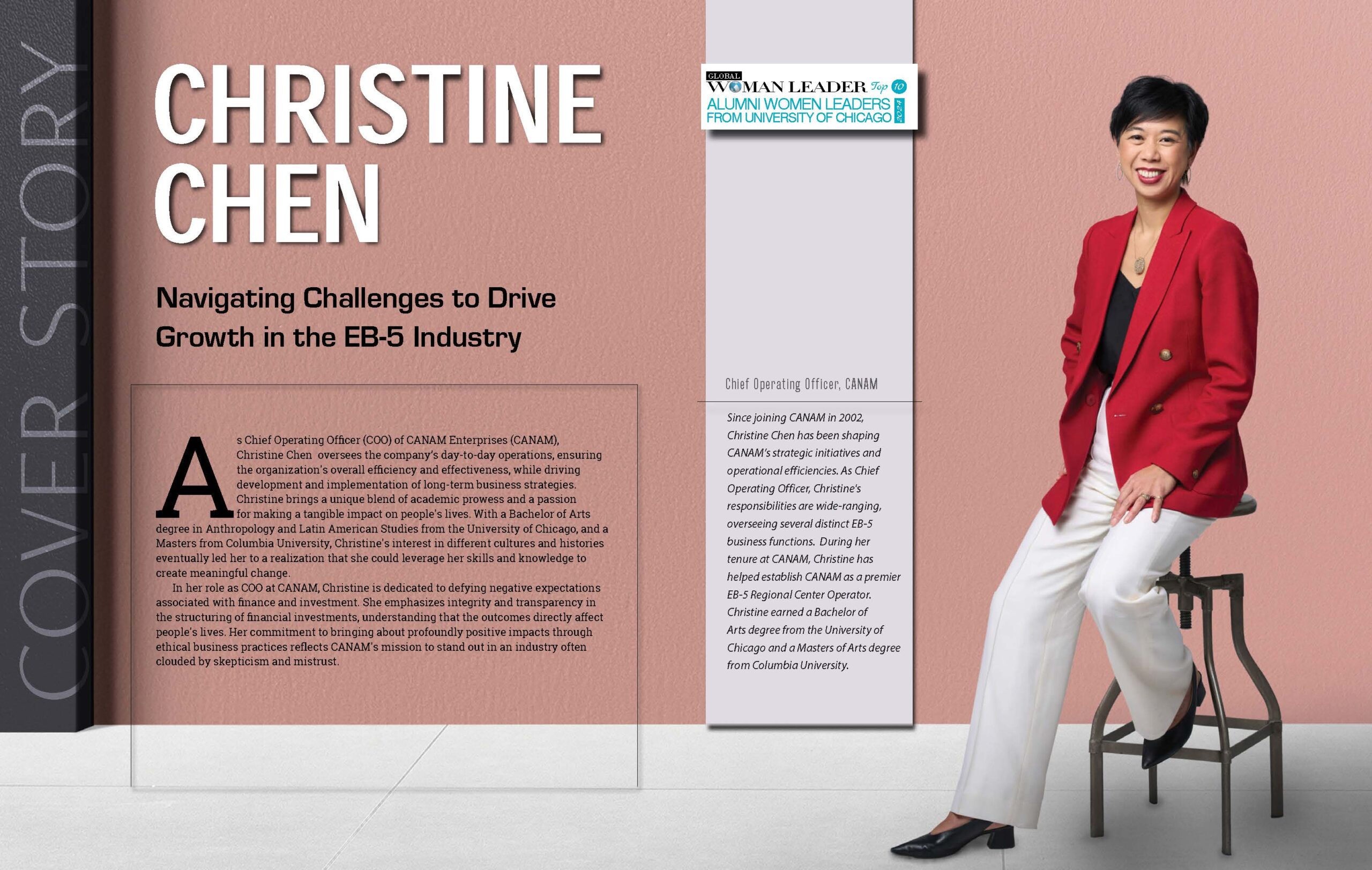

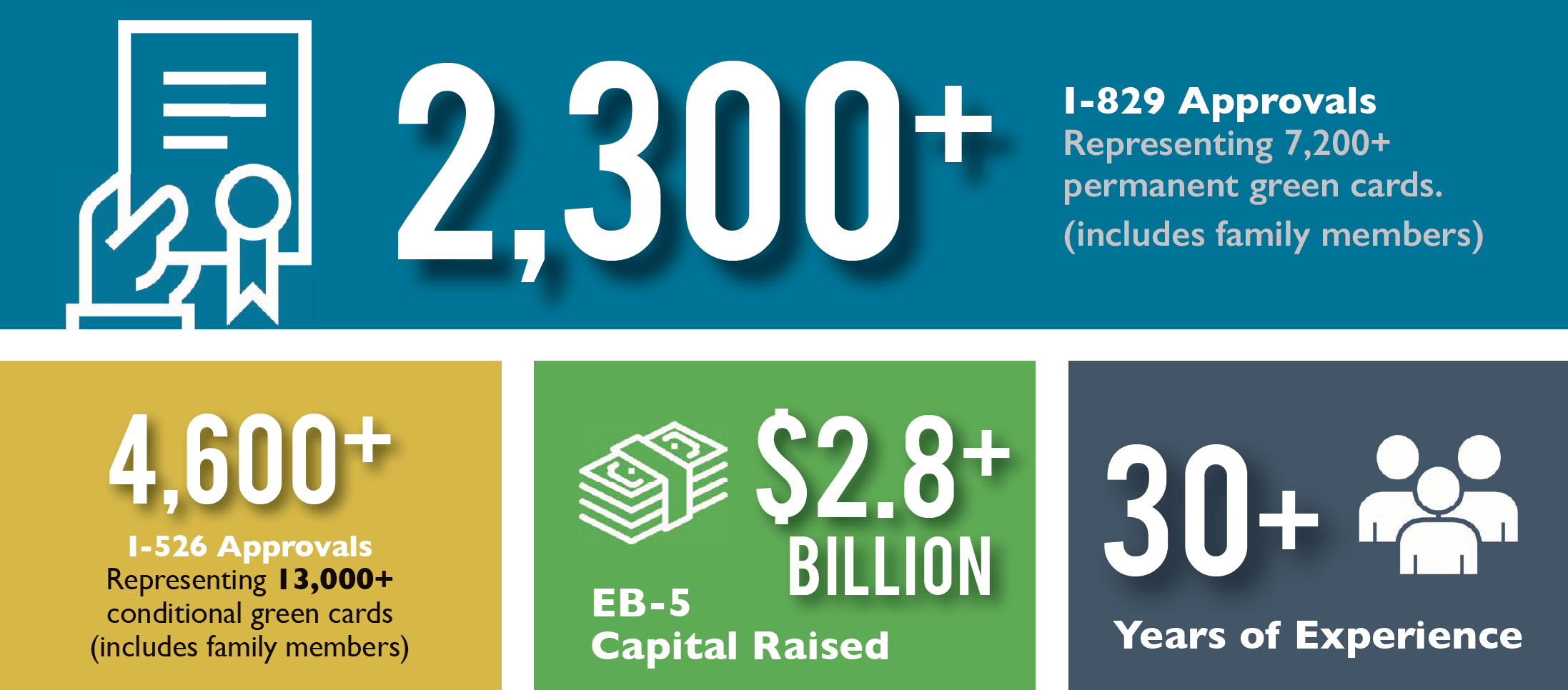

CanAm Enterprises, with over three decades of experience promoting immigration-linked investments in the US and Canada, has a demonstrated track record of success. With over 60 financed projects and $3 billion in raised EB-5 investments, CanAm has earned a reputation for credibility and trust. To date, CanAm has repaid more than $2.26 billion in EB-5 capital from over 4,530 families. CanAm manages several USCIS-designated regional centers that stretch across multiple states. For more information, please visit www.canamenterprises.com.