As banks tighten their lending standards amid the economic downturn, proponents for a little known—and somewhat controversial—program for foreign investors seeking to move to the U.S. are hoping to fill funding gaps for projects ranging from office spaces, condos, and even rail lines.

The EB-5 immigration program grants conditional green cards to wealthy foreigners who invest at least $900,000 in projects that create and save U.S. jobs. New York City’s Hudson Yards, Philadelphia’s Navy Yard, and the Westin Hotel at the Texas Medical Center in Houston, Texas, are all projects that received at least some funding from EB-5 investors. The program has been around since the early 1990s but has undergone some iterations over the last few years, primarily increases to the minimum required investment.

Now with unemployment high, and the fear of funding drying up for shovel-ready projects, supporters of the program are calling on Congress to issue a long-term, or permanent, reauthorization of the program.

Banks, hampered by low interest rates and looming loan losses caused by the coronavirus, have been reluctant to lend. According to the Federal Reserve’s recent Senior Loan Officer Opinion Survey, which covers 75 U.S. banks, the industry largely admitted that its lending standards were tighter during the second quarter. With the path of the economic recovery uncertain but rates almost certain to stay low, it’s less likely that banks will be quick to issue riskier loans.

Of course, there is dry powder on the sidelines in the form of private-equity firms, hedge funds, and others who managed through the crisis with cash ready to be deployed. A lesser-known type of player are the financial services firms that sponsor EB-5 investment funds.

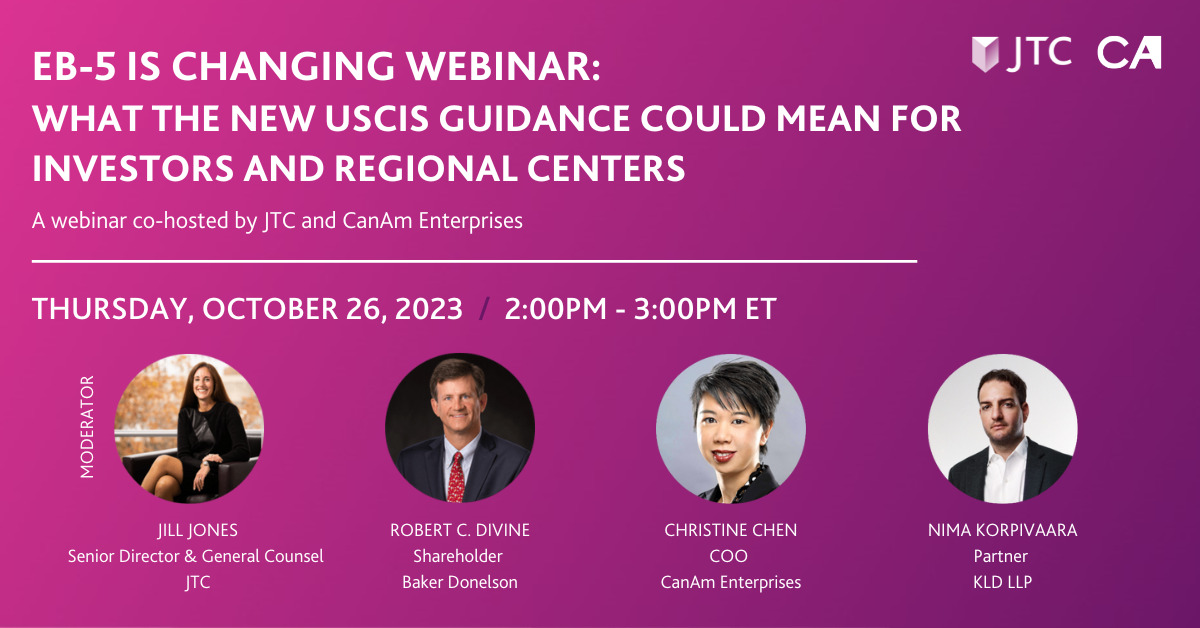

CanAm Enterprises, based in New York City, is one such firm. It put money to work in more than 60 projects over the last 30 years and recently announced the repayment of $350 million for its All Aboard Florida Project, which created a high-speed rail connecting Miami to Orlando. It’s ready to put more money to work, albeit somewhat more selectively.

“We want to be careful how we do it and where we do it,” explained Tom Rosenfeld, chief executive of CanAm.

With travel down and a discussion about the future of the office as many white-collar workers continue to work from home during the pandemic, picking the right projects—which will employ U.S. workers and lead to the repayment of funds—becomes more of a balancing act. Rosenfeld said there are some office projects that interest him, though a stable long-term lease tenant must already be locked in.

“We’re not looking for a risky project,” Rosenfeld said, noting that more than 3,500 investors in CanAm’s projects have been fully repaid.

The current climate reminds him in some ways of the last financial crisis when banks abruptly pulled back financing projects that already had cranes in place. Without gap funding provided by EB-5 investors and others, some projects may not have been completed.

And this is where proponents of the program are pushing for its continuation—or even expansion. There are only 10,000 EB-5 visas granted a year, though demand—while it ebbs and flows based on economic and political conditions—often well exceeds that, meaning the potential for more money to be put to work. In the seven years after the financial crisis of 2008, it is estimated that the EB-5 program generated $20.6 billion of investment, which led to the creation—or saving—of more than 700,000 U.S. jobs, according to analysis by trade industry group, Invest in the U.S.A.

Still, the program is not without its detractors. While U.S. job creation—roughly 10 jobs per applicant—is a condition of the program, many fault the program for basically allowing people to buy their way into the country. There have also been concerns about regulation of the program and whether the funds go to projects in areas where jobs are needed more.

There was a rule change in November, which increased minimum investment from $500,000 to $900,000 for so-called “target employment areas” and increased minimum for non-TEAs from $1 million to $1.8 million. The latter group has historically been more enticing for foreign investors because it is believed that the projects have a greater chance of being completed—especially in accordance with the program—providing a greater sense of security that the investment will be recouped.

Write to Carleton English at carleton.english@dowjones.com

CanAm Enterprises, with over three decades of experience promoting immigration-linked investments in the US and Canada, has a demonstrated track record of success. With over 60 financed projects and $3 billion in raised EB-5 investments, CanAm has earned a reputation for credibility and trust. To date, CanAm has repaid more than $2.26 billion in EB-5 capital from over 4,530 families. CanAm manages several USCIS-designated regional centers that stretch across multiple states. For more information, please visit www.canamenterprises.com.