Prior to the EB-5 Reform and Integrity Act of 2022 (RIA), all EB-5 investors were required to sustain their investments throughout their conditional lawful residence period, the timeframe of which is dependent on many factors outside the investor’s control, such as visa availability. This meant that for investors from countries that did not have available EB-5 visas at the time of their EB-5 project repayment, they had to reinvest or redeploy their EB-5 capital until there was availability. When the RIA eliminated the need for post-RIA investors to redeploy, it was a game changer for the EB-5 industry. However, almost a year and half later, USCIS issued additional guidance clarifying that post-RIA investors must be expected to maintain their investment for at least two years, provided that the job creation requirement has been met. And in that moment, the discussion shifted from ‘Do post-RIA investors have to sustain their EB-5 investment?’ to an entirely different question – ‘What is the minimum sustainment time required by USCIS for an EB-5 investment?’.

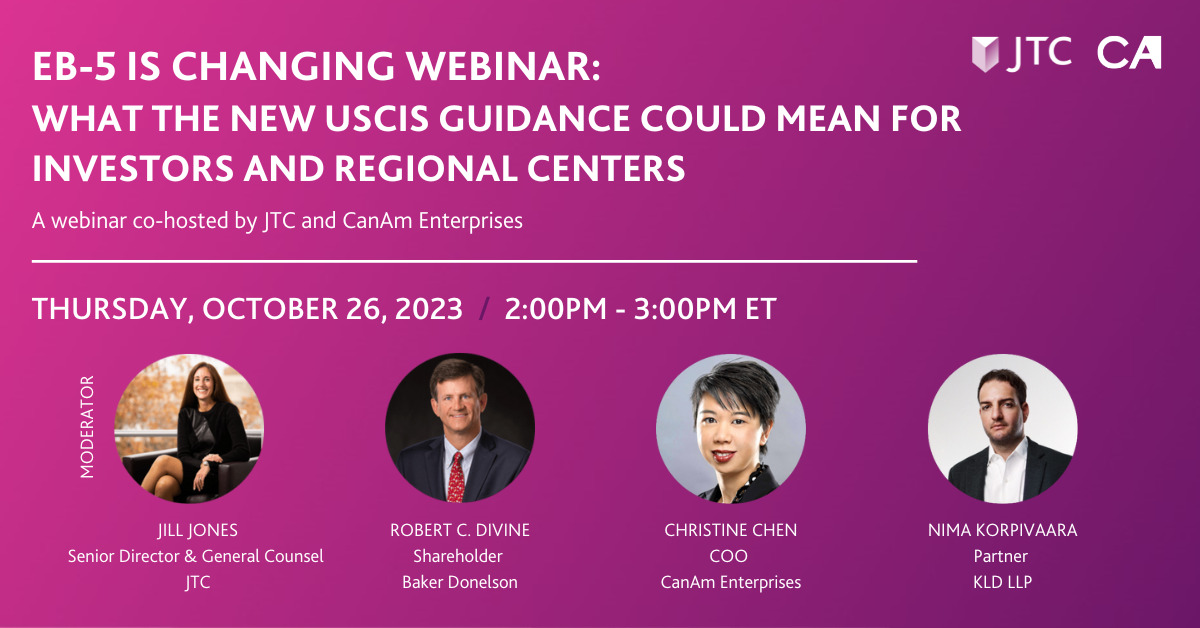

Since USCIS provided this additional guidance, there have been a lot of conflicting opinions and, unfortunately, misinformation swirling around the industry. To help investors understand the challenges and identify questions they should consider as they explore the EB-5 investment path to immigration, CanAm recently hosted a webinar, ‘Putting the 2-Year Sustainment Requirement into Context: What Questions Should Investors be Asking?’ hosted by our Chief Operating Officer, Christine Chen and featuring Robert Divine, Shareholder and Chair of the Global Immigration Group at Baker Donelson, Suzanne Lazicki, Principal at Lucid Professional Writing, and our General Counsel, Walter Gindin. A link to the webinar can be found here: https://www.canamenterprises.com/media/videos/?wchannelid=iiv5jgq10e&wmediaid=pjhur09a9n. Our goal was to dig into the nuances and questions surrounding this complex issue and attempt to shed some much-needed light on this important topic. Key highlights and takeaways from the webinar included:

How should an investor interpret the investment sustainment start and end dates?

Sustainment Start Date

The USCIS guidance language on this point is as follows:

“For purposes of determining the date when the two-year period required by INA 203(b)(5)(A)(i) begins, we will generally use the date that the requisite amount of qualifying investment is made to the new commercial enterprise and placed at risk under applicable requirements, including being made available to the job creating entity, as appropriate.”

The panelists all agreed that the safest, most practical interpretation of the language is the start date begins when the job creating entity (JCE) has spent all the EB-5 investment funds. The key thing to remember here is that the transfer of investment funds from the new construction entity (NCE) to the JCE does not necessarily put the investment “at risk”, which is a factor that USCIS has historically scrutinized. Starting the 2-year period once the JCE has spent all the investment funds incorporates all the “at risk” requirements in the RIA:

- Full amount of EB-5 investment made available to job-creating entity

- Business activity

- Risk of loss and chance for gain

- No guaranteed return (no right to repayment, no promise of willing buyer in a certain number of years)

Our panelists all believe that taking the most conservative interpretation of the USCIS language regarding the sustainment start date is in the best interest of EB-5 investors given the lack of any clearer guidance from USCIS right now.

Sustainment End Date

The USCIS guidance on this point is as follows:

“An investor filing an EB-5 immigrant visa petition must have invested, or be in the process of investing, the required amount of capital in a new commercial enterprise in the United States and expect to maintain that investment for not less than 2 years, provided job creation requirements have been met.”

“The INA establishes only minimum required investment timeframes for purposes of applicable eligibility requirements and does not place any upward limit on how long an investor’s capital may be retained before being returned.”

Again, the panelists urged investors to be very cautious when approaching the interpretation of this language. The investment needs to be “at risk” for at least 2 years from when the money was spent by the JCE. Investors need to make sure there are terms in the applicable financing documents that restrict the borrower’s ability to liquidate, sell or refinance before the two years have been completed. An investor does not want to be in a situation where the EB-5 capital is paid back prior to two years and their funds now must be redeployed to abide by the USCIS guidance.

The Viability of a 2-Year EB-5 Investment Project

The most important objectives of an EB-5 investor are to 1.) Get their green card and 2.) Get their money back. Historically, a typical ground-up construction EB-5 investment that has met these crucial requirements has spanned 4-5 years. With the new USCIS guidance, there is an increasing demand for shorter deals. Regional Centers, including CanAm, do not want investors’ capital invested for an unnecessarily extended period. However, our panelists agreed that it is very challenging for a project to meet job creation and sustainment requirements, as well as hit a threshold of profitability that supports an exit to repay its investors, within 2 years. To meet this shorter timeframe, the industry may shift to projects that take less time to stabilize than typical large-scale construction developments, or reposition existing assets, for example tenant improvements or conversions. Investors should be wary and take extra care with their due diligence on any EB-5 projects marketed as a 2-year investment.

The panelists then discussed whether a 2-year investment was feasible given the time it takes for a project to be constructed, stabilize and repay.

Bridge Financing

Post-RIA, it has become increasingly common for EB-5 projects to utilize bridge financing. As originally envisioned by USCIS, bridge financing was permitted to start a project while the EB-5 capital was being raised. An EB-5 project utilizing bridge financing can be attractive in that it allows an investor to get into a project where the money was already spent, and the jobs have already been created. The panelists all agreed that USCIS will specifically scrutinize the timing and documentation of the bridge financing to determine whether investors’ money is a real investment “at risk” and that there is a true link to job creation. These two criteria are the keystones of the EB-5 program. There will be a heightened burden to prove to USCIS that there is a sufficient nexus between the EB-5 investment and the jobs that were created before such EB-5 investment became available to the job creating entity. It is in an investor’s best interest to be extremely cautious when analyzing an EB-5 Project that involves bridge financing.

In summary, our panelists agreed that investors need to take great care in their due diligence on potential EB-5 investments. Investors should work with seasoned professionals who take a best practices approach to EB-5 to understand the intricacies of sustainment requirements and investment timelines. An EB-5 investment should not take undue risk, and caution is always advised. This conservative approach to the EB-5 investment process will help investors navigate the evolving landscape of EB-5 with greater confidence and clarity.