Navigating the U.S. tax system can be a challenge for any individual. In fact, the Internal Revenue Service (IRS) has more than 800 different tax forms and schedules. The good news is that most taxpayers have a relatively small number of tax forms to navigate. However, it is important to fully understand which tax forms are relevant to your situation and what to do with those documents to avoid any tax penalties. Forms that often spark questions from CamAm’s investors include the Schedule K-1, W-2 and Form 8805. Below are some answers to frequently asked questions to help provide a better understanding of these tax forms.

Frequently Asked Questions for a Schedule K-1

What is a Schedule K-1 document? A K-1 is a tax form that is issued annually for investors in partnerships, LLCs, S-Corps and other structures that have pass-through income. The document details your individual share of any income gained or any financial loss from ownership in the entity during a tax year.

What is a Schedule K-1 document? A K-1 is a tax form that is issued annually for investors in partnerships, LLCs, S-Corps and other structures that have pass-through income. The document details your individual share of any income gained or any financial loss from ownership in the entity during a tax year.

Why do I receive a K-1? The main purpose is for annual tax reporting to the IRS. The IRS uses the form to verify that an individual taxpayer is paying all of the appropriate taxes. The K-1 Schedule documents any income or losses from an investment, such as income earned from dividends or any income or loss from the sale of an asset. It serves a similar purpose as IRS Form 1099-MISC or 1099-NEC, which reports dividends or interest from securities or income from the sale of securities. CanAm and its affiliates provide annual K-1s to all investors in its EB-5, private equity and other investment funds. Individuals also may receive a K-1 from other non-CanAm investments, such as an Exchange Traded Fund that operates as a partnership.

What information is included in a K-1? The three parts of a K-1 Schedule are:

1. Issuing entity information

2. Partner/shareholder information

3. Financial details

When do I receive my K-1? It is common to receive a K-1 much later than other tax documents. Tax forms that provide annual income information, such as a W-2 or 1099, are issued by the end of January, while the deadline to receive K-1 Schedules is March 15.

Will I receive multiple K-1s from CanAm? Normally, an investor will receive one K-1 from CanAm. A redeployment investor who invests into different redeployment projects will only receive one K-1.

What should I do with my K-1? The entity issuing the K-1 files the form with the IRS and provides a copy to its investors. Individuals need to provide a copy of their K-1 to their tax preparer or accountant along with other tax forms and documents when preparing their annual tax return.

Frequently Asked Questions for a W-2

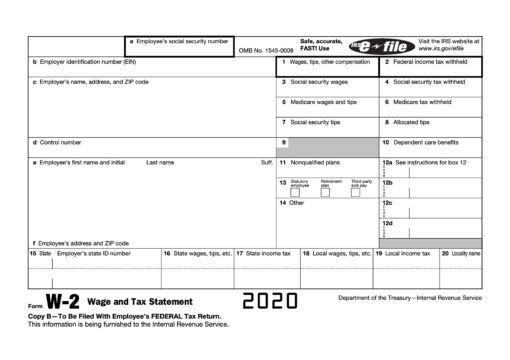

What is a W-2? Also known as a Wage and Tax Statement, the W-2 reports the annual wages an employee has been paid and the amount of taxes that have been withheld from an individual’s paychecks over the course of the year. Employers are required to issue a W-2 for all employees who earn more than $600. Independent contractors who earn more than $600 from a client or business, but are not an employee, typically receive a 1099-MISC tax form that reports income earned rather than a W-2.

Why do I receive a W-2? The main purpose is for annual tax reporting to the IRS. The employer reports W-2 information—taxable wages and taxes withheld – to the IRS for all employees. The individual receiving a W-2 also files a copy with their individual tax return. Importantly, an employer also files W-2 information with the Social Security Administration. That earnings history is used to calculate the amount of social security benefits an individual is eligible to receive after retirement, usually after the age of 62.

What information is included on a W-2? A W-2 includes total wages from salary, commissions and tips, as well as taxes withheld by the employer for federal, state, local, Medicare and social security. W-2s also include other important information, such as how much you have contributed to your retirement plan (401k) and how much your employer might have paid toward your health insurance coverage.

When do I receive my W-2? The deadline for employers to issue or mail a W-2 to employees is January 31.

Can I receive multiple W-2s? Yes. You will receive a W-2 if you have more than one employer. Each employer is required to issue W-2s for all employees who are paid more than $600 per year.

What should I do with my W-2? Individuals need to provide a copy of their W-2 to their tax preparer or accountant along with other tax forms and documents.

Frequently Asked Questions for Form 8805

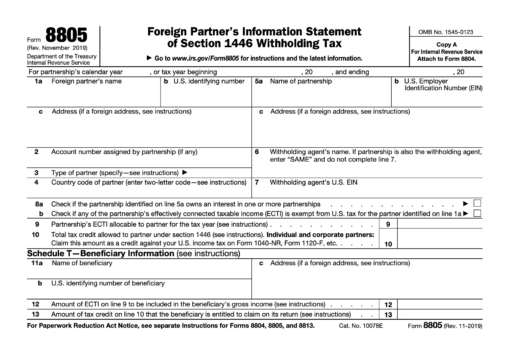

What is Form 8805? Form 8805 is filed by a U.S. partnership to report withholding tax for a foreign partner on the partner’s share of the effectively connected taxable income (ECTI). The withholding tax may be paid by the partnership even if no distributions are made.

What information is included on an 8805? The form is similar to a W-2 in that it requires identifying information for the partnership, the foreign partner and the amount of withholding tax paid on the U.S. earnings of each foreign partner.

When do I receive my 8805? Form 8805 must be sent to each foreign partner, whether or not any withholding tax is paid, at the end of the tax year. Copies of the forms should be sent to the foreign partners no later than April 15. CanAm and its affiliates typically send 8805 form to investors in March.

What do I do with my Form 8805? A copy of Form 8805 must be attached to the foreign partner’s U.S. income tax return. Individuals need to provide a copy of their Form 8805 to their tax preparer or accountant along with other tax forms and documents.

Navigating the U.S. tax environment can be complex. It is always wise to seek guidance and advice from a trusted tax professional or financial advisor.

Resources and Helpful Links to Learn More About K-1s, W-2s and 8805s

What Are Schedule K-1 Documents Used For? (investopedia.com)

Form W-2: Understanding Your W-2 Form (investopedia.com)

# # #

CanAm Enterprises, with over three decades of experience promoting immigration-linked investments in the US and Canada, has a demonstrated track record of success. With over 60 financed projects and $3 billion in raised EB-5 investments, CanAm has earned a reputation for credibility and trust. To date, CanAm has repaid more than $2.26 billion in EB-5 capital from over 4,530 families. CanAm manages several USCIS-designated regional centers that stretch across multiple states. For more information, please visit www.canamenterprises.com.