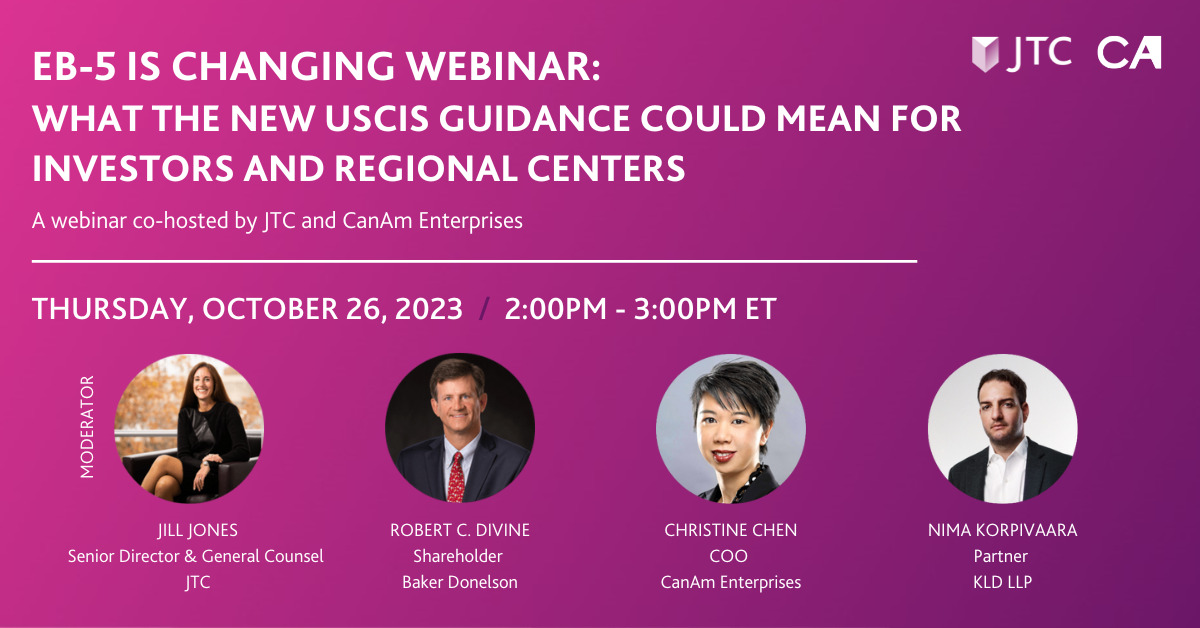

Even though COVID-19 has created significant challenges and uncertainty related to the near-term performances of EB-5 projects, there are options on the market. For qualifying developers and real estate owners, EB-5 redeployment funds can be an excellent source of alternative financing, particularly in the current post-COVID capital markets environment when the resources are scarce, said Christine Chen, chief operating officer at CanAm Enterprises.

As of Jan. 29, 629 CanAm EB-5 investors (representing a total of $314.5 million EB-5 principal) have submitted their consent forms to opt for a redeployment into a portfolio of market rate, and USCIS-compliant investments, including mezzanine loan, private equity deals, a mixture of mezzanine or PE or newly issued municipal bonds, she said.

“At CanAm, we have been utilizing redeployed EB-5 capital for real estate developments primarily in the form of mezzanine loans,” Chen said, “These mezzanine loans differ from traditional EB-5 loans in that they are not subject to the job creation requirements of the EB-5 program. Our capital is available immediately to fund different project types: new construction, asset repositioning and/or tenant improvements in a variety of asset classes, such as, office/commercial, hospitality, residential/multifamily, industrial, and mixed-use properties.”

In November 2019, CanAm announced the repayment of its first redeployment investments to their investors totaling $43.5 million, but that was just the beginning. In 2020 alone, five EB-5 project loans repaid in full and on time, totaling $450 million, including CanAm’s largest EB-5 repayment of $350 million from its All Aboard Florida project in August 2020. Of that, 447 investors consented to be redeployed, Chen said, and the rest were eligible to be repaid. The capital of $223.5 million have been redeployed in a range of different real estate development projects across Florida, each conforming to their investors’ time frames, risks tolerances and other factors.

“To date, we have repaid 3,500 investor-families, an aggregate principal amount of $1.75 billion,” Chen said.

CanAm Enterprises, with over three decades of experience promoting immigration-linked investments in the US and Canada, has a demonstrated track record of success. With over 60 financed projects and $3 billion in raised EB-5 investments, CanAm has earned a reputation for credibility and trust. To date, CanAm has repaid more than $2.26 billion in EB-5 capital from over 4,530 families. CanAm manages several USCIS-designated regional centers that stretch across multiple states. For more information, please visit www.canamenterprises.com.