Published on EB-5 Investors Magazine on 4/8/2020

By Christine Chen and Walter S. Gindin

The concept of redeploying, or reinvesting, capital following the realization of the original EB-5 investment was already on the minds of many EB-5 stakeholders by the time that retrogression for Chinese nationals was announced in May 2015. And while there was ample discussion within the industry about what redeployment would or should entail, it was not until June 2017 when USCIS updated its policy manual that we received formal guidance regarding both the capital at-risk requirement of the EB-5 program and redeployment of capital.

First, USCIS provided an important clarification that EB-5 capital is required to be sustained at-risk only during an investor’s “sustainment period” – that is, the initial two years of conditional lawful permanent residency – and that an investor “does not need to maintain his or her investment beyond the sustainment period.” Second, USCIS introduced, and articulated some criteria, for effectuating the “further deployment” of capital, including the requirement that any such further deployment must continue to satisfy the capital at-risk requirement consistent with the underlying EB-5 documents. USCIS also provided two examples of permissible further deployment investments – namely, an investment into another construction project or new issue municipal bonds, such as for infrastructure spending.

Unfortunately, USCIS has not provided any additional written guidance or clarification on further deployment beyond its initial pronouncements in the policy manual. Moreover, there is little prospect of timely feedback on any implemented further deployment strategy in the form of favorable I-829 petition adjudications, given that I-829 Petition are taking 3+ years to process. Accordingly, the industry’s initial foray into redeployment investments has not looked markedly different from the undertaking of the original EB-5 investments. But with more than two years having passed since USCIS provided its guidance, it is time to closely examine the current state of redeployment across the EB-5 landscape and consider some alternatives and “best practices.”

“Redeployment policy has added another layer of complexity to EB-5 investment immigration. Even in this environment, though, there is opportunity for EB-5 managers to move forward on investors’ behalf, closely mapping their decisions to written policy as a part of its redeployment due diligence process,” said Carolyn Lee, Founder of Carolyn Lee PLLC, counsel specialized in EB-5 investment immigration.

Redeployment can yield returns

The structure of EB-5 investments has long been premised on the need to price EB-5 capital below traditional bank financing to incentivize well-established job creating businesses to accommodate the additional oversight and reporting required by USCIS. And while EB-5 investors are typically willing to accept lower returns on their capital during the 5-7 years of the initial EB-5 investment, fewer investors are willing to continue to do so for another 5-10 years during redeployment. Frankly, there is no need to lock in capital for another period of five or more years with minimal returns. Redeployment investments can be structured in ways that provide investors with opportunities to invest in a myriad of options that can yield market rate returns.

In practice, redeployment funds have been directed into new issue municipal bonds, mezzanine loans, and/or preferred equity real estate investments. Nevertheless, it is possible to expand the menu of investment options to include pooled capital redeployment funds covering multiple projects to diversify investors’ market exposure. So how does a regional center select the right redeployment investment(s) for its EB-5 investors?

With different countries retrogressed for different numbers of years, a single redeployment investment alternative is not going to work for everyone. Investors with relatively short redeployment terms (for example, 2-3 years) may not want to stay in a longer-term redeployment investment suitable for investors subject to a 10+ year visa backlog. Moreover, the length of the redeployment term will affect each investor’s goals in terms of expected returns, liquidity needs, and risk tolerance. Finally, the possibility of backlog relief that shortens redeployment timeframes could factor into an investor’s decision making when considering redeployment alternatives.

As with any investment decision, it is critical that EB-5 investors assess the suitability of a particular redeployment investment. As such, regional centers should offer EB-5-compliant redeployment investments suited to the needs and objectives of their investors.

Redeployment is an investment, and therefore, subject to investment oversight

EB-5 investments are regulated securities subject to SEC oversight. Redeployment investments are no different. Most EB-5 investors subscribed for the original EB-5 investment based on an offering which described the specific EB-5 project, but most likely did not contain details regarding a redeployment investment. And even if the original offering generally allowed for other investments to be made after the original EB-5 investment, the process of investors actually choosing a subsequent investment may require investor consent for any such subsequent investment. Most investors who wish to continue pursuing their EB-5 visa would feel compelled to approve a reasonable investment that suits each investor’s individual circumstances. In such cases, it would behoove a regional center to engage an SEC-registered advisory provide consultation to ensure that SEC and FINRA’s suitability rules are being met.

“When redeploying EB-5 capital, working with an SEC-registered investment adviser is strongly recommended as those certifications prove the credibility of a wealth manager that can recommend a suitable option to investors,” said Donald McDonald, Founder and Managing Director of One Capital Management, a cross-border wealth management solutions firm based in California. “Registered investment advisers who have analytical expertise and execution capability in the U.S. municipal bond market can ensure that investments meet specific EB-5 redeployment criteria to satisfy USCIS policy,” added McDonald.

Understandably, USCIS’s policy guidance on redeployment may be outside the expertise of most financial advisors or wealth managers. For this reason, CanAm established its own registered investment advisory to leverage its EB-5 expertise with an experienced and licensed a sub-advisor to accommodate the needs of all our investors. And while doing so is consistent with CanAm’s preference for keeping as much of our EB-5 investment structuring in-house as possible, we know that it is not an option for every regional center. With 792 USCIS-approved EB-5 regional centers currently operating in the United States, it is clear that not all regional centers have the experience, capabilities, and/or resources to sufficiently accommodate all redeployment investment options . In some instances, many regional centers only have a handful of investors and providing a range of redeployment solutions to its investors is simply not a viable option.

There are other, less intensive ways that regional centers can provide redeployment investment alternatives that take into account an investor’s individual situation consistent with SEC and FINRA suitability rules. For example, for investors whose regional centers do not offer any redeployment solutions, or the options offered are not appealing to investors, regional center could consider allowing investors to vote to redeploy their capital into redeployment investments structured by another regional center, provided that the governing documents allow for it.

The bottomline

Per USCIS policy, investors need to sustain their capital “at risk” through the reinvestment of capital following the realization of the original EB-5 investment for at least the duration of their sustainment period. As with any investment, when redeploying EB-5 capital, investors are exposed to market risks. However, that does not mean that redeployment is or should be a risky investment, nor should the only “safe” option be another EB-5 project.

In fact, all redeployment offerings should undergo detailed project screening and proper due diligence should be performed by all regional centers. Well-rounded projects with sound financials will generally come with sufficient documentation to explain and evidence the capital stack, the investment strategy, and any exit strategies. Those are the qualities that regional center operators should look for in evaluating a possible redeployment investment.

Engaging a registered investment adviser is also advisable. With proper due diligence, redeployment investments can fulfill investor’s immigration requirements while producing solid returns.

—–

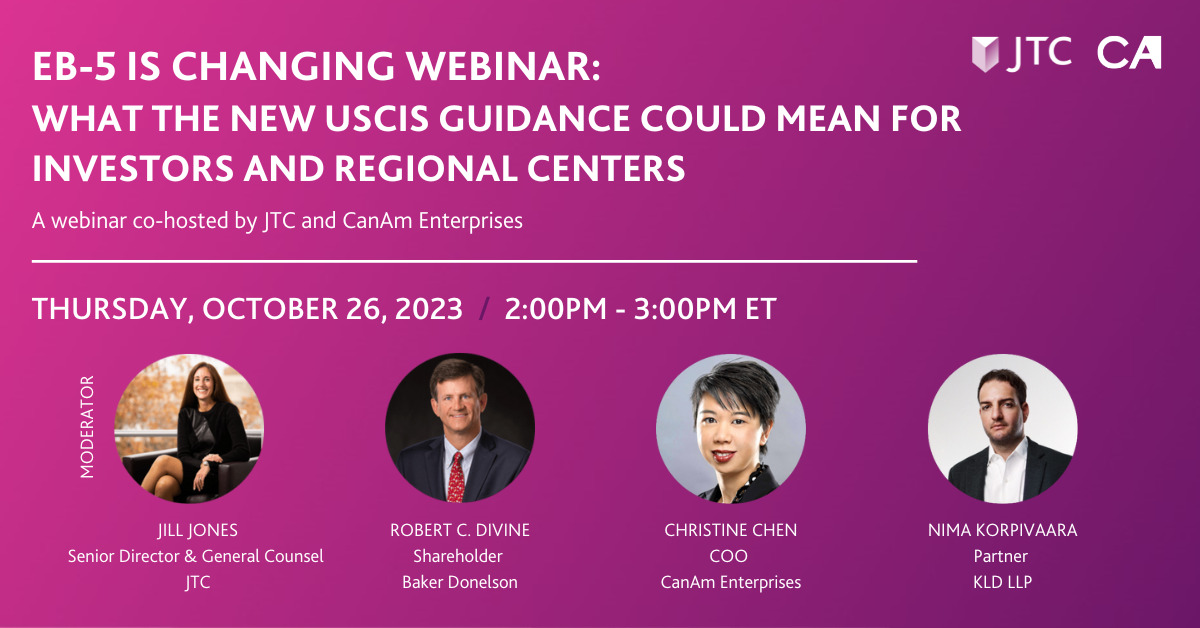

Christine Chen

Chief Operating Officer, CanAm Enterprises

Since joining CanAm in 2002, Christine Chen has been shaping CanAm’s strategic initiatives and operational efficiencies. As Chief Operating Officer, Ms. Chen’s responsibilities are wide-ranging, overseeing several distinct EB-5 business functions and employee management of over 40 staff worldwide.

During her tenure at CanAm, Ms. Chen has led a variety of initiatives to support CanAm’s myriad operations, including: facilitating an in-house FINRA Broker-Dealer, CanAm Investor Services; establishing and staffing representative offices in China; and leading initiatives to target new investor markets. Ms. Chen has appeared at several industry events as a panel member discussing EB-5 program issues and providing insight based on her executive management experience. Ms. Chen has helped establish CanAm as a premier EB-5 regional center operator.

Ms. Chen earned a Bachelor of Arts degree from the University of Chicago and a Master of Arts degree from Columbia University in the City of New York.

—–

Walter S. Gindin

Director, Legal Affairs, CanAm Enterprises

Walter S. Gindin is the Director of Legal Affairs at CanAm Enterprises, which operates seven USCIS-designated Regional Centers throughout the United States. Mr. Gindin is primarily responsible for developing and overseeing all aspects of the preparation of Forms I-924, I-526, and I-829 for CanAm’s projects, including providing guidance on compliance with EB-5 law, regulations, and policy.

Prior to joining CanAm, Mr. Gindin was an associate at a full-service immigration law firm where he handled a variety of EB-5 and non-EB-5 immigration matters. From 2011-2013, Mr. Gindin served as a law clerk at the U.S. Court of Appeals for the Second Circuit, where he drafted bench memoranda and orders in appeals and substantive motions concerning diverse areas of law, including immigration, constitutional law, civil rights (42 U.S.C. § 1983), civil procedure, torts, criminal law and procedure, employment discrimination, and appellate procedure and jurisdiction.

Mr. Gindin received a bachelor’s degree in economics (magna cum laude) and master’s degree in political science (summa cum laude) from New York University in 2005 and 2008, respectively. Mr. Gindin attended the University of Iowa College of Law and received his Juris Doctor (with Distinction) in 2011. Mr. Gindin served as an Editor on the Iowa Law Review and was a member of the law school’s Immigration Clinic. He is an active member of the New York State Bar and the American Immigration Lawyers Association and represents LGBTQ asylum applicants through Immigration Equality’s pro bono network.