There’s no denying that the COVID-19 pandemic created significant short-term challenges for the seniors housing segment of the real estate market. Leasing activity stalled as a result of lockdowns, and owners had to channel efforts into new cleaning and safety protocols to keep residents safe. Rising vaccination levels have brought a return in renter demand.

Despite the negative impact from the pandemic, many investors maintained their interests in seniors housing due to the favorable long-term outlook for the sector. One of the main factors that has been driving investment capital into the space in recent years is simple demographics and an aging population. According to Marcus & Millichap, the 65 and older population in the U.S. is expected to increase by 16.2 million over the next 10 years, and by 2030, the senior cohort will comprise 21% of the total population.

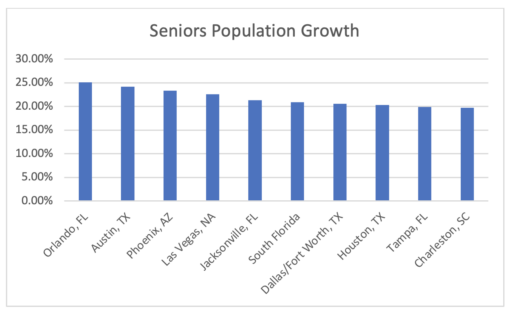

America’s aging seniors are also living longer and embracing more active lifestyles. The 65+ group has worked hard to amass wealth, and now they are looking to enjoy retirement. They are selling homes where they have to mow the grass and shovel snow in exchange for maintenance-free living, oftentimes in resort-style rental communities. The southern “Sunbelt” states are capturing a bigger share of seniors relocating to warmer climates. According to Marcus & Millichap, the top 10 metros for 65+ population growth based on percentage growth between 2020-2025 are projected to be:

- Orlando at 25.1%

- Austin at 24.2%

- Phoenix at 23.3%

- Las Vegas at 22.6%

- Jacksonville at 21.3%

- South Florida at 20.9%

- Dallas/Fort Worth at 20.6%

- Houston at 20.3%

- Tampa-St. Petersburg at 19.9%

- Charleston at 19.7%

Another tailwind behind the demand for senior living communities is the strong for-sale housing market, which is allowing aging homeowners to sell their homes quickly and at premium prices. According to the National Association of REALTORS, average home sale prices as of September were up 13.3% year-over-year.

The seniors housing market spans different types of facilities that range from independent living to nursing homes that offer 24-hour healthcare services. Independent senior housing rentals are age-restricted properties, usually for 55+ or 65+ residents. The operative word being independent. While nearly 4 in 10 older adults worldwide live with extended family, those in the U.S. rarely do. According to Pew Research, in the U.S., 27% of senior adults live alone, compared with only 16% of adults in the other 130 countries and territories studied. Furthermore, almost half (46%) of seniors in the U.S. live with only their spouse or partner, compared with three-in-ten globally (31%). For U.S. seniors, living by themselves provides more freedom and flexibility, and it is common to move to senior care facilities, such as assisted living, memory care or nursing homes, when they want companionship or need more day-to-day assistance with daily living or health needs.

Occupancies at seniors housing properties that declined during the worst of the pandemic are now bouncing back. The latest seniors housing data from the National Investment Center for Seniors Housing & Care (NIC) shows a strong recovery in occupancies following the worst of the pandemic. Additionally, occupancies at independent living properties weathered the pandemic better than assisted living and nursing care facilities. Third quarter 2021 data shows that occupancies at independent living facilities climbed to 83.2%, which is up from the pandemic low of 81.8% in the first quarter of 2021 but still below its pre-pandemic level of 89.7%.

CanAm Capital Partners (CACP) is continuing to look for new investment opportunities in the seniors housing sector on behalf of its EB-5 redeployment and private equity clients. One recent private equity offering was funding an $16 million mezzanine loan for Aviva, a 159-unit 55+ rental community located in Port St. Lucie on the southeast coast of Florida. The independent living community is designed for active adults with numerous amenities that include a pool, pickleball courts, dog park, putting green and walking trails. The project is being built on 10 acres by Lloyd Jones LLC, a nationally recognized real estate investment, development, and management firm that specializes in multifamily and senior housing. Since 1990, the firm has developed, owned, and/ or managed approximately $1.2 billion in total assets. Aviva is another example of how CACP partners with leading developers to deliver what it considers to be best-in-class opportunities to its investor base.

![]() About CanAm Capital Partners (CACP)

About CanAm Capital Partners (CACP)

A private equity affiliate of CanAm Enterprises, CanAm Capital Partners (“CACP”) makes project-level capital investments in real estate and other assets. CACP’s investment strategy focuses on geographies and assets where CanAm has informational, operational, and other competitive advantages. CanAm identifies and partners with mid-sized and regional operators who are specialized by asset type and/or geography and have proven to be experts in their niche with the capacity and potential to successfully execute on their proposed projects, including multifamily apartments, commercial space, mixed-use buildings, hotels, and private equity funds. To date, CACP and its affiliates have funded $254 million of capital in almost 20 private equity real estate investments in major metropolitan areas of the U.S.