The EB-5 Program is administered by U.S. Citizenship and Immigration Services (“USCIS”) through a complex network of immigration laws, regulations, and policies.

This guide aims to provide up-to-date information about the EB-5 Program’s origin, purpose, requirements, and benefits to immigrant investors and their families.

Up to 10,000 visas are allocated each fiscal year to investors in the EB-5 Program.

The minimum capital investment amount within a high unemployment area is $800,000.

The minimum capital investment amount outside a high unemployment area is $1,050,000.

Each EB-5 investor must create or preserve at least 10 full-time jobs in the United States.

The USCIS allocates 10,000 visas to the EB-5 Program each fiscal year (October 1 to September 30). EB-5 visas are very popular and the demand for EB-5 visas has increased consistently since 2009.

The EB-5 Reform and Integrity Act created new EB-5 immigrant visa set-asides for qualified immigrant investors. Each fiscal year, a certain percentage of EB-5 immigrant visas are available to qualified immigrants who invest in specific areas:

| Area of Investment | EB-5 Immigrant Visas Set-Aside Each Fiscal Year |

|---|---|

| Rural Area | 20% |

| High Unemployment Area | 10% |

| Infrastructure Project | 2% |

Any set-aside EB-5 visas that go unused are held in the same set-aside category for one additional fiscal year. After the second fiscal year, any remaining unused immigrant visas from EB-5 set-aside categories are released to the pool of unreserved EB-5 immigrant visa during the third fiscal year.

For many investors, the EB-5 visa offers the clearest and most practical path to getting green cards for the entire family.

EB-5 investors who become U.S. lawful permanent residents (green card holders) and their qualifying dependents:

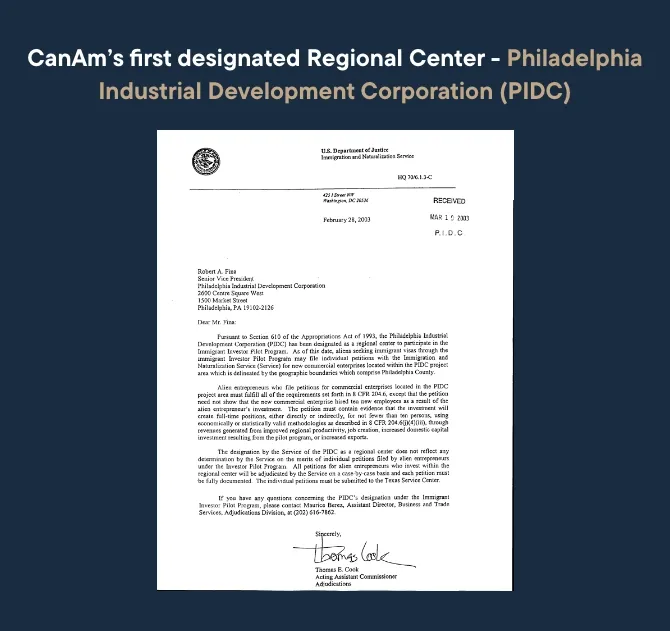

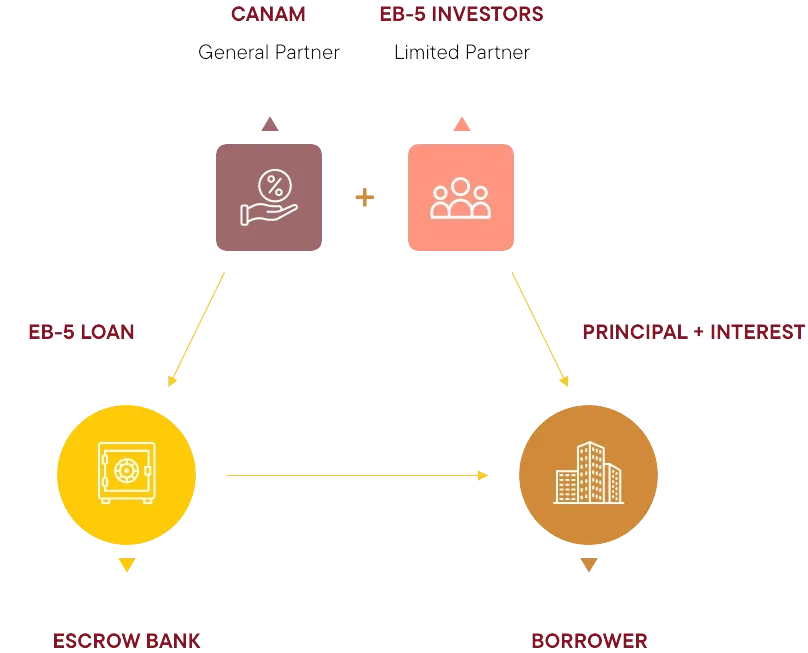

A Regional Center is an economic unit in the United States that is involved with promoting economic growth. Regional Centers are designated by USCIS for participation in the EB-5nProgram. Regional Centers can offer investors already-defined investment opportunities, thereby reducing the investors’ responsibility to identify acceptable investment vehicles. The minimum investment and job creation requirements are the same for both investment options. Overall, more than 90% of the EB-5 investors choose to invest with a Regional Center.

Preparation of offering documents and materials related to USCIS immigration application:

CanAm Enterprises will guide you through every step of the process with a proven track record of success.

Explore what’s happening now with CanAm and the EB-5 Visa.

Something significant happened inside USCIS in the third quarter of 2025. After more than a year of processing roughly 400 individual investor petitions per quarter,...

Understanding what goes into an I-956F filing and what USCIS scrutinizes is important, but understanding why some petitions get denied is critical for risk management....

For Indian EB-5 investors, the monthly visa bulletin determines whether you can file for adjustment of status—or whether you’ll be waiting months or years for...

The EB-5 Reform and Integrity Act of 2022 (RIA) created the infrastructure project category, offering investors access to dedicated visa set-asides. But CanAm’s infrastructure experience...

Fill out the form below and our team will get back to shortly.

48 Wall Street – 24th Floor New York, NY 10005, USA

Monday-Friday: 9am to 5pm

lawyer, united states citizenship and immigration services, green card, eb 5 visa, consul, citizenship, employment, law, foreign direct investment, economic growth, fraud, visa bulletin, adjustment of status, investment fund, due diligence, petition, immigration law, naturalization, priority date, united states department of state, immigration act of 1990, fee, regulatory compliance, debt, eb 5 visa program, infrastructure, asset, background check, joint venture, property, national visa center, adjudication, legislation, foreign national, economic development, equity, interest, rate of return, risk, partnership, evidence, fair market value, statute, net worth

eb 5 visa, eb 5 visa program, eb 5, eb5 visa program, visaeb5perucom, eb5 visa, eb5, eb5 investment projects, canam eb5 review, canam enterprises reviews, eb5 visa projects, can am enterprises, eb5 banks, canam eb5, eb 5 project

The EB-5 Visa Program offers a unique pathway for foreign investors to obtain U.S. permanent residency through investment. This program not only facilitates immigration but also plays a pivotal role in job creation and economic growth in the United States. By investing in approved projects, investors can secure their family's future while contributing to the local economy.

Originating from the Immigration Act of 1990, the EB-5 program has evolved into a critical tool for attracting foreign capital. Investors can choose between direct investments in new commercial enterprises or participate in regional center projects that pool funds for larger developments. This flexibility allows for diverse investment opportunities across various sectors, enhancing the program's appeal.

The application timeline for the EB-5 Visa can vary significantly based on individual circumstances and project specifics. Generally, the process involves several key stages, including the preparation of the I-526E petition, approval, and subsequent steps leading to the issuance of a green card. Understanding this timeline is crucial for investors to plan their investments effectively.

Typically, the I-526E petition processing times have been increasing, making it essential for prospective investors to apply as early as possible. After the petition approval, investors must navigate the consular interview process, which may also vary in duration. Staying informed about these timelines helps investors avoid potential delays and ensures a smoother application experience.

Several factors can significantly influence the success of an EB-5 investment, including the credibility of the regional center, the project's economic viability, and the track record of job creation. Investors should conduct thorough due diligence to assess these elements before committing their capital.

Additionally, the alignment of the investment project with the EB-5 requirements, such as job creation and lawful source of funds, plays a critical role in determining the likelihood of obtaining permanent residency. Engaging with experienced immigration attorneys and financial advisors can provide investors with valuable insights into making informed decisions.

Recent legislative changes, particularly the EB-5 Reform and Integrity Act, have introduced new regulations that affect both investors and regional centers. These changes aim to enhance the program's integrity and ensure that investments lead to genuine economic benefits. Understanding these updates is essential for prospective investors.

Investors should be aware of how these legislative changes impact visa allocation, investment amounts, and compliance requirements. Keeping abreast of the latest developments allows investors to adapt their strategies accordingly and maximize the benefits of their EB-5 investments.

lawyer, united states citizenship and immigration services, green card, eb 5 visa, consul, citizenship, employment, law, foreign direct investment, economic growth, fraud, visa bulletin, adjustment of status, investment fund, due diligence, petition, immigration law, naturalization, priority date, united states department of state, immigration act of 1990, fee, regulatory compliance, debt, eb 5 visa program, infrastructure, asset, background check, joint venture, property, national visa center, adjudication, legislation, foreign national, economic development, equity, interest, rate of return, risk, partnership, evidence, fair market value, statute, net worth

eb 5 visa, eb 5 visa program, eb 5, eb5 visa program, visaeb5perucom, eb5 visa, eb5, eb5 investment projects, canam eb5 review, canam enterprises reviews, eb5 visa projects, can am enterprises, eb5 banks, canam eb5, eb 5 project

The EB-5 Visa Program offers a unique pathway for foreign investors to obtain U.S. permanent residency through investment. This program not only facilitates immigration but also plays a pivotal role in job creation and economic growth in the United States. By investing in approved projects, investors can secure their family's future while contributing to the local economy.

Originating from the Immigration Act of 1990, the EB-5 program has evolved into a critical tool for attracting foreign capital. Investors can choose between direct investments in new commercial enterprises or participate in regional center projects that pool funds for larger developments. This flexibility allows for diverse investment opportunities across various sectors, enhancing the program's appeal.

The application timeline for the EB-5 Visa can vary significantly based on individual circumstances and project specifics. Generally, the process involves several key stages, including the preparation of the I-526E petition, approval, and subsequent steps leading to the issuance of a green card. Understanding this timeline is crucial for investors to plan their investments effectively.

Typically, the I-526E petition processing times have been increasing, making it essential for prospective investors to apply as early as possible. After the petition approval, investors must navigate the consular interview process, which may also vary in duration. Staying informed about these timelines helps investors avoid potential delays and ensures a smoother application experience.

Several factors can significantly influence the success of an EB-5 investment, including the credibility of the regional center, the project's economic viability, and the track record of job creation. Investors should conduct thorough due diligence to assess these elements before committing their capital.

Additionally, the alignment of the investment project with the EB-5 requirements, such as job creation and lawful source of funds, plays a critical role in determining the likelihood of obtaining permanent residency. Engaging with experienced immigration attorneys and financial advisors can provide investors with valuable insights into making informed decisions.

Recent legislative changes, particularly the EB-5 Reform and Integrity Act, have introduced new regulations that affect both investors and regional centers. These changes aim to enhance the program's integrity and ensure that investments lead to genuine economic benefits. Understanding these updates is essential for prospective investors.

Investors should be aware of how these legislative changes impact visa allocation, investment amounts, and compliance requirements. Keeping abreast of the latest developments allows investors to adapt their strategies accordingly and maximize the benefits of their EB-5 investments.