As the political landscape shifts following the recent U.S. presidential election, questions arise about potential impacts on immigration programs, especially those facilitating legal immigration for investors, like the EB-5 visa program. Pete Calabrese, CEO of CanAm Investor Services, and Rohit Turkhud, Counsel at CSG Law, addressed these concerns in a recent webinar. Both experts provided valuable insights into how this change could affect Indian investors considering the EB-5 program as a pathway to permanent residency in the United States.

The Stability of the EB-5 Program

Pete Calabrese opened the discussion by affirming his optimism for the EB-5 program’s future, regardless of administration changes. He emphasized that EB-5 is a legal, merit-based program. Calabrese reassured investors that past support for the EB-5 program will likely continue under the new administration due to its strong economic contributions.

Similarly, Rohit Turkhud highlighted the bipartisan appeal of the EB-5 program:

“I’m not expecting any adverse changes to the EB-5 program.”

He explained that the program’s core function of creating jobs and economic opportunities aligns well with economic priorities. Investors can be reassured by the strong bipartisan backing, which is unlikely to waver given the program’s economic benefits.

Impacts of the Reform and Integrity Act

Calabrese and Turkhud discussed how the recent passage of the EB-5 Reform and Integrity Act (RIA) adds significant stability to the EB-5 landscape. “There is stability in place in the form of the RIA,” Calabrese noted. “The program has been reinstated through September of 2027, with any petition filed before September of 2026 being grandfathered.” This new law not only extends the program but also strengthens protections for investors and ensures stricter oversight of regional centers, filtering out unreliable operators from the market.

Turkhud elaborated, pointing out that “the RIA has brought much greater protections to the investor community…it seems to be separating the wheat from the chaff.” He emphasized that these regulatory changes enhance the program’s credibility by requiring rigorous compliance standards for regional centers. “The good ones are still around and prospering, like CanAm,” he said, urging potential investors to prioritize trusted and compliant entities when making investment decisions.

Read More: Why do Indians view the EB-5 Visa program as an avenue to live, work and study in the United States

EB-5 as a Pathway for Indian Investors

For Indian investors, the EB-5 program remains one of the fastest routes to obtaining a green card. Turkhud underscored this point, saying, “For Indian investors, it is probably the fastest way to get a green card, unless it’s through a real marriage to an American citizen or a green card holder.” He also noted the benefits for Indian nationals on H-1B or F-1 visas, who could leverage EB-5 to obtain employment authorization while waiting for green card approvals. Calabrese echoed these sentiments, acknowledging that “the EB-5 program…still remains the strongest pathway for an Indian investor who can meet the qualifications.”

Possible Effects of the New Administration

Although the incoming administration has shown a strong stance on immigration, Calabrese and Turkhud believe the EB-5 program is unlikely to face major changes.

“I don’t see any huge wholesale changes done,” Calabrese stated, noting that EB-5 has consistently enjoyed bipartisan support and that the new administration is well-acquainted with the program’s value. Turkhud added, “I’m optimistic about the EB-5 program…it brings in money, creates jobs, and creates prosperity for the United States.”

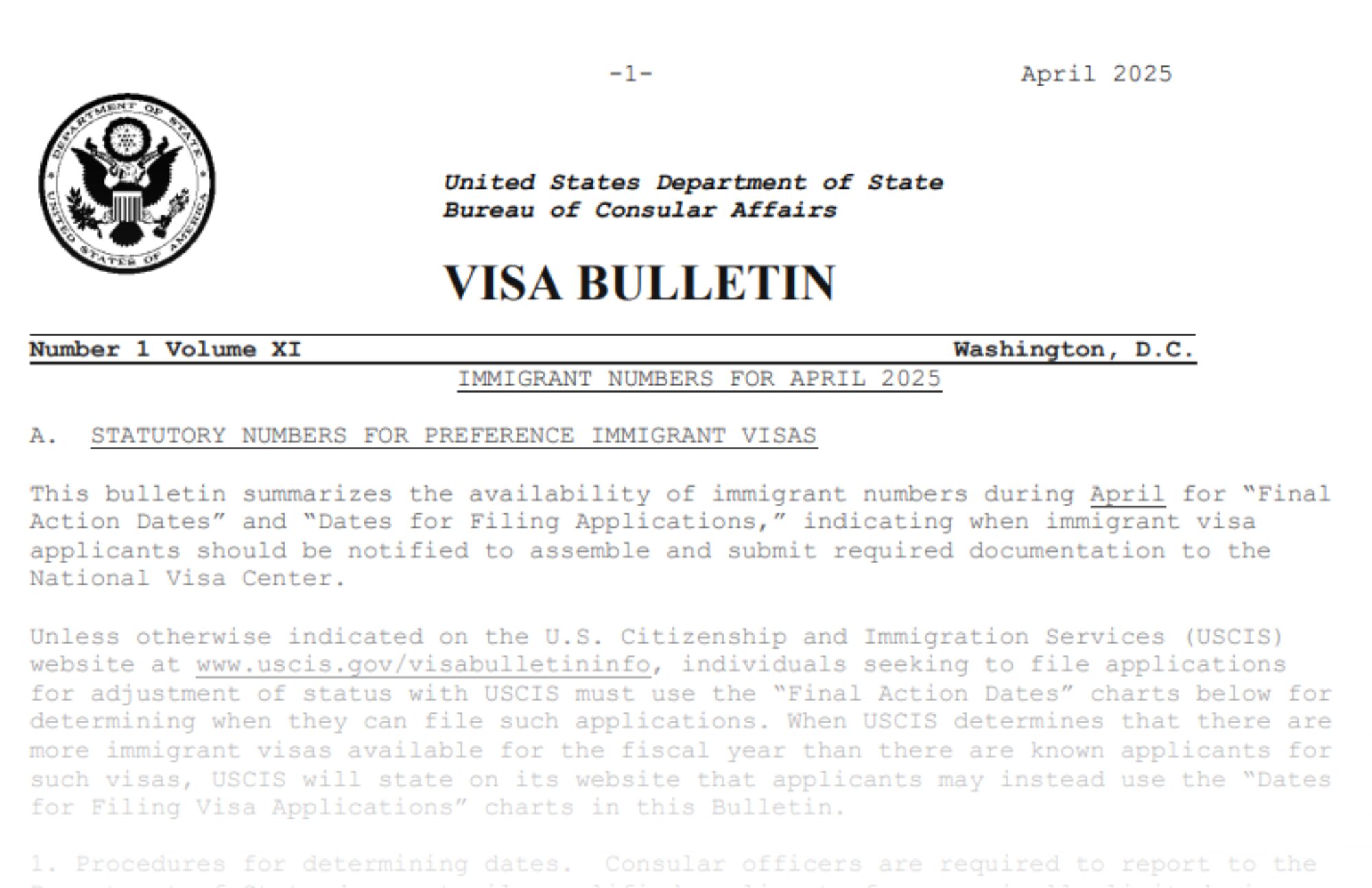

Turkhud also noted that while there could be changes affecting broader immigration categories, the EB-5 program’s strict regulatory framework would shield it from sudden shifts. “We may face some issues with processing timelines,” he cautioned, especially if government staffing or security checks are affected. Yet he remained hopeful, concluding, “If the interest rates go down as [Trump] indicated…it may promote EB-5 activities even further.”

Potential Challenges and Considerations

While largely positive about the program’s future, Turkhud did advise potential investors to keep an eye on processing timelines and broader immigration policies. “If I had to worry about anything, it might be challenges with staffing at the State Department level,” he explained. He also noted the possibility of additional security checks for certain countries, although this is unlikely to affect major EB-5 source countries like India and China significantly.

For investors already residing in the U.S., the outlook is especially favorable. Calabrese emphasized that “Indian investors who are legally in the United States…do stand to benefit” due to easier adjustment of status options and benefits like employment authorization and advanced parole.

The Road Ahead

As the U.S. enters a new presidential term, the consensus from Calabrese and Turkhud’s discussion is that the EB-5 program remains a robust and reliable pathway for investment-based immigration. “The program has bipartisan support. It’s got a president that understands it, that has been in favor of it in the past,” Calabrese concluded, urging investors to view this as an opportune moment for EB-5 investments.

Turkhud ended on an optimistic note: “It is the one program that’s bringing in billions of dollars to the U.S….from all those perspectives, it’s clearly a go-to program.” Both speakers expressed confidence that the EB-5 program will continue to serve as a valuable tool for foreign investors seeking U.S. residency, particularly those from India.

As new policies are implemented, potential EB-5 investors can take comfort in the program’s legislative support and enhanced regulatory structure. The economic benefits of EB-5 investments—job creation and economic growth—are invaluable for the United States, which bodes well for its stability and long-term viability.