Renewed Demand for the U.S. EB-5 Immigrant Investor Program

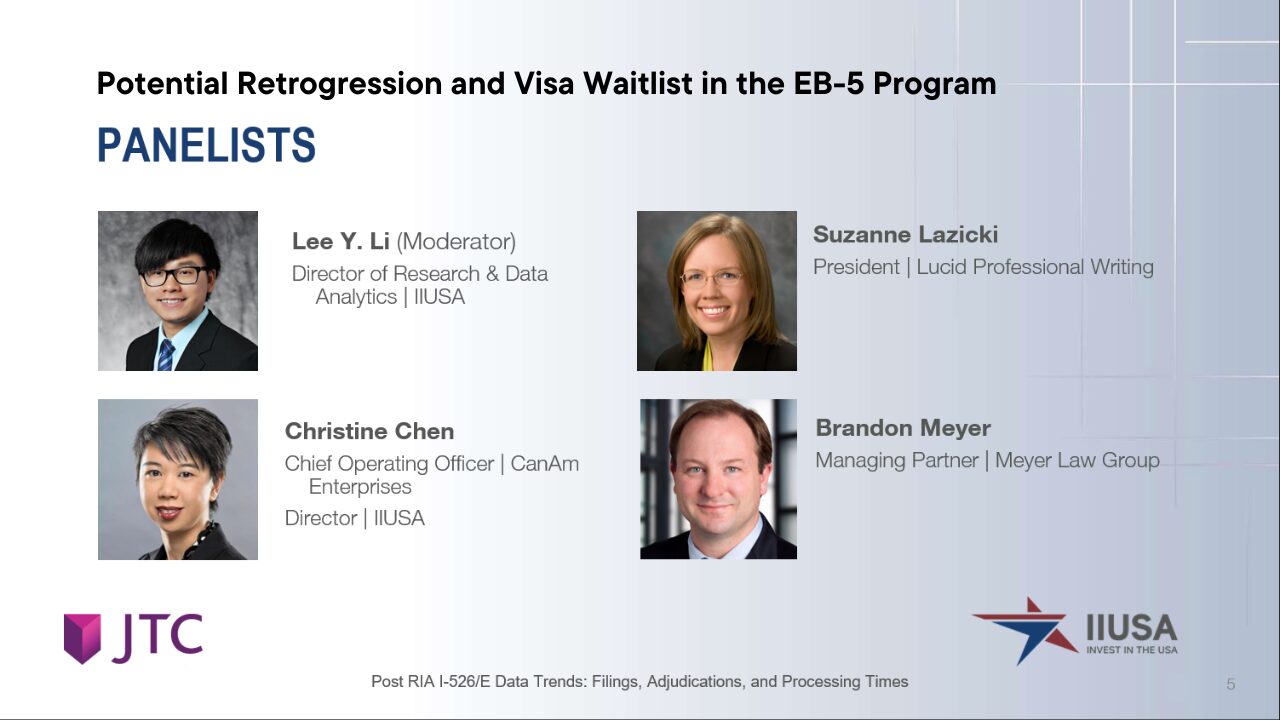

In recent years, the EB-5 Immigrant Investor Program has seen a resurgence of interest from high-net-worth individuals worldwide seeking a secure pathway to U.S. residency. Hosted by Henley & Partners, and featuring Nick Buonagurio, Senior Vice President of Business Development at CanAm Investor Services, Dmytro Chernega, Private Client Advisor Austria at Henley & Partners and George Ganey, Founding Partner at Ganey Law Group, the Global Webcast Series event provided crucial insights into the program’s evolution, benefits, and practical considerations for investors and their families.

Understanding the EB-5 Program’s Appeal

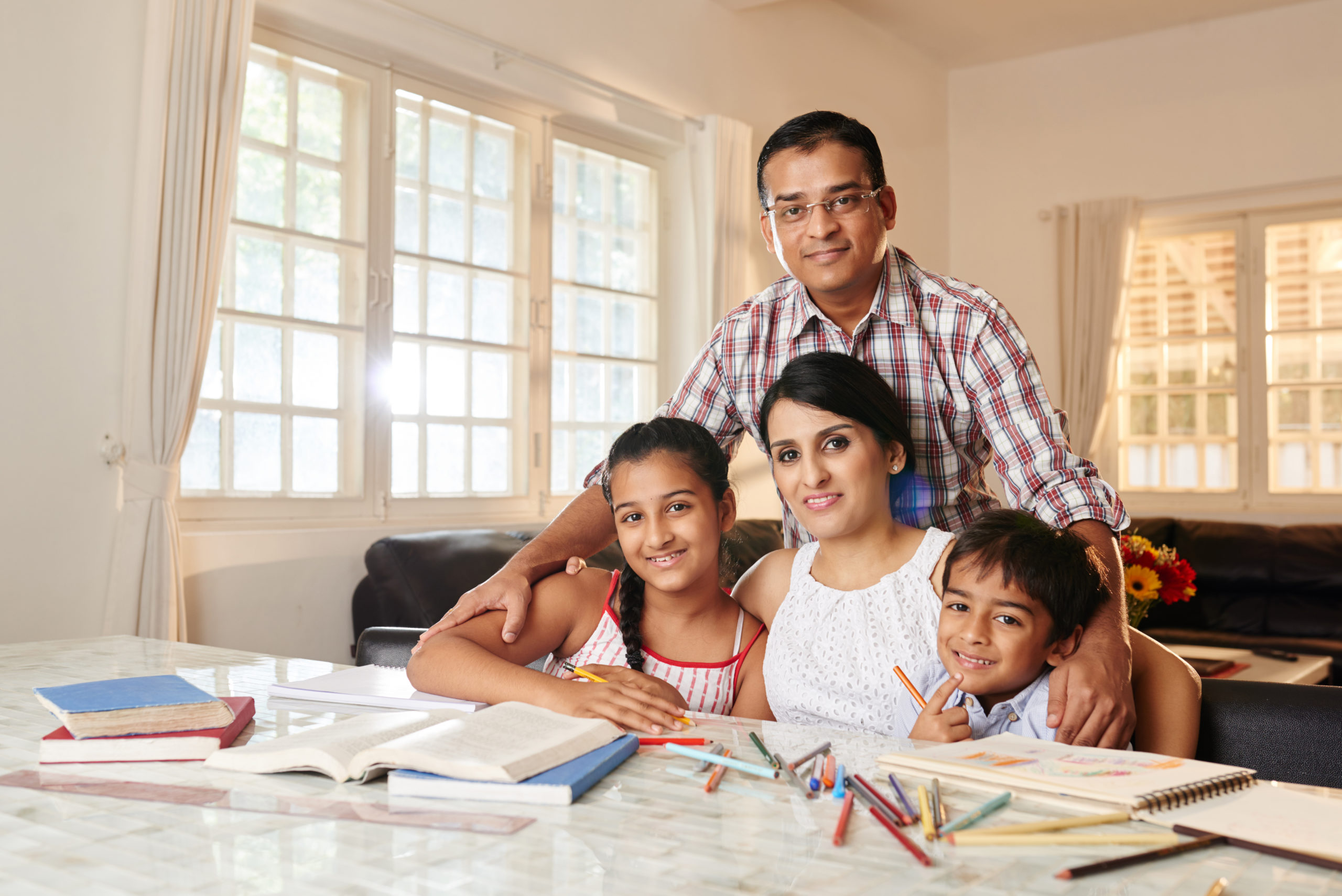

The U.S. government introduced the EB-5 program in the 1990s to attract foreign capital and create jobs for American workers. By making a substantial investment in the U.S., qualified investors and their immediate families gain a pathway to permanent residency, with the potential for U.S. citizenship after five years. The program, enhanced by recent reforms, is an appealing route for families seeking access to the world’s largest economy, top-tier education, and a stable environment.

Recent Reforms Bolster Transparency and Demand

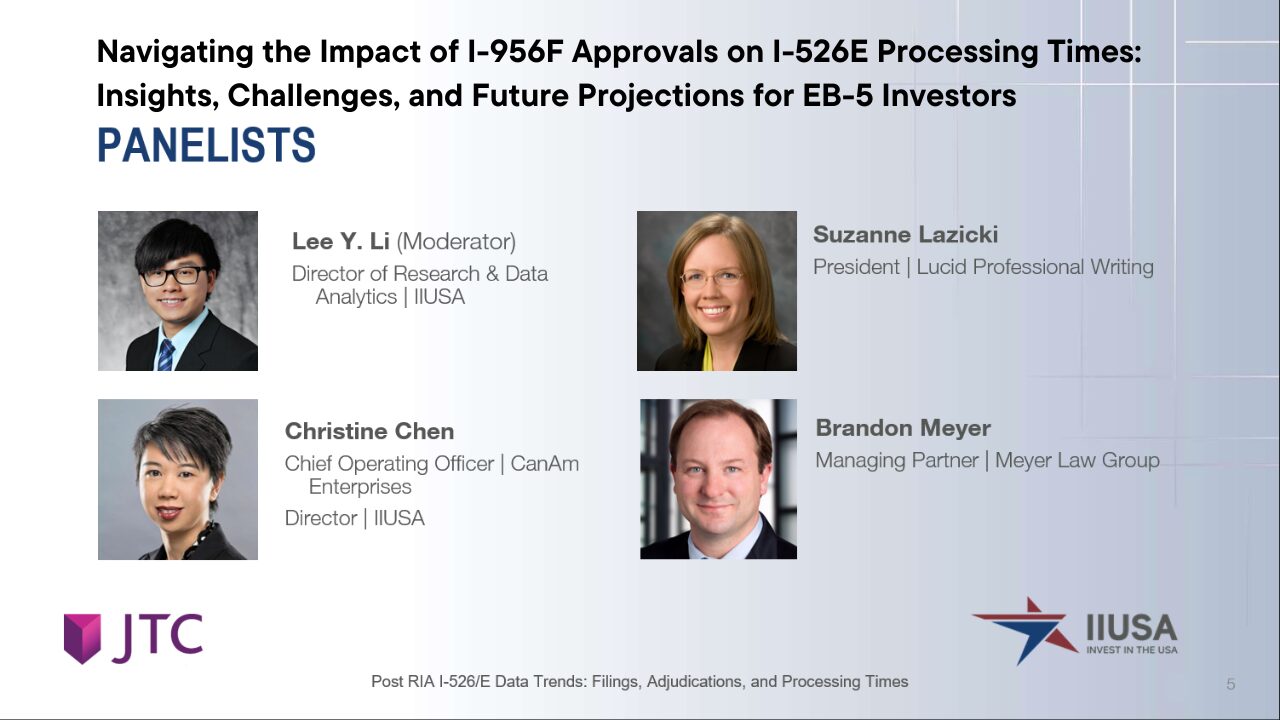

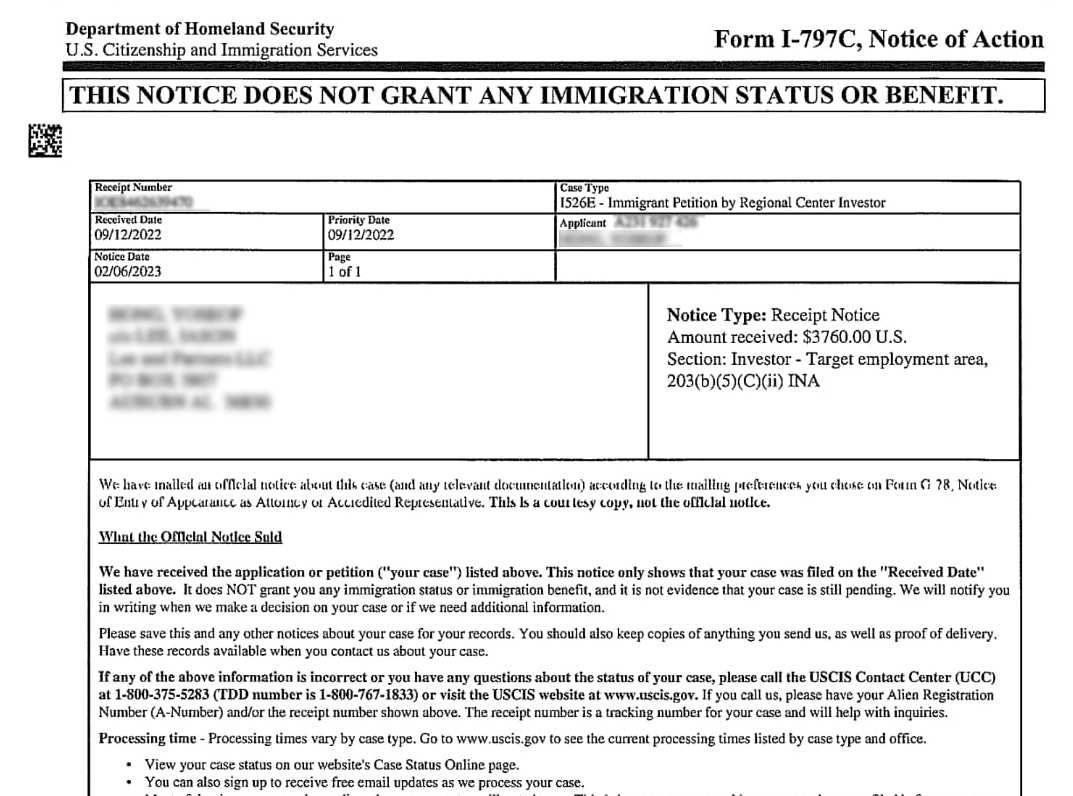

The EB-5 program underwent significant updates in 2022 with the passage of the EB-5 Reform and Integrity Act (RIA), which introduced key changes aimed at improving transparency, accountability, and investor protection. These changes included heightened oversight of regional centers, more stringent fund management requirements, and a structured process for job creation tracking. These reforms have heightened investor trust, making EB-5 a more predictable and attractive option in a volatile global climate.

The webcast revealed that many high-net-worth families are drawn to EB-5 for different reasons. Henley & Partners serves clients from both emerging markets facing instability and developed economies seeking a safe, long-term investment in U.S. residency. The RIA’s accountability measures have strengthened the program, making it an increasingly viable option for families around the world.

Read More: Post-RIA EB-5 I-526E Data Trends: Insights and Implications for Investors and Stakeholders

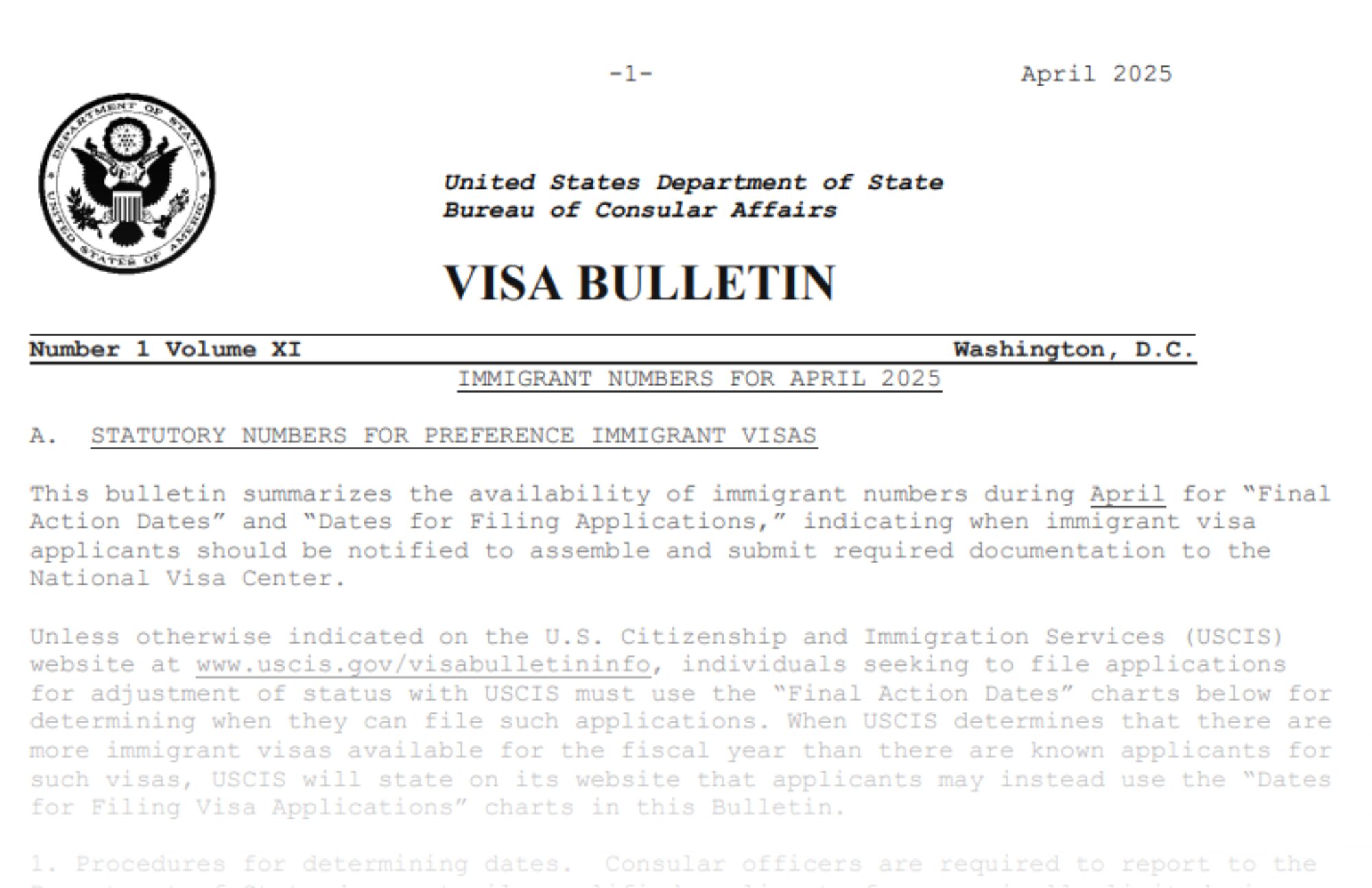

EB-5 Investment Requirements

EB-5 investments come with specific criteria. Investors are required to contribute either $800,000 for a project in a Targeted Employment Area (TEA) or $1,050,000 outside a TEA. Additionally, each investment must create at least ten full-time jobs for U.S. workers. George Ganey provided a detailed analogy to illustrate the investment process, likening it to planting a tree: investors must prove the “seed” (initial source of funds), the “tree” (growth of investment funds), and the “fruit” (the funds ready for investment). This comprehensive approach ensures that the investment’s legality is verifiable, which is a critical factor for program eligibility.

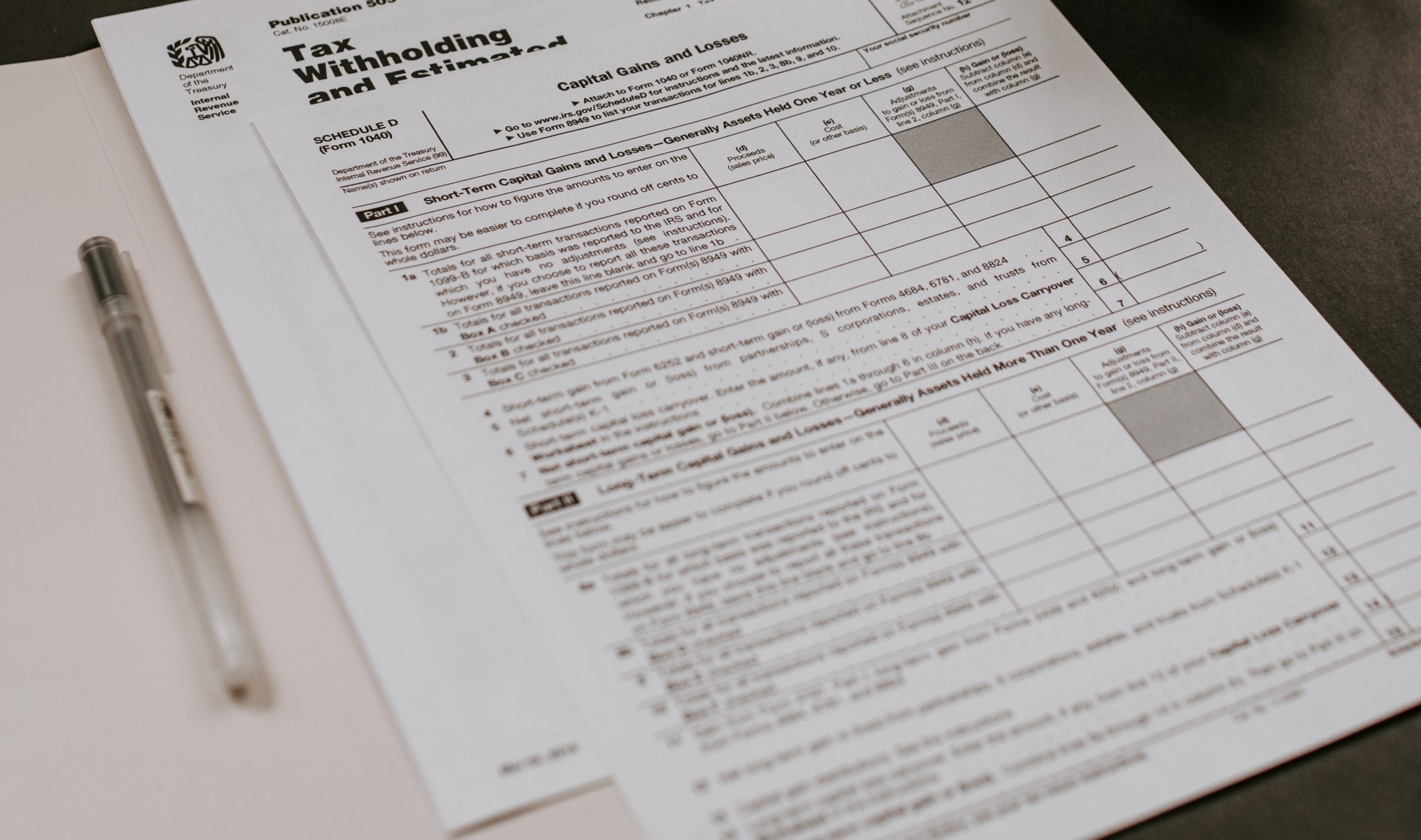

For families considering an EB-5 investment, Ganey advised potential investors to engage in pre-immigration tax planning to address any implications tied to U.S. residency. Henley & Partners facilitates these considerations, ensuring a smooth transition by providing support through legal, financial, and immigration services.

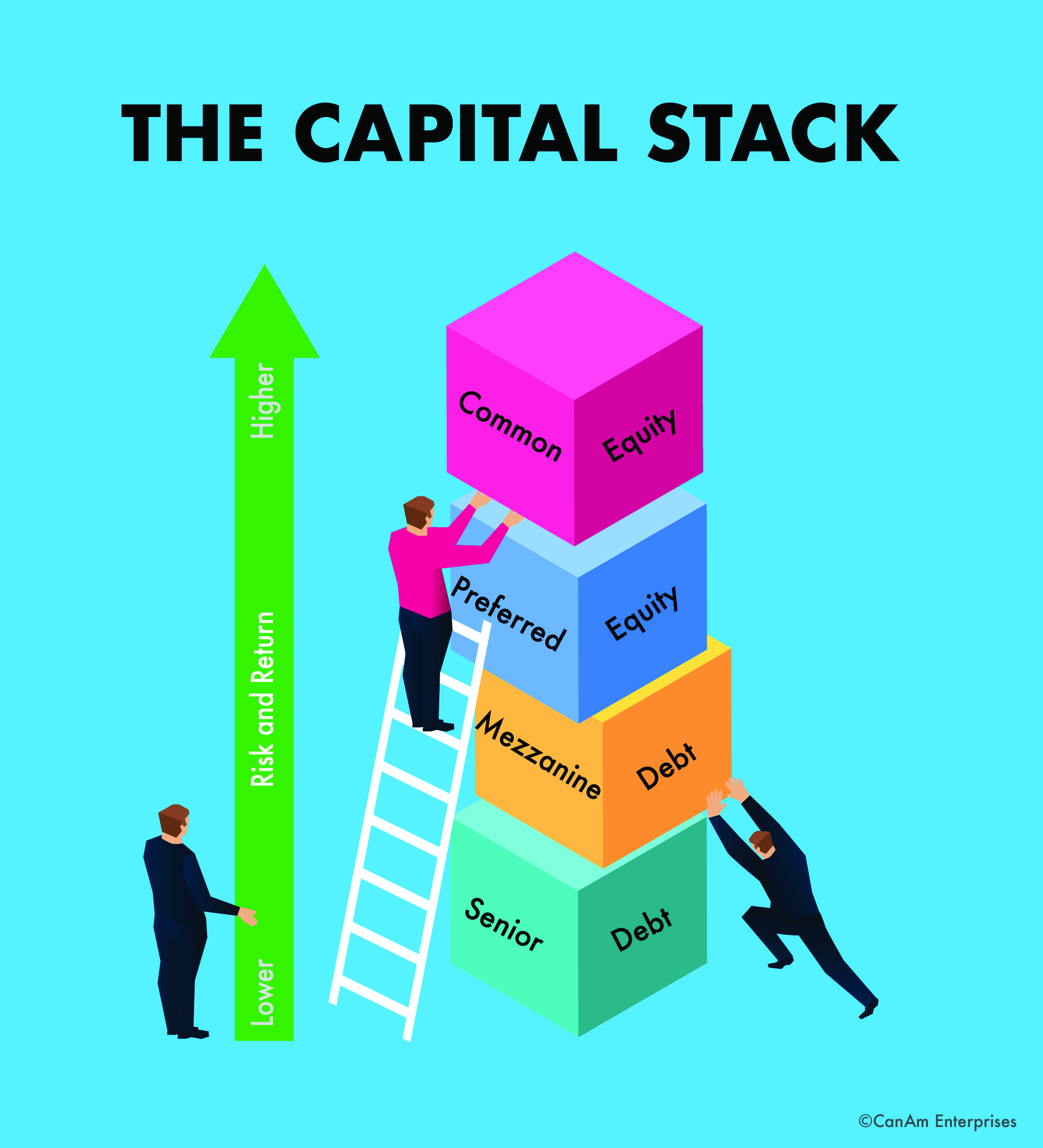

Two Routes: Regional Centers and Direct Investment

A central feature of the EB-5 program is the choice between investing through a regional center or directly in a business. Direct investment requires investors to own and manage a business, employing at least ten U.S. workers directly. This active investment path is typically complex, demanding intensive management and operational involvement.

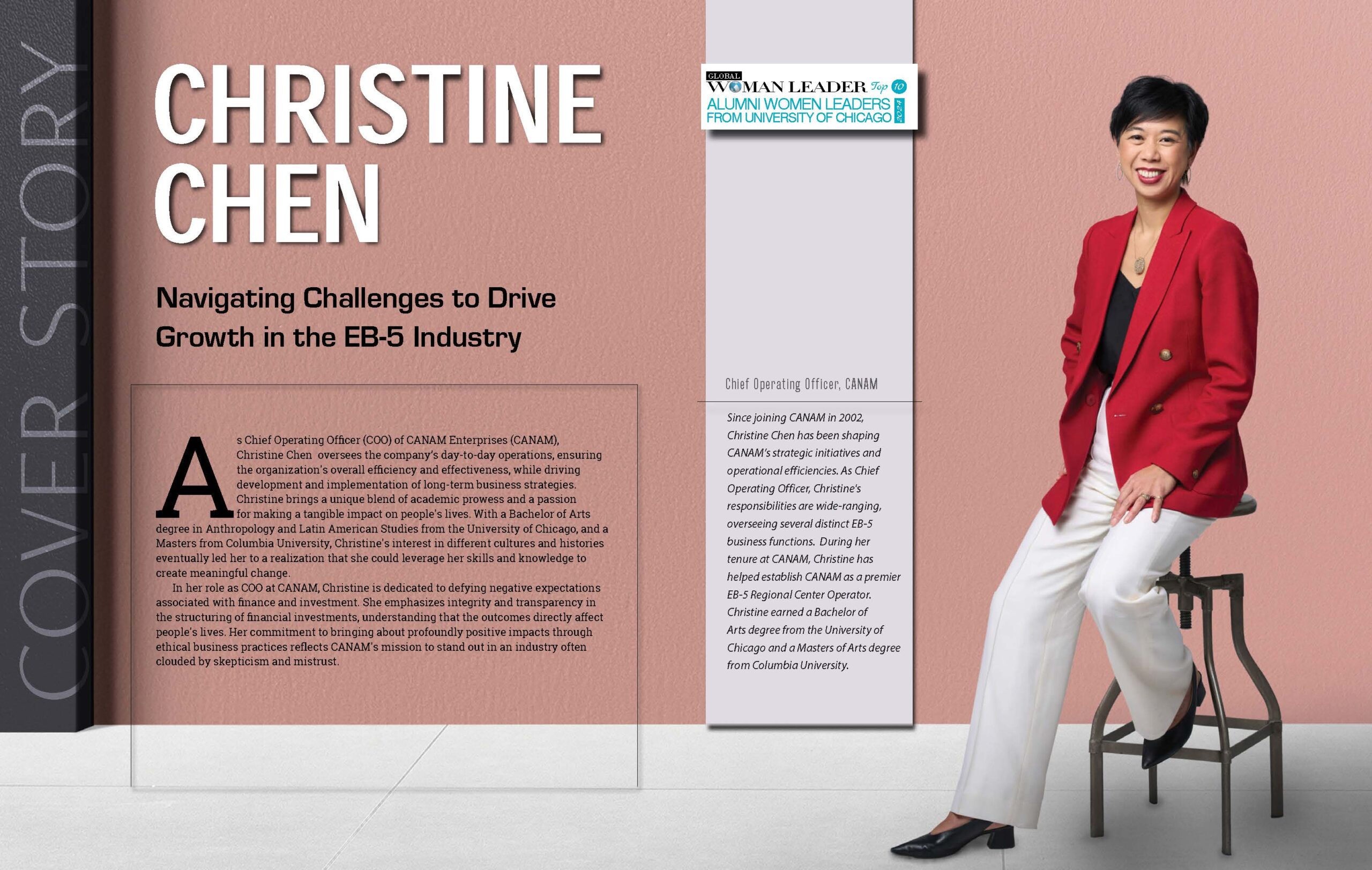

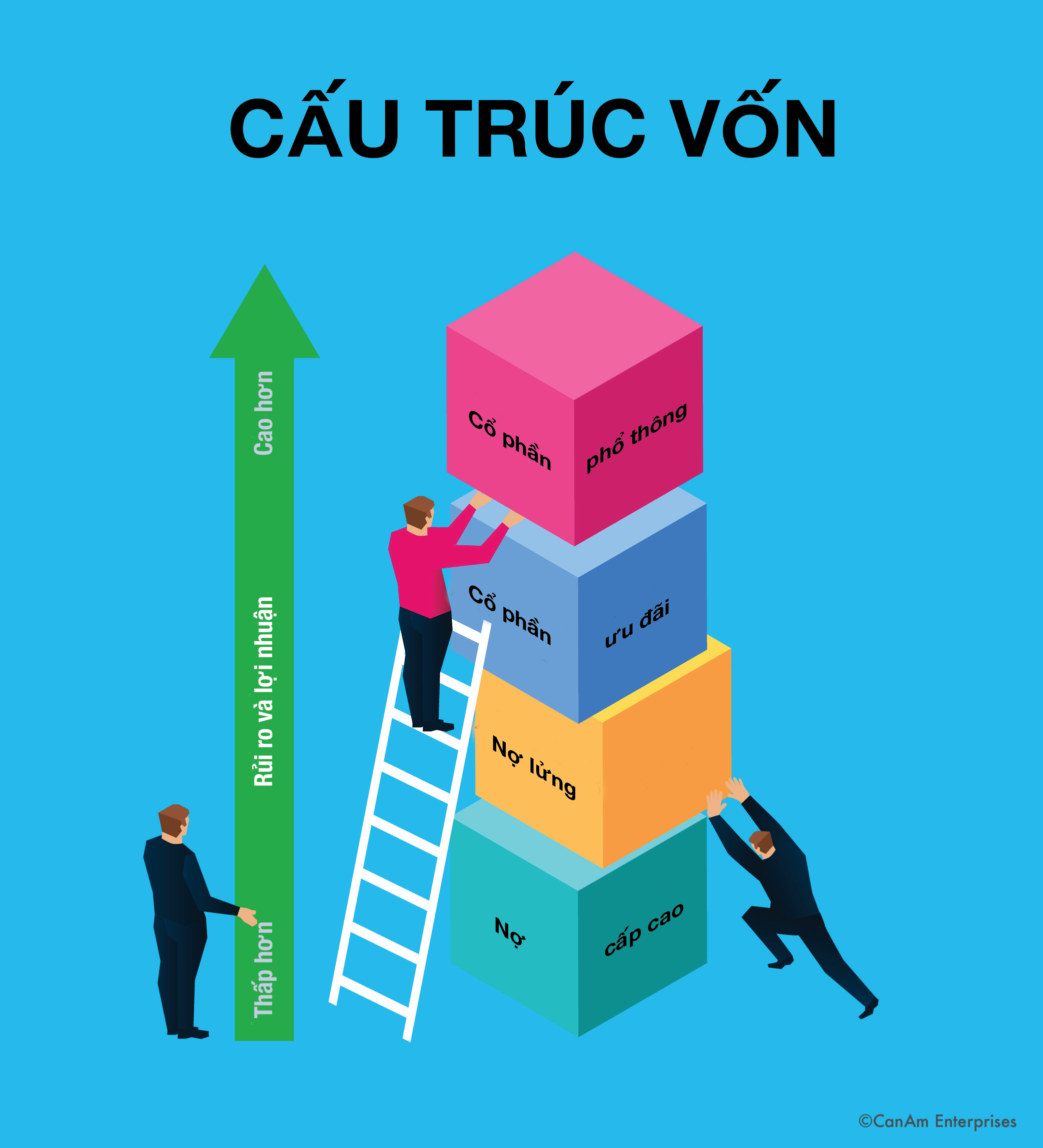

In contrast, most EB-5 investors prefer the regional center model, a more passive option. Regional centers, which are organizations authorized by the U.S. government, manage qualified projects that create jobs indirectly. This model allows investors to contribute capital without managing daily operations. Regional centers like CanAm provide transparency, risk management, and investor support throughout the process, offering a lower-risk, compliance-driven approach for families.

Selecting a Quality Regional Center

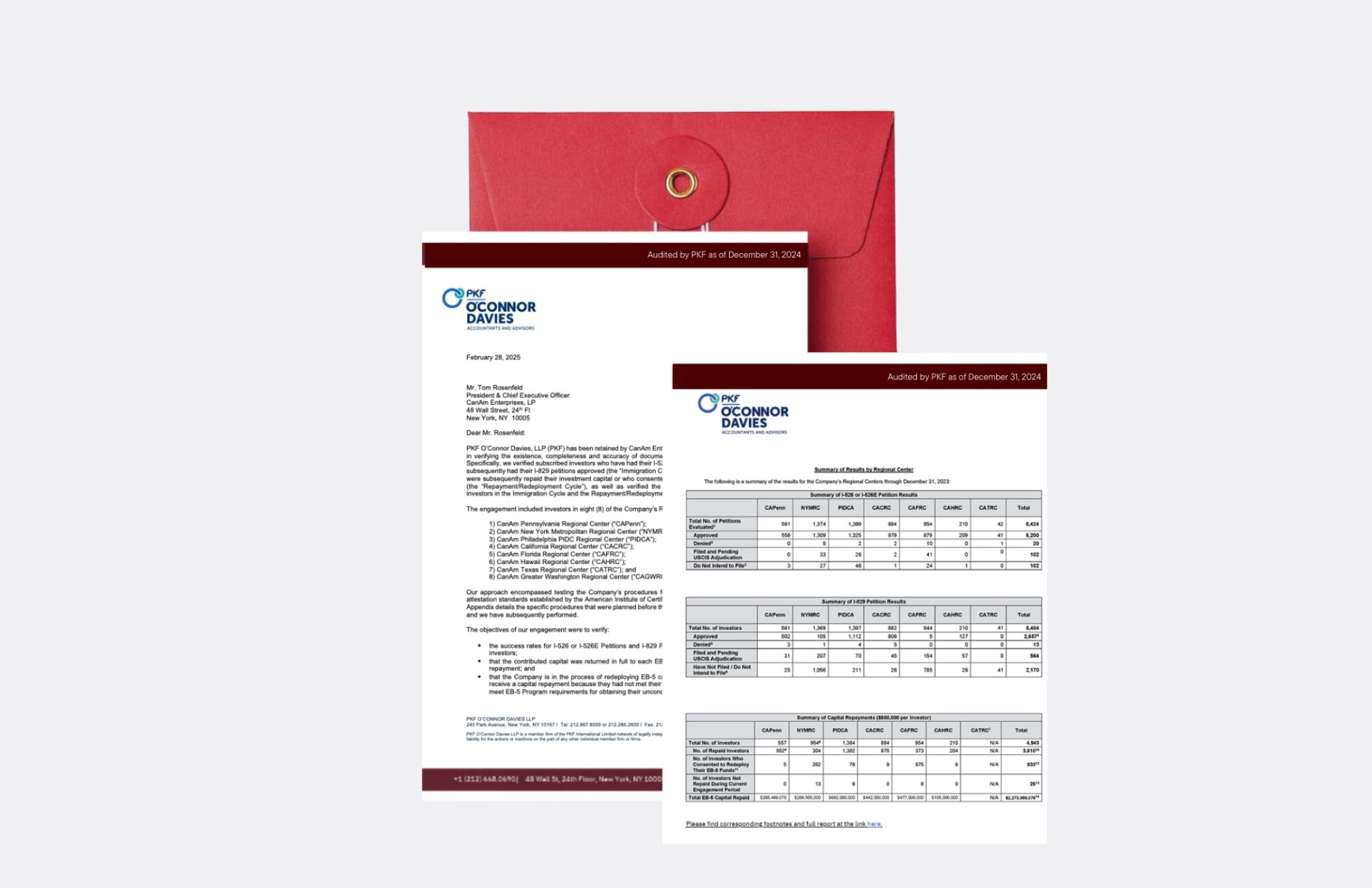

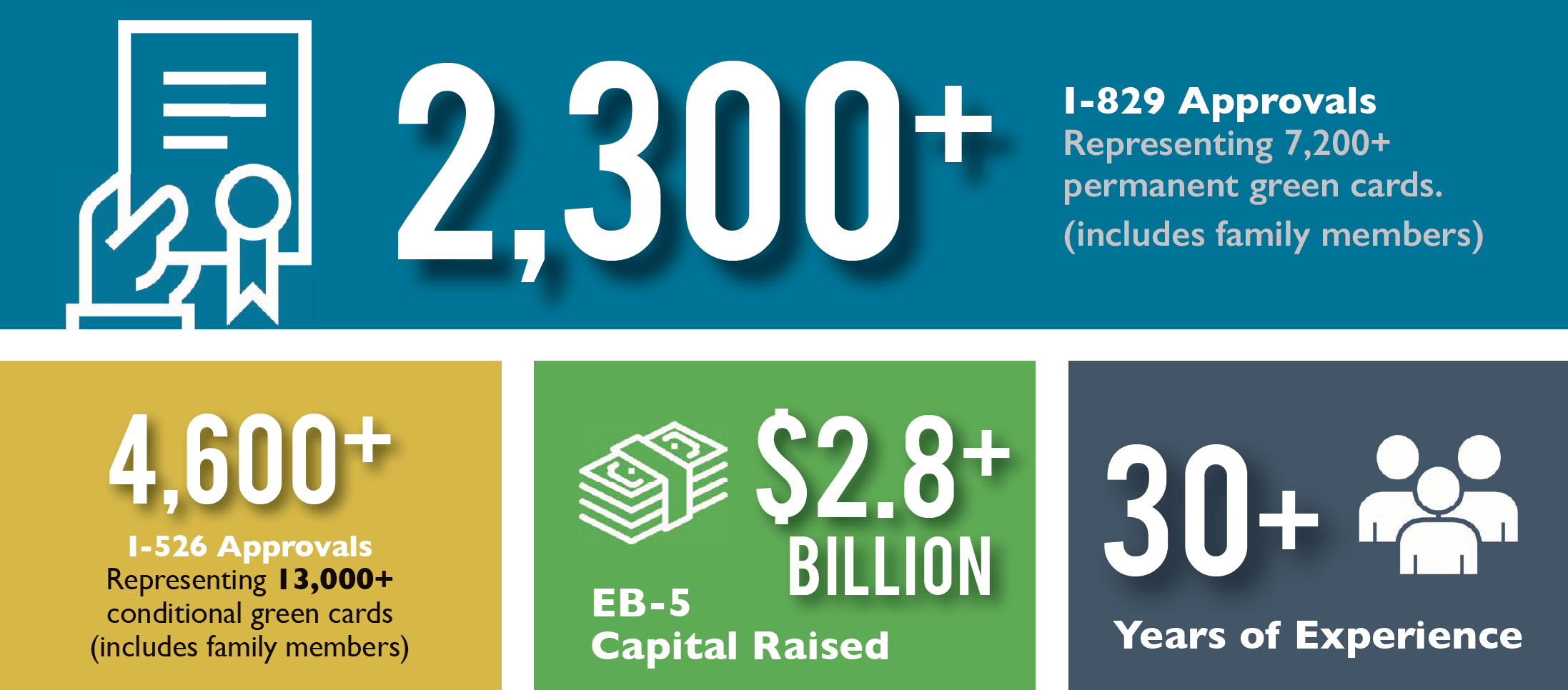

For investors opting for a regional center, due diligence is essential. Nick emphasized the importance of choosing a regional center with a strong track record in securing approvals for conditional green cards and repaying investor capital. CanAm, for instance, has raised $3.5 billion in EB-5 capital, and to date, has repaid over $2.27 billion to our investors. Our EB-5 projects have resulted in more than 8,700 permanent green cards for our investors and their families.

Nick Buonagurio explained the role of independent third-party oversight, which CanAm employs to monitor funds throughout the investment cycle. By working with reputable developers and employing a debt-based model, CanAm minimizes risk while ensuring that project milestones are met and investor capital is protected.

Read More: EB-5 Investor Due Diligence: Finding the Right Project for Immigration Success

The Path to U.S. Permanent Residency and Citizenship

The EB-5 process involves a petition phase (demonstrating investment and job creation) and an application phase (applying for a green card). The Reform and Integrity Act introduced priority processing for projects in rural areas, reducing wait times significantly. For instance, Ganey explained that rural projects may see petition approvals in as few as six months, compared to about two years for other projects.

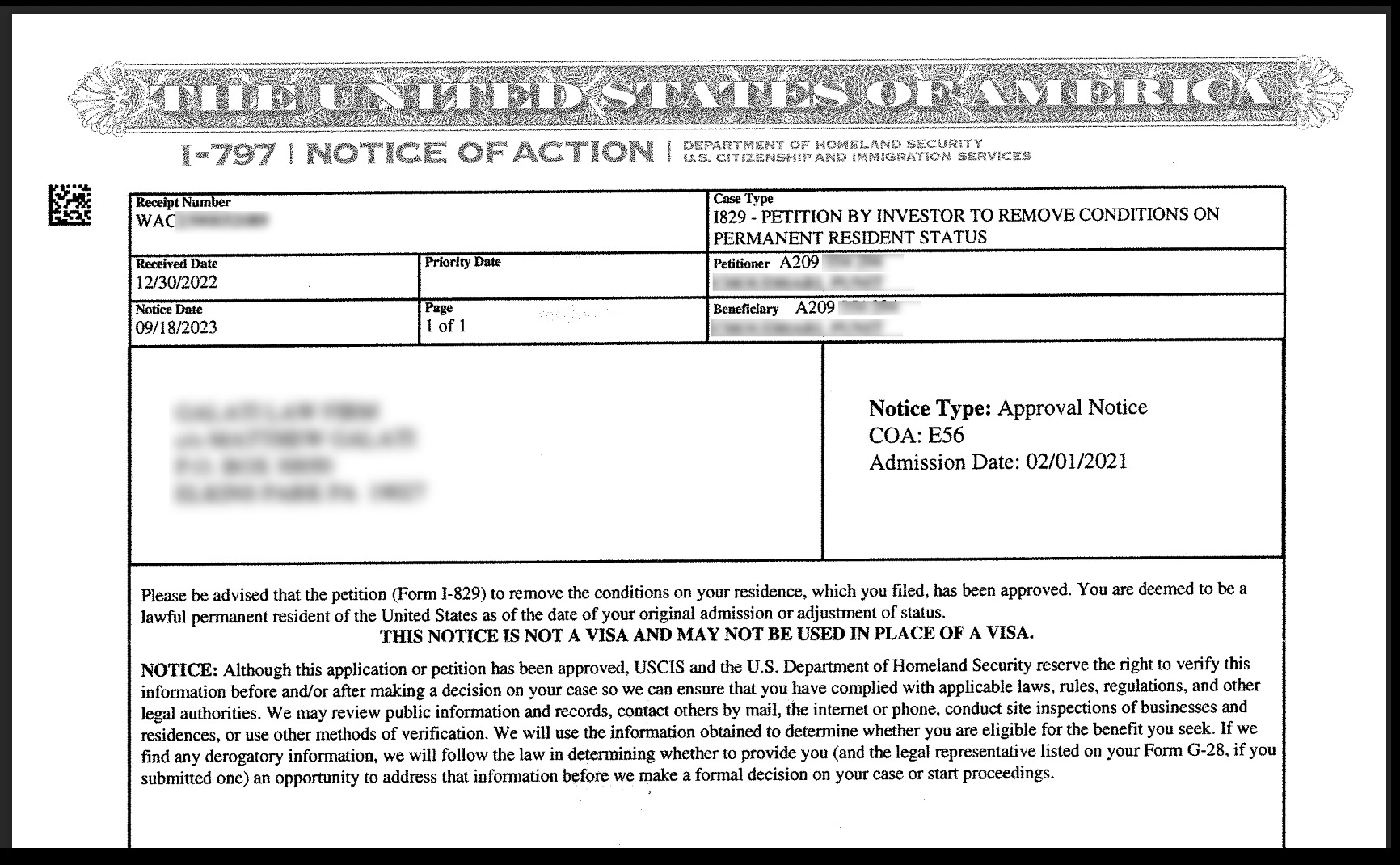

Once granted, the EB-5 visa initially provides a conditional green card valid for two years. After demonstrating that the investment created the required jobs, investors can apply to remove these conditions and obtain a full 10-year green card. After five years of continuous residency, individuals may apply for U.S. citizenship, assuming they meet residency requirements and pass a basic civics test.

Financial Considerations for EB-5 Investors

In addition to the initial investment, EB-5 investors should expect additional costs for administration, legal fees, and filing fees, which generally amount to between $65,000 and $80,000. Moreover, as Ganey noted, investors need to provide comprehensive documentation of their source of funds to meet U.S. Citizenship and Immigration Services (USCIS) standards. This rigorous process helps USCIS verify the legality of each investor’s capital.

Buonagurio pointed out that CanAm works extensively with investors to manage and oversee these details, providing regular progress reports on projects and facilitating timely communication on any updates. This ongoing service underscores the importance of a trusted partner for navigating the EB-5 journey.

Key Takeaways for EB-5 Investors

The EB-5 Immigrant Investor Program offers an attractive and stable option for high-net-worth families seeking U.S. residency. With recent reforms enhancing its transparency, structure, and investor protection, EB-5 is poised to meet the growing global demand for secure, long-term residency options. By selecting a reputable regional center and thoroughly understanding the program’s requirements, investors can embark on a promising path toward U.S. residency and, ultimately, citizenship.

For families exploring EB-5, CanAm Enterprises, Henley & Partners, and Ganey Law Group stand as valuable guides through the complex and rewarding process of U.S. residency investment.