(Updated as of August 22, 2024)

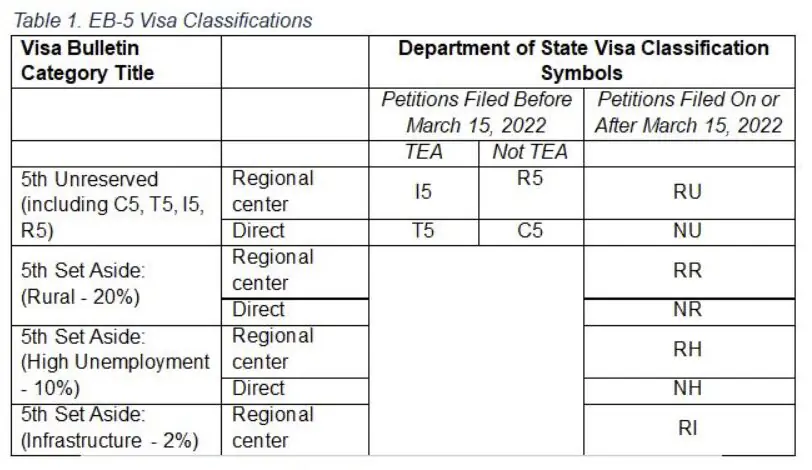

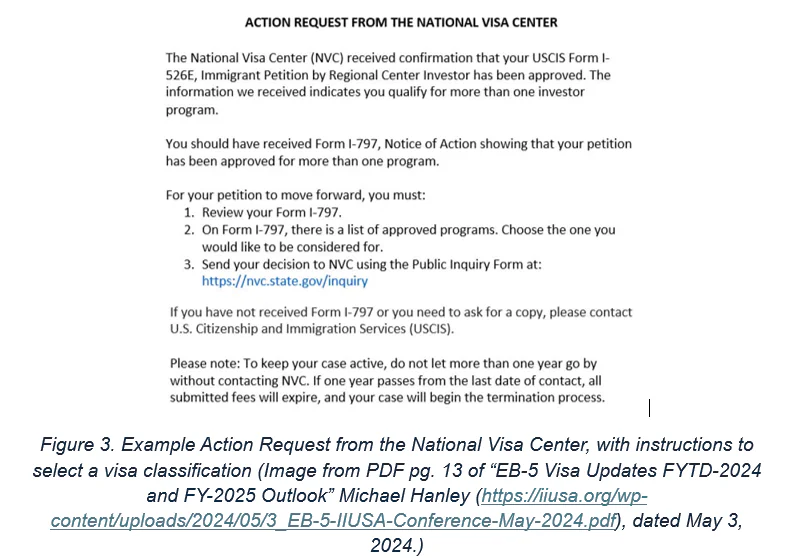

USCIS will judge whether a regional center project qualifies as a rural, high unemployment, or infrastructure when USCIS adjudicates the Form I-956F application for the project. Investors can consult the I-956F approval notice from USCIS to see the approved category. When the investor files I-526E, he will check one or more boxes to indicate the type of investment in the associated I-956F, whether rural, high unemployment, infrastructure, high employment, or other.

What is a country cap? The country cap places an annual per-country limit of 7% on employment and family-based visa issuances. This cap operates on a systemwide basis, not simply controlling or reacting to high demand in any one visa category.

Who is affected by country caps? The Department of State applies the country cap when a country qualifies as “oversubscribed,” i.e. when applicants from that country threaten to exceed 7% of the total employment-based and family-based visas available. The list of countries that qualify as oversubscribed, and thus subject to the country cap, can be found in any month’s visa bulletin Section A.3, which concludes, “The visa prorating provisions of Section 202(e) apply to allocations for a foreign state or dependent area when visa issuances will exceed the per-country limit. These provisions apply at present to the following oversubscribed chargeability areas: _________ .” Every year from 2005 to 2024, monthly Visa Bulletins have completed that sentence by listing at least the following four countries as “oversubscribed chargeability areas”: China-mainland, India, Mexico, and Philippines. In most years, only those countries were listed. A few other countries have been temporarily included in the list (see source references below for details), but generally, only four countries have ever come remotely close to exceeding demand for 7% of total EB and FB visas. A number of other countries have high demand for individual categories such as EB-4 or EB-5, but high demand in one category does not trigger the country cap, only high demand across the immigration system.

How does the cap work? For a country that counts as oversubscribed, Department of State prorates visa issuance within EB and FB categories with the goal of ensuring even distribution across categories. However, 7% is not a strict cap within each category, because Department of State does not want category visas to go unused. When one category has more visas than applicants, then country cap pro-rating is not applied in that category. When a category has visas left unused after limiting oversubscribed countries to 7%, then such otherwise unused visas can be allocated to oversubscribed countries above 7%.

Source Reference:

Example of an oversubscribed country receiving 7% of EB-5 visas: In FY2022, India qualified as “oversubscribed” on a systemwide basis, and India-born applicants in the EB-5 Unreserved category received 7% of total EB-5 visas. Indians did not receive more than 7% of total EB-5 visas, because the “otherwise unused visas” available above country cap limits were all issued to the oldest priority dates and Chinese in the EB-5 Unreserved backlog have older priority dates than Indians. Indians did not receive less than than 7% of total EB-5 visas, even though they were applying in the Unreserved category that can only access 68% of total EB-5 visas. With no Indian applicants to accommodate in the Set Aside categories, Department of State could allow Unreserved applicants to use the total cap numbers available to Indians. The 7% country limit applies to the EB-5 category as whole, not in isolation within each subcategory.

Examples of oversubscribed countries free to receive more than 7% of set aside visas: the May 2024 visa bulletin lists China, India, Mexico, and the Philippines as “oversubscribed” countries subject to per-country pro-rating. And yet the visa bulletin lists all of these countries as “C” – no limit on allocation – in all the EB-5 5th Set-Aside categories. Per-country limits are not in effect for anyone in the EB-5 5th Set-Aside classes as of May 2024, because these classes have more visas than applicants as of May 2024. To avoid wasting visas in a class with insufficient qualified applicants, DOS must allocate visas to all qualified applicants in that class regardless of country.

Source Reference:

Source Reference:

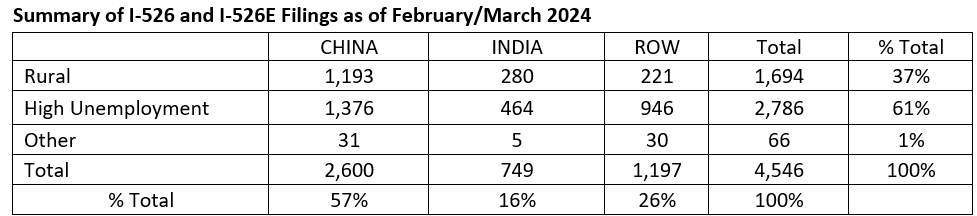

Of all I-526 and I-526E filed for High Unemployment Area investments in 2022-2023, 19% were filed by Taiwanese. But Taiwan is not subject to prorating under a 7% per-country limit, because Taiwan is a relatively low-demand country outside of EB-5 (and is counted separately from China for the purpose of visa issuance). Taiwan can only qualify as “oversubscribed” and subject to the country cap if and when it demands more than 7% of total family-based and employment-based visas. Taiwan has never been remotely close to that threshold. High visa demand within one category is not sufficient to trigger a limit.

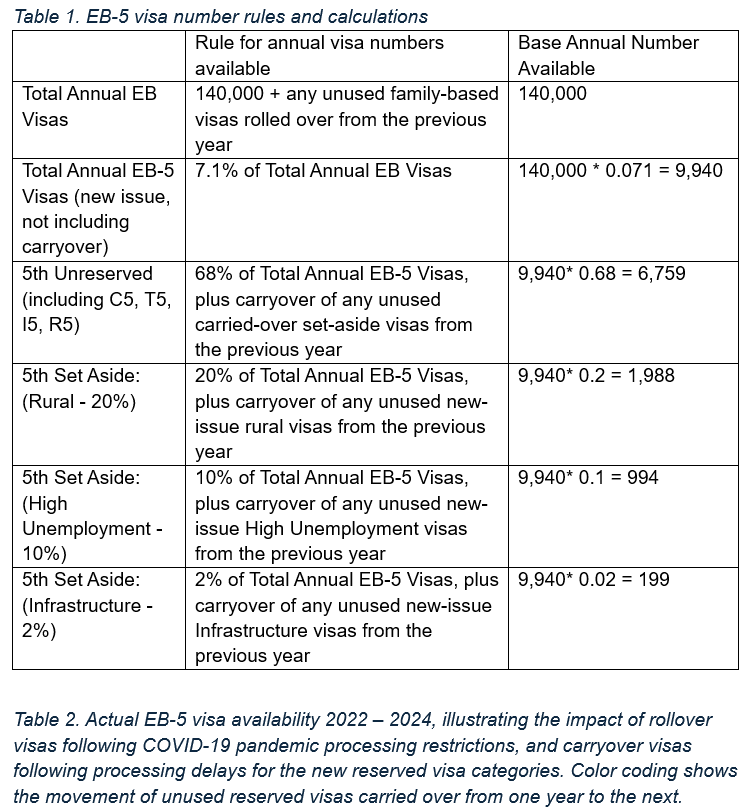

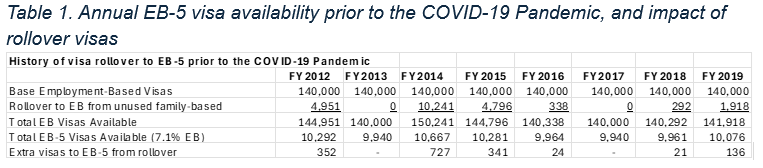

If applicants simply received visas in FIFO order, then the pre-RIA Unreserved backlog could be estimated as over seven years (the time to clear 50,000+ applicants at an average 7,000 visas per year). However, country caps mean that some visa applicants wait longer than others. Applicants from China and India can face backlogs longer than seven years in Unreserved, while Rest of World countries have not yet been delayed by visa availability. Any post-RIA applicants who compete for Unreserved visas will be placed, based on priority date and country, at the end of the queues illustrated in Table 1.

Retrogression happens:

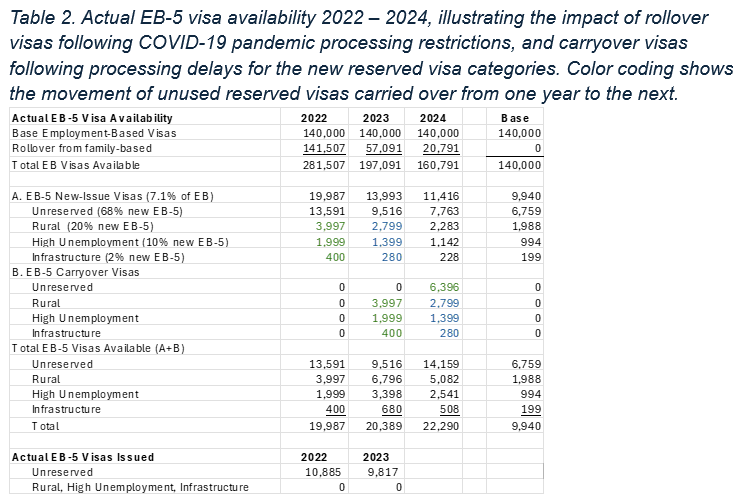

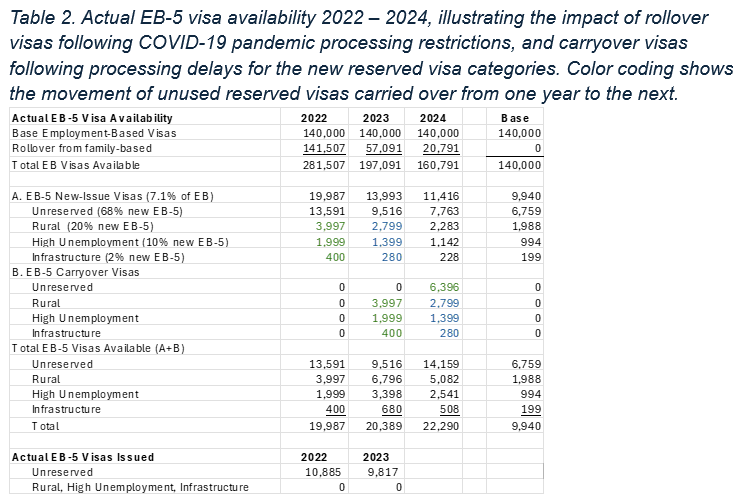

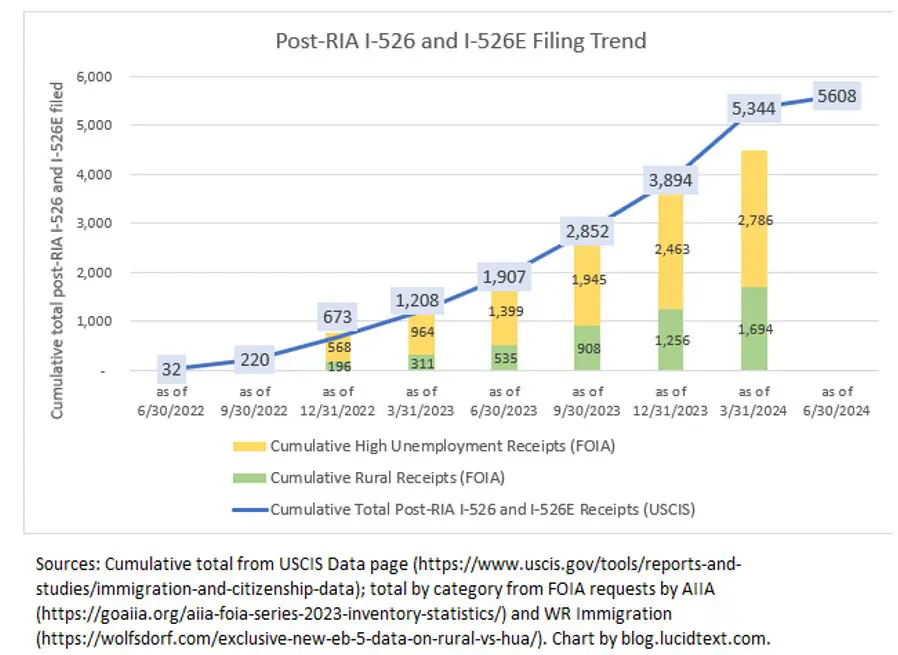

No High Unemployment visas were issued in FY2022 or FY2023, and a very minimal number were issued in FY2024, due to processing constraints. This means that the pipeline of applicants for High Unemployment visas in 2025 and beyond is essentially all High Unemployment investors since 2022, plus their family members, less applicants who will end up being denied or who will ultimately choose to select an Unreserved instead of a High Unemployment visa.

From April 2022 through December 2023, nearly 3,900 I-526/I-526E were filed, of which nearly 2,500 (63%) were identified with the High Unemployment category. Assuming an average ratio of visas-to-investors of at least 2:1, this suggests that there was pipeline demand for over 5,000 visas from High Unemployment applicants as early as 2023. (About 2,000 more I-526/I-526E were filed January-June 2024, but the TEA breakdown for 2024 is as-yet unknown.) High Unemployment visa availability is 2,000+ in a carryover year and about 1,000 in a normal year. With pipeline demand significantly exceeding annual supply, the High Unemployment category is already heading into a visa-stage backlog – at least from the perspective of new potential applicants entering the end of the queue.