EB-5 VISA PROGRAM

Unleash Limitless Potential for Your Future

The EB-5 Program is administered by U.S. Citizenship and Immigration Services (“USCIS”) through a complex network of immigration laws, regulations, and policies.

A Definitive Guide to The EB-5 Visa

This guide aims to provide up-to-date information about the EB-5 Program’s origin, purpose, requirements, and benefits to immigrant investors and their families.

What is The EB-5 Visa?

The EB-5 Program provides qualified foreign investors with the opportunity to gain permanent residence (a “green card”) in return for investing $800,000 in projects located in Targeted Employment Areas that create at least ten permanent full-time jobs for U.S. workers.

CONTACT US

The EB-5 Program Origin and Purpose

Congress created the employment-based fifth preference immigrant visa category (“EB-5”) in 1990 to benefit the U.S. economy by attracting investments from high-net-worth foreign nationals in return for lawful permanent resident status, commonly referred to as a “green card.” Congress intended to create and sustain American jobs by infusing foreign investment into the U.S. economy.

The Immigration and Nationality Act (INA) sets aside 10,000 visas each fiscal year (October 1 to September 30) for immigrant investors along with their spouses and unmarried children under the age of 21. USCIS has allocated a quota of 700 green cards per country each fiscal year.

Pursuant to the EB-5 Program, foreign nationals may pool their investments in economic entities (public or private) known as “Regional Centers” and claim credit for direct or indirect/induced job creation. Foreign nationals and their qualifying dependents initially receive conditional permanent resident status for a 2-year period, and if the investment and job creation requirements are thereafter satisfied, the conditions are removed, and unconditional lawful permanent resident status is granted.

The minimum investment requirement under the EB-5 Program is $800,000 in high unemployment areas and $1,050,000 outside those areas. Investments under the EB-5 Program must be “at-risk,” i.e. while the investments can be secured by the assets of the project, the return of investment cannot be guaranteed.

EB-5 Program Overview

How many EB-5 visas are available annually?

Up to 10,000 visas are allocated each fiscal year to investors in the EB-5 Program.

What is the minimum capital investment amount within a high unemployment area?

The minimum capital investment amount within a high unemployment area is $800,000.

What is the minimum capital investment amount outside a high unemployment area?

The minimum capital investment amount outside a high unemployment area is $1,050,000.

What is the minimum job creation requirement per EB-5 investor?

Each EB-5 investor must create or preserve at least 10 full-time jobs in the United States.

Who receives lawful permanent residency through the EB-5 Program?

- The investor

- The investor’s spouse

- Any unmarried children under the age of 21

- Any unmarried adopted children under the age of 21

EB-5 Visa Availability

The USCIS allocates 10,000 visas to the EB-5 Program each fiscal year (October 1 to September 30). EB-5 visas are very popular and the demand for EB-5 visas has increased consistently since 2009.

The EB-5 Reform and Integrity Act created new EB-5 immigrant visa set-asides for qualified immigrant investors. Each fiscal year, a certain percentage of EB-5 immigrant visas are available to qualified immigrants who invest in specific areas:

| Area of Investment | EB-5 Immigrant Visas Set-Aside Each Fiscal Year |

|---|---|

| Rural Area | 20% |

| High Unemployment Area | 10% |

| Infrastructure Project | 2% |

Any set-aside EB-5 visas that go unused are held in the same set-aside category for one additional fiscal year. After the second fiscal year, any remaining unused immigrant visas from EB-5 set-aside categories are released to the pool of unreserved EB-5 immigrant visa during the third fiscal year.

The Benefits of EB-5 Visa

- Eligible EB-5 investors receive lawful permanent resident status in the U.S. along with their qualifying family members. They can live and work anywhere in the U.S. and travel in and out of U.S. without any restrictions.

- EB-5 applicants who reside in the U.S. with lawful status are permitted to adjust their visas to that of a lawful permanent resident (Form I-485) concurrently with the filing of their EB-5 petition (Form I-526E), which allows applicants to remain in the U.S. while their immigration applications are pending.

The Advantages Of The EB-5 Visa

For many investors, the EB-5 visa offers the clearest and most practical path to getting green cards for the entire family.

EB-5 Visa does not require an offer of employment or family sponsorship. An EB-5 investor can self-petition for an EB-5 Visa.

For nationals of many countries, the EB-5 visa is one of the fastest ways to become a lawful permanent resident of the U.S.

There are no educational, business background, or language requirements for EB-5 investors or their qualifying dependents.

Benefits of Lawful Permanent Residency

EB-5 investors who become U.S. lawful permanent residents (green card holders) and their qualifying dependents:

- Are eligible to receive free public education from kindergarten to high school.

- May be eligible to pay lower college tuition and fees than international students.

- Are eligible to receive financial aid and scholarships for education, which are not available to international students.

- Are eligible for federal student loans with interest rates that are usually lower than those charged by private banks.

- Are eligible to receive social security benefits upon retiring (subject to fulfilling certain conditions).

- Are eligible to sponsor other relatives for permanent residence (including upon obtaining U.S. citizenship).

Better employment and business opportunities:

- Upon becoming a lawful permanent resident of the United States, EB-5 investors and qualifying dependents have access to the U.S. job market just like any other U.S. national or permanent resident.

- EB-5 investors with a green card enjoy more employment choices than foreign nationals and their dependents who rely on work authorization. Additionally, internship opportunities for students with EB-5 visas are often more readily available and offer more vocational flexibility than other visas available to international students.

- EB-5 investors with a green card may have more leverage in salary negotiations as they are not dependent on their employers to live and work in the United States.

- Unlike employees with temporary work visas (such as H-1B), EB-5 investors can own and operate their startups and manage employees.

- EB-5 investors with a green card can own a franchise business. Many companies do not offer franchises to foreign nationals.

Who is Eligible to Invest in The EB-5 Program?

The EB-5 Program is suitable for everyone, as there are no age, language, education, or nationality restrictions. However, there are a few conditions that each investor and his/her family members must satisfy:

- EB-5 investors must satisfy the eligibility requirements of the EB-5 Program, including demonstrating the lawful source(s) of the funds that are used for the EB-5 investment.

- EB-5 investors need to be able to pass a consular screening interview and criminal background and medical checks.

Two Ways to Apply For an EB-5 Visa

Investing in a direct EB-5 project:

Starting his/her own business and hiring at least 10 full-time U.S., work-authorized employees; or

Investing in a Regional Center-sponsored EB-5 project:

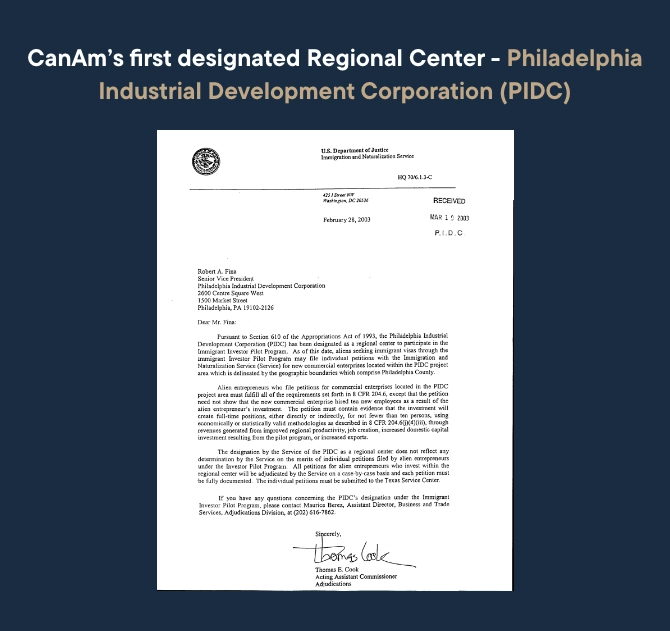

A Regional Center is an economic unit in the United States that is involved with promoting economic growth. Regional Centers are designated by USCIS for participation in the EB-5nProgram. Regional Centers can offer investors already-defined investment opportunities, thereby reducing the investors’ responsibility to identify acceptable investment vehicles. The minimum investment and job creation requirements are the same for both investment options. Overall, more than 90% of the EB-5 investors choose to invest with a Regional Center.

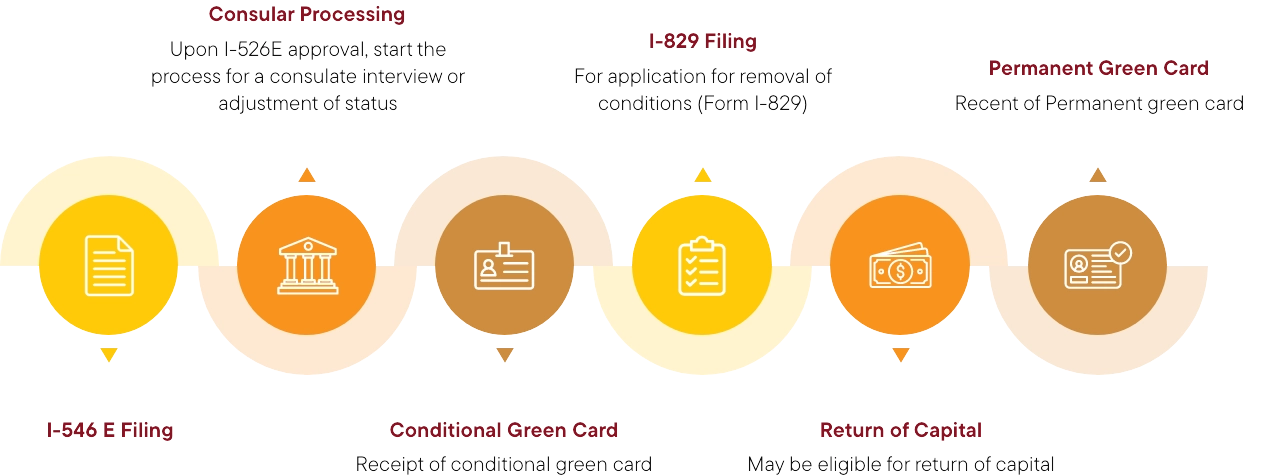

The EB-5 Visa application consists of the following steps:

- Review the investor eligibility requirements under the EB-5 Program.

- Select an EB-5 Regional Center-sponsored project and retain an experienced EB-5 immigration attorney.

- Remit applicable funds, either $800,000 or $1,050,000, depending on the location of the project.

- Submit Form I-526E, Immigrant Petition by Alien Entrepreneur. Upon approval, prepare for adjustment of status if in the U.S. (or consular processing if abroad).

- Consular interview & conditional green card – Post approval of the I-526E Petition, the EB-5 investor needs to apply for an EB-5 visa and attend a consular interview if he/she is outside the United States. Upon successfully appearing for the consular interview, the EB-5 investor and qualifying dependents will receive an initial 2-year conditional green card.

- Removal of conditions & permanent green card – Between 21 and 24 months prior to the expiration of the conditional green card, an EB-5 investor must submit an I-829 Petition to remove conditions. At this stage, the investor needs to prove that the funds have been fully invested and sustained at-risk over conditional residence period and have resulted in the creation of at least 10 jobs for U.S. workers. If the investor satisfies these requirements, the conditions on the green card are removed and the EB-5 investor receives unconditional permanent residence (green card).

EB-5 Visa Process

Typical I-526E pre-filing timeline chart:

Required Forms and Documents

Preparation of offering documents and materials related to USCIS immigration application:

- Conditional green card (Form I-526E).

- Unconditional green card (Form I-829).

Marketing and sales:

- SEC compliant.

- Foreign laws and regulations.

- Pre-qualifying investors.

New Commercial Enterprise (NCE):

- Tax filings/annual financial statements.

- Investor communications.

Ongoing compliance with EB-5 Program requirements:

- Annual filing of Form I-956G.

- Continued promotion of economic benefits and job creation.

What is a Regional Center?

A Regional Center is an entity designated by the USCIS to sponsor EB-5 projects for EB-5 investors pursuant to the EB-5 Program. Regional Center-based investments are “passive,” in that EB-5 investors retain certain voting rights and policymaking rights in the New Commercial Enterprise (NCE) but otherwise are not involved in day-to-day functions of the Regional Center or the EB-5 project.

How Do Regional Centers Work?

Regional Centers act as liaisons between foreign investors and EB-5-eligible projects in the United States.

Regional Centers will source projects, conduct due diligence to ensure viability of those projects, and then offer projects to potential investors.

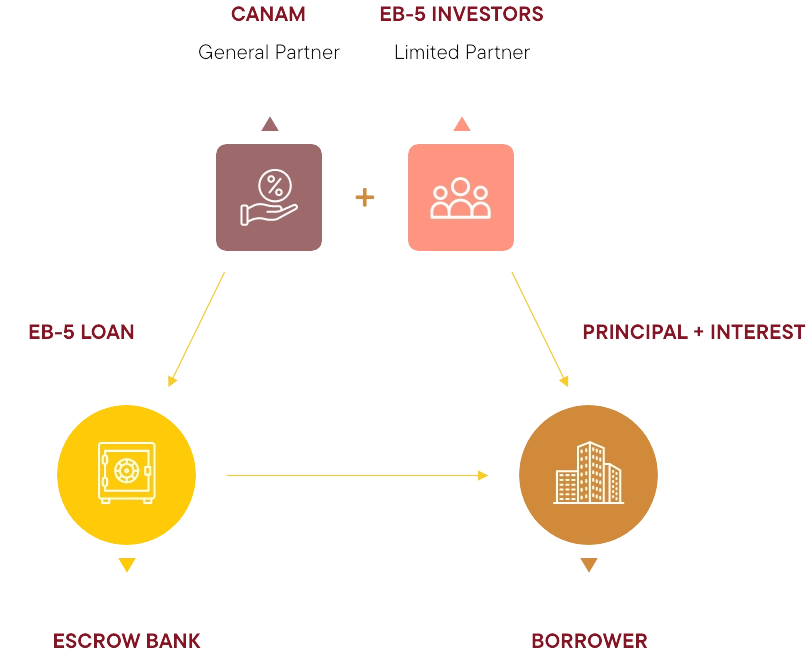

Regional Centers pool funds from multiple investors and deploy the proceeds either as debt or equity into an EB-5 project.

Debt-based structures are by far the most common EB-5 investment vehicles. Here, the Regional Center pools capital from EB-5 investors who invest in a special purpose entity, or NCE, which then loans the proceeds to an EB-5 project for a period of 5 to 7 years. The EB-5 project must create at least 10 qualifying jobs per EB-5 investor. The EB-5 project may use the EB-5 investors’ funds for construction and/or operations to create the qualifying EB-5 jobs. Upon the maturity and repayment of the loan to the NCE, investors who have sustained their investments for at least 2 years of conditional lawful permanent residence may be repaid their investment capital.

In the case of an equity-based structure, the EB-5 investor is expected to take an equity risk position in the EB-5 project.

Prudent Regional Centers aim to provide low-risk, investor-focused EB-5 investment opportunities that have sound financial projections and aim to exceed the minimum job requirement of 10 jobs per investor to maximize the likelihood of achieving immigration and repayment benefits for all investors.

EB-5 Regional Center Investment Structure (need to update the dollar amount $800,000 and 5-7 year loan term)

EB-5 funds can become available to the Borrower immediately following the immigrant investors’ contribution of capital to the Limited Partnership; or, the funds may be held in escrow and released to the Borrower upon the occurrence of some condition.

What are the Primary Goals of a Regional Center?

- Structuring EB-5 Program-compliant investment opportunities, with sufficient job creation and conservative underwriting;

- Helping investors secure immigration benefits (permanent green card); and

- Return of investors’ capital. Investors should be cautious of any promises or guarantees of highyield returns. If it is too good to be true, then it probably is.

What are a Regional Center’s Responsibilities?

Regional Centers manage the entire process from inception to completion and mitigate potential risks:

- Project selection, structuring, underwriting and monitoring.

- Ensuring EB-5 project meets USCIS qualifications.

- Verifying project fulfills USCIS job creation requirement.

What are the Advantages of Using a Regional Center for Your EB-5 Visa Needs?

- Investors avoid involvement in day-to-day management of the Regional Center or the EB-5 project. This gives EB-5 investors the freedom to seek other employment or start another business.

- A Regional Center-based investment gives EB-5 investors the freedom to live and work anywhere in the United States. EB-5 investors are not restricted to the region where the Regional Center is located.

- Unlike direct EB-5 investments that can only count direct jobs, Regional Center EB-5 investments can rely on indirect/induced jobs, as well direct jobs under certain circumstances.

- A Regional Center-based investment diversifies risk by allowing EB-5 investors to be part of a large project as opposed to being dependent on a small business in the case of a direct EB-5 investment.

- With a direct EB-5 investment, commercial and immigration goals are not always aligned, as the business may not require 10 workers to be operational.

- In case of Regional Center projects with a debt-based model, the NCE is a creditor that has rights to enforce any pledged collateral to seek recovery of the loan proceeds.

- The Regional Center process is cost-effective and less cumbersome as compared to direct EB-5 investments, which requires the EB-5 investor to start and directly operate a business. Regional Center-based investments can be more cost-effective as well since much of the burden of corporate, tax and other compliance is the responsibility of the Regional Center and not the EB-5 investors.

- Unlike a direct investment, in a Regional Center project, an EB-5 investor cannot be compelled to personally expend more funds to sustain a business enterprise.

Why is it Easier to Satisfy the Job Creation Requirement Through EB-5 Regional Centers?

The USCIS requires that EB-5 investments preserve or create at least 10 full-time jobs for U.S. workers per EB-5 investor. At the I-526E Petition stage, an EB-5 investor must demonstrate prospectively that the requisite number of jobs are more than likely to be created within 2½ years of the approval of the I-526E Petition. Later, at the I-829 Petition stage, the EB-5 investor must demonstrate that the requisite number of jobs have already been created or will be created within a reasonable period of time (that is, within 1 year of the expiration of the conditional green card).

In case an EB-5 investor elects to make a direct EB-5 investment in a business, it must be proven that the EB-5 capital investment will create a minimum of 10 direct jobs (i.e., W-2 jobs) for U.S. workers who are employed directly by the business.

On the other hand, when investing with a Regional Center, EB-5 investors can count indirect/induced and direct jobs to meet the job creation requirement. EB-5 projects offered by reputable Regional Centers generally tend to be large-scale projects. It is often easier and safer for EB-5 investors to satisfy the job creation requirements with a large-scale project, as jobs are created across multiple industries, including direct construction jobs related to the project itself (if construction is 2+ years), indirect jobs created by the realization of the project, and jobs that were induced in the area by the creation of the EB-5 project. The job creation is calculated by the application of USCIS-approved economic models that take into consideration each set of project expenses to determine the resulting economic impacts.

Types Of EB-5 Deal Structures: Debt And Equity

The two most common deal structures for EB-5 offerings are debt and equity.

- Debt structure typically has stronger collateral, including liens on real estate and/or equity interests in the project entity, and a clearer timeline in terms of repayment.

- Equity structure typically has more upside potential but collateral is often more limited.

Types of EB-5 Projects:

EB-5 investments have been used to fund various types of projects to create the jobs for U.S. workers that satisfy each investor’s EB-5 requirements. Common project types include the development of commercial and residential real estate as well as manufacturing, logistics, health care, energy and infrastructure facilities.

CanAm’s EB-5 portfolio includes projects that span multiple sectors and industries all across the United States, such as:

- Transportation infrastructure;

- Energy terminals;

- Research & Development labs;

- Health care facilities;

- Corporate headquarters;

- Mixed-use housing;

- Convention centers;

- Specialty hotels;

- National defense manufacturing contractors;

- And more.

There are no specific limitations on what types of projects qualify for EB-5 funding, as long as the projects satisfy USCIS job creation requirements and provide a comprehensive business plan.

Things to Consider When Selecting an EB-5 Project:

- Regional Center’s track record: petition approval and repayment of investment;

- Credentials of the borrower or joint venture entity;

- Deal structure: debt or equity; collateral and lien priority;

- Business plan of the qualifying investment project; and

- Soundness of economic and job creation projections.

Watch this video on project selection:

“At Risk” Considerations

USCIS regulations require EB-5 investors’ funds to be “at risk”. This means that the return of capital cannot be guaranteed. That said, this does not mean that EB-5 investors need to or should make a risky investment. Instead, the “at risk” requirement means that the EB-5 investment needs to be subject to market risk. Regional Centers try to minimize the risk of the EB-5 investment by requiring the sponsor to have committed significant equity to the project, negotiating for adequate collateral, and undertaking extensive project due diligence.

Investor’s Source Of Funds

The EB-5 Program requires that all capital invested by EB-5 investors is “obtained by lawful means.” This essential requirement means that capital obtained through any criminal or otherwise unlawful activity is strictly prohibited. EB-5 investors can only invest capital that comes from a legal source and its origin can be tracked and identified.

The USCIS requires a detailed overview of the capital investment funds and their source, and the documentation required may be extensive depending on each EB-5 investor’s particular circumstances. EB-5 investors should also be able to prove the source of funds used to cover any administrative fees associated with the investment project, as USCIS may require documentation for these expenses as well.

What qualifies as a lawful source of funds for EB-5 investments?

- Employment earnings, salary, bonuses

- Business earnings

- Sale of business or its assets

- Retirement funds

- Inheritance of capital and other assets

- Gifts

- Stock earnings or stock sale

- Sale of real estate

- Equity loan secured against a property

- Loaned capital from a family or friend

- Loan from the investor’s business

- Loan from a financial institution

In case the funds come from another entity, the responsibility to prove a legal source of funds extends to the loaner or the donor who bestowed the funds to the investor.

Inheritance is an exception to this requirement. The USCIS generally does not require to prove how the person who left the inheritance acquired the funds.

Lawful path of funds

The USCIS also requires investors to fully document the lawful path of funds. In other words, investors are required to prove that they have possession of the funds and that they transferred the funds to the NCE in the United States through lawful channels. EB-5 investors are advised to document the path of funds in a responsible and detailed manner.

EB-5 projects often provide funding to real estate developments.

When is The Right Time to Apply For an EB-5 Visa?

EB-5 investors should begin their investment process as soon as possible due to the following reasons:

- I-526E Petition processing time keeps increasing

- Visa allocation – invest early to avoid any (potential) retrogression and backlogs

- Job and business opportunities

- Children may age out

What to Look for When Considering an EB-5 Visa Investment

Apart from significant financial considerations, prospective investors also need to assess the likelihood of their investments to comply with a complex network of immigration laws, regulations, and policies such that permanent immigration to the United States will become possible. Considering the multi-faceted factors facing prospective investors, decisions regarding which EB-5 investments are most appropriate are by no means straightforward.

Prospective investors evaluating Regional Center-sponsored EB-5 investments should perform extensive due diligence on both the Regional Center sponsor and the project. In this regard, the parties should always carefully review the full offering package provided by the Regional Center – following up with any questions – as well as consult with experienced financial/tax professionals and immigration counsel, in order to understand the nature of the investment, the extent to which it complies with EB-5 Program requirements, and the potential consequences/risks in the event the investment is compromised for any reason.

Key facts to know before investing in any EB-5 project:

Fundamentals

It is essential to know the fundamentals of the EB-5 Program to adequately assess whether an investment opportunity will satisfy program requirements.

Qualification of the Regional Centers

EB-5 investors must determine whether the Regional Center is authorized by USCIS and active at the time of making the investment. The track record of the Regional Center one is interested in must be reviewed and compared against other centers. The years of experience and the number of successful projects sponsored are good measures to analyze the performance of the Regional Center. A successful project would most likely be defined by its ability to achieve full immigration status and repayment of funds to investors.

Qualification the EB-5 Projects

EB-5 investors should cross-check the reputation, track record and experience of the project developer. The Regional Center should be authorized by the government and approved by USCIS. The project must not harm any religious or any other beliefs of the citizens of the country. The investors are recommended to confirm these conditions to make sure there is nothing preventing the project from completion.

Should I Retain an Immigration Attorney when Applying for EB-5 Visa?

The short answer is definitely YES!

Prospective EB-5 investors may face the decision whether or not they need assistance from an immigration lawyer. As you can tell by now, the EB-5 Program is complex and requires a significant amount of document submission and administration. Any misstep or error caused by providing incorrect information or documents may lead to several months of delays, requests for additional documentation or even a complete application denial. It is strongly recommended that investors work with experienced immigration attorneys that specialize in the EB-5 Program.

Experienced EB-5 immigration attorneys assist investors with pre-filing work, transitions from conditional residency to permanent residency, and offer expert guidance in case there are any roadblocks or issues along the EB-5 application process. EB-5 immigration attorneys are also often able to direct to reputable Regional Center operators.

The guidance of an experienced and knowledgeable EB-5 immigration attorney and Regional Center is recommended in order to maximize the likelihood of receiving permanent residency in the United States.

How to Apply

Our Team will guide you through the entirety of your EB-5 journey.

STEP 1

Connect With Us

Get started on your Green Card journey by connecting with us.

STEP 2

Review and Submit

Review essential offering documents and submit your I-526E petition with our guidance.

STEP 3

Prepare for Interview

Prepare thoroughly for your Consulate Interview with professional assistance from us.

STEP 4

Submit I-829 Petition

Successfully achieve permanent U.S. residency by submitting your I-829 petition with our support.

Featured News

Explore what’s happening now with CanAm and the EB-5 Visa.

Why do Indians view the EB-5 Visa program as an avenue to live, work and study in the United States

Written by Sunil Dhawan EB-5 Visa program is a reliable avenue to live, work, study, and travel anywhere in the United States. The EB-5 Visa Program is extremely popular among Indians who want to leave India and settle in America. The EB-5 Residency Program is a type of investor visa that allows people of all nationalities […]

EB-5 is Changing: What the New USCIS Guidance Could Mean for Investors and Regional Centers Webinar

As the EB-5 program evolves, CanAm is committed to keeping regional center investors up to date with all the changes – and what they mean. Soon after USCIS released new guidance on how it was interpreting sustainment period provisions of the EB-5 Reform and Integrity Act (RIA) of 2022, CanAm teamed up with the JTC […]

CanAm Executive to Speak at National Industry Conference on the State of the EB-5 Program

New York, NY – The sources and methods of raising capital for EB-5 projects are evolving, largely thanks to the EB-5 Reform and Integrity Act (RIA) of 2022. CanAm Enterprises (“CanAm”) will be sharing its insights on the recent trends — and what they may signal — in an upcoming industry expert panel at the […]

CONTACT US

Start Your EB-5 Visa Journey With Us Today

Fill out the form below and our team will get back to shortly.

OUR ADDRESS

48 Wall Street – 24th Floor

New York, NY 10005, USA

OUR PHONE NUMBER

+1 (212) 668-0690

OUR OFFICE HOURS

Monday-Friday: 9am to 5pm

OUR EMAIL

info@canamenterprises.com