As of 2025, the EB-5 Rural category has a significant hidden backlog. The backlog is called “hidden,” because it largely represents Rural investors who are still awaiting I-526E approval. The backlog is significant, for there are thousands more Rural investors that are in process than can get visas in a year.

A backlog happens when visa applicants exceed visas available. Investors who do not have I-526E approval are not visa applicants yet. However, these investors are on the way to becoming visa applicants. Their early I-526E filing dates will become early priority dates. They represent the queue that later investors wait behind on their way to acquiring a visa. When an investor files I-526E, the filing date marks a place in line. That place depends on the number of people who are in process with earlier priority dates and on forthcoming visa availability.

Up to December 31, 2024, a total of 4,005 Rural investors had filed I-526E. When adding spouses and children, this likely represents over 8,000 potential visa applicants with priority dates from 2022 to 2024. A majority of these potential applicants are still in process as of mid-2025, considering the low volume of I-526E processing and the small number of Rural visas issued to date. As of March 2025, only 17% of I-526E petitions ever filed had been processed and fewer than 1,000 Rural visas had been issued. Meanwhile, the Rural applicant pipeline has continued to expand, as thousands of new investors have filed I-526E since 2024.

The Rural category typically has about 2,000 annual visas available and can expect one year with about 4,000 visas due to carryover. If the 8,000+ Rural applicants with priority dates up to 2024 could get all available visas in first-in-first-out order, then everyone on the existing pre-2025 backlog could get visas in three years given available supply. In this oversimplified scenario, the last Rural applicant with a December 2024 priority date could get a visa in 2028. But in reality, visa issuance is not FIFO. Country caps allow Rest of World applicants to move ahead of those applicants from China and India who are subject to the 7% country cap. If a FIFO wait time would be as much as three years, then real wait times would be much longer for China and India and potentially less for Rest of the World. Real wait times are longer, because country caps can force applicants from China and India to wait behind ROW applicants with later priority dates. The severity of the Rural backlog could be mitigated if many Rural investors can ultimately elect to take Unreserved visas instead.

Source References:

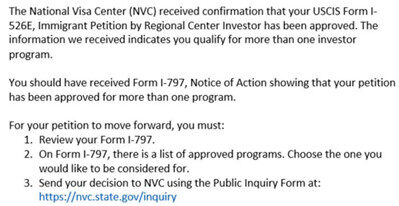

As a Rural investor, you may have a choice between a Rural visa or an Unreserved visa. An applicant may take a visa in any category listed on the I-797C notice that USCIS will issue after approving the I-526E petition. The following notice provides an example of an approval notice for a Rural investor, and it lists visa classification options in the RR Rural category and the RU Unreserved category. The Rural category is exclusive to Rural investors, while the Unreserved category is not exclusively reserved.

Applicants applying for a visa through consular processing can follow instructions from the National Visa Center to choose which “approved program” to select from the options on the approval notice. The following is a quote from an email that EB-5 applicants have received from NVC.

The options for status adjustment applicants are less clear. As of July 2025, USCIS has not yet announced a mechanism for I-485 applicants to specify that they want an Unreserved visa rather than the set-aside visa for which they qualify. Investors should consult qualified immigration counsel to assess risk, timing, and strategy based on their individual case.

A pre-RIA Chinese investor should not give up an early priority date unless a post-RIA reserved petition could provide a faster track to a visa.

As of mid-2025, there is no assured EB-5 fast track for China-born investors. High Unemployment and Rural each have documented backlogs in progress, considering the large number of I-526E reportedly filed in these categories. The Infrastructure category has gone unreported, but it could easily be backlogged given its small size. The Unreserved backlog is larger than Reserved backlogs, but it also advances more quickly thanks to more available visas.

Based on data available as of July 2025, it is theoretically possible that a China-born Rural investor with a 2025 priority date might access a Rural visa sooner than a China-born investor with a 2018 priority date can access an Unreserved visa. But the China Rural visa wait time could easily prove longer than Unreserved for 2025 investors, particularly if the Rural category remains popular with Rest of World investors. High Unemployment is almost certainly a longer wait than Unreserved for 2025 China investors, given available data.

As soon as Unreserved becomes the most promising path, there is no special incentive for a Rural or High Unemployment investment. In competing for an Unreserved visa, a 2018 China priority date stands ahead of a 2025 China priority date.

If a 2018 Chinese investor decides to try filing a new I-526E in 2025 based on Rural investment, does she need to give up her 2018 priority date? Not necessarily. USCIS does not limit the number of immigrant petitions that one person can have pending. The investor’s 2018 priority date would only be lost if her 2018 application ceases to qualify – for example if she withdraws the 2018 investment.

The Visa Bulletin shows “current” for a category and country when there are more than enough visas available to accommodate all qualified visa applicants. When a backlog reaches the visa stage, then the Visa Bulletin shows final action dates to control who can get a visa each month, and who needs to wait for more numbers to become available.

India Unreserved is not on track to be “current,” because there is sufficient existing and potential demand to feed a persistent backlog. However, Visa Bulletin dates for India Unreserved will continue to advance. As of July 2025, the Visa Bulletin makes Unreserved visas available to India-born applicants with priority dates before May 2019. Based on available data, we can estimate that India-born investors with March 2022 priority dates may start to have Unreserved visas available in 2030.

The 2030 estimate starts from limited facts about the backlog of India Unreserved applicants with priority dates up to March 2022: 2,019 applicants registered at the National Visa Center as of May 2024, 823 pending I-485 as of October 2024, and 473 I-526 pending as of July 2024. The estimate adds assumptions about denial rates, family sizes, visa issuance, and overlap among the pending NVC, I-485, and I-526 pools to reach an aggregate estimate of 3,200 Unreserved India applicants with pre-March 2022 priority dates still pending as of the start of FY2025. Considering country caps and carryover visas, Unreserved India can expect about 800 visas in FY2025 and about 480 annual visas thereafter. (3,200-800)/480 = 5 years estimated to issue 3,200 visas. 2025+5=2030.

The reality could be earlier than 2030, if many of the estimated 3,200 India Unreserved pipeline applicants who appeared to be in process as of 2024 drop out before claiming a visa. Visa supply might also get a boost above the averages used in the estimate.

If the estimate proves accurate, however, the Department of State might issue a visa to the last pre-RIA India applicant in 2030. And then Visa Bulletins in the early 2030s could progress toward post-2022 priority dates, accommodating demand from Indians who invested in Rural or High Unemployment areas, but were unable to receive a Rural or High Unemployment visa by that point. This assumes that Rural and High Unemployment investors will have the option to request an Unreserved visa. The India Unreserved Final Action Date could then gradually move forward through 2023, 2024, and so on.

India Unreserved would only have a chance to become “current” if India-born Rural and High Unemployment investors were not allowed to request Unreserved visas as they become available.

India will face persistent backlogs in EB-5 as long as demand remains high. For example, India-born investors filed nearly 1,000 petitions in 2024, likely generating over 2,000 visa applicants – more annual demand than can be accommodated in a program with about 10,000 annual visas available in total and a 7% country cap.

Given a choice, an India-born investor will want to take the first EB-5 visa available. An Unreserved visa may be available earlier than a Rural or High Unemployment visa for some priority dates, given the relative balance of supply and demand in each category. This balance can be estimated based on current estimates for the number of EB-5 applicants in process and future visa availability. But the investor will make the visa choice after I-526E approval, considering the Visa Bulletin and conditions at the time of approval.

Rest of World (“ROW”) investors face several considerations when choosing a visa category. What is the fastest and easiest path to a visa for me personally? What choice would optimize EB-5 visa availability overall and benefit other EB-5 investors? Do I have the option to make a choice?

As time goes on, the considerations in favor of an Unreserved visa choice will become increasingly compelling for ROW investors. Initially, while the Visa Bulletin remains “current” for ROW in all categories, investors may enjoy the same personal visa timing outcome regardless of visa category

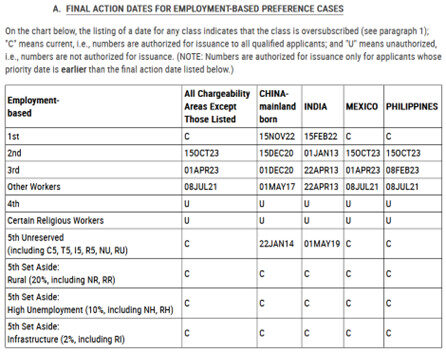

Country caps do not apply to all individual countries. The Visa Bulletin Chart A shows how final action dates are imposed on just a handful of countries individually–China, India, Mexico, Philippines–while all other countries are treated collectively as a group called “All Chargeability Areas Except Those Listed.”

Why are China, India, Mexico, and the Philippines the only countries listed individually in the Visa Bulletin as of 2025? Because they are the only countries demanding more than 7% of available visas across all EB and FB categories. It does not matter that EB-5 has low demand from Philippines and high demand from South Korea. Country caps apply based on overall visa demand, not category-specific demand. The list of high-demand countries affected by the 7% country cap can theoretically change, depending on demand trends. But in practice, the same four countries have been individually listed in nearly every Visa Bulletin for the past 25 years.

When EB-5 has “rest of world” retrogression, how will that look in the Visa Bulletin? As an example, look at the Employment-based 3rd category in the July 2025 Visa Bulletin Chart A copied above. The chart shows that a “rest of world” applicant in the EB-3 category faces a final action date of April 1, 2023. This date applies regardless of whether the applicant happens to come from Brazil or Suriname, from a large country or a small country. The date reflects the fact that in July 2025, the EB-3 category lacks sufficient visas to accommodate all qualified EB-3 applicants, even after controlling demand from the four cap-subject countries. April 1, 2023 marks the priority date of the earliest EB-3 applicant who will have to wait until more EB-3 visas become available.

The Visa Bulletin applies the April 1, 2023 date to Mexico as well to as other countries, suggesting that Mexico doesn’t have excess demand for EB-3 specifically. The much earlier EB-3 dates for China and India show that these countries do have EB-3 backlogs far above the 7% cap.

Mexico and Philippines historically have low EB-5 demand, while China and India have high demand. When worldwide retrogression occurs in an EB-5 set-aside category, China and India will predictably have the oldest final action dates while Mexico, Philippines, and “All Chargeability Areas Except those listed” will share the same more recent final action date. Worldwide retrogression could occur, for example, in a year when Department of State has only a thousand High Unemployment visas available to allocate, yet receives over a thousand High Unemployment visa applications from ROW applicants on top of pending applications from China and India.

The Visa Bulletin does not affect all aspects of the EB-5 process, but specifically visa application filing and visa issuance. A date in the monthly Visa Bulletin controls which I-485 and visa applications can be filed that month and which visa applicants cannot get visa numbers that month.

Retrogression does not change the benefits available with pending I-485 and does not stop processing for EAD and Advance Parole. Someone who already holds a conditional green card is not affected if the Visa Bulletin later retrogresses. A person’s place in line for a visa does not change when the Visa Bulletin changes.

Dates in the Visa Bulletin do limit both when I-485 can be filed and approved and when visa applications can be filed and approved. If USCIS continues to implement the “visa availability approach” to I-526/I-526E processing, then Visa Bulletin Chart B dates will also delay I-526/I-526E processing for affected countries and categories.

Investors should consult with their legal counsel about the specific facts of their case. Appropriate questions may include whether children can retain eligibility to adjust status even if the visa bulletin retrogresses before I-526E is approved.

The USCIS Employment-Based Adjustment of Status FAQs page includes the following Q&A regarding the effects of retrogression on visa priority, I-485 status, Advance Parole, EAD, child status, and conditional permanent residence.

Q. Does retrogression affect my priority date or place in line for an immigrant visa?

A. Retrogression does not affect your priority date or your place in line for an immigrant visa. You may still receive a visa when one becomes available to you based on that priority date. Retrogression only means that due to the high demand for visas exceeding the statutory limits, visas are not available to all aliens who want them, even if they have already filed an application for adjustment of status.

Q. My category retrogressed or a Final Action Date was applied. What is my path forward to a Green Card?

A. When a visa becomes available to you in the future based on the Final Action Date for your country and category as compared to your priority date, USCIS will be able to approve your adjustment of status application if you are admissible, merit a favorable exercise of discretion, and are otherwise eligible. While your I-485 application for adjustment of status is pending, you are eligible to seek certain benefits, among which are:

Q. If my adjustment of status application was approved, but then the Final Action Date for my category and country of chargeability later retrogresses, does that affect my status as a lawful permanent resident?

A. Retrogression has no effect on lawful permanent residents. (Added 10/26/2022)

Excerpts quoted from the Q&A published at https://www.uscis.gov/green-card/green-card-processes-and-procedures/fiscal-year-2023-employment-based-adjustment-of-status-faqs (Accessed July 1, 2025)

I-526E processing time can make a difference for visa timing, but not always and not for everyone. It depends on whether the investor is part of a visa backlog and on whether the I-526E process is first-in-first-out.

“How long will it take me to get an EB-5 visa?” The time is equal to the wait time for petition/application processing or the wait time for a visa number, whichever is longer. I-526E processing time only makes a difference to the extent that it is longer than the visa number wait, or if it allows a petitioner to cut the queue.

Processing waits and visa number waits occur concurrently and result from independent factors. Processing times depend on operational efficiency at USCIS and Department of State. The visa number wait results from the difference between annual quota visas available and visa demand.

I-526E processing time is significant for a “rest of world” investor with no visa number wait. The sooner this investor can get I-526E approval, the sooner he can receive a visa. The longer he has to wait for I-526E approval, the more delay to his chance to get a visa. I-526E processing time (together with any processing-specific delays associated with I-485 or the visa application) is the major factor in visa timing for any investor who does not risk exceeding the annual visa quota, and thus needn’t worry about delay from the Visa Bulletin.

I-526E processing time is less significant for an investor from China or India who faces a visa number wait.

Consider a China-born investor in 2018 who expected that a visa number would be available in 2028, given the size of the backlog when she filed I-526. Does she care whether I-526 processing takes two years or six years? It is the difference between spending two years waiting for I-526 approval followed by eight years waiting for a visa interview, or six years waiting for I-526 approval followed by four years waiting for a visa interview. If an investor faces a long visa number wait regardless, she may even welcome a long I-526 processing time for the sake of extending child age-out protection.

Consider the China-born investor who files I-526E in February 2025, becoming China High Unemployment investor #2,301. This investor can expect to wait for a visa for as long as it takes for those 2,300 earlier investors to get I-526E approval and then visas, with their spouses and children. The visa wait time is paced by annual High Unemployment visa availability, even if USCIS is very efficient in adjudicating petitions.

I-526E processing can make a difference for backlogged investors if it allows jumping the queue. If all Rural investors get priority processing and fast I-526E approvals, then swift processing gives no individual advantage in competing for Rural visas. But if one Rural investor gets I-526E approval earlier than others, that Rural investor has a chance to skip ahead of others in the Rural backlog and reduce her visa number wait time.

If you can shorten your I-526E processing time relative to others competing for the same visa, then you can shorten your visa wait time. This is demonstrated by India-born investors with priority dates in November 2019, a major backlog month. A few November 2019 investors already have visas today, thanks to their luckily having received I-526 approvals and filing visa applications ahead of the crowd. Other November 2019 investors are still waiting for visas, because they received I-526 approval together with others from the same date and the resulting crowd caused the Visa Bulletin to retrogress.

I-526E processing is broadly but not strictly first-in-first-out. Three investors who file Rural I-526E on the same day may receive approvals months apart depending on factors such as I-956F approval timing, Mandamus litigation, expedite approvals, and luck. A non-FIFO I-526E approval can give an advantage for visa timing.

A cap-limited country like China or India can get more than 7% of EB-5 visas if the visas would otherwise go unused. When “rest of the world” demand is too low to absorb available visas, then unused visas can be allocated to applicants from cap-limited countries even above 7%. The unused visas are allocated to whichever country’s applicants have the earliest priority dates.

The USCIS Adjustment of Status FAQs page explains,

Under INA 202(a)(5)(A), if the total number of visas available in one of the employment-based categories for a calendar quarter exceeds the number of qualified immigrants who may otherwise be issued such visas, the visas made available in that category will be issued without regard to the per-country numerical limitation.

EB-5 Unreserved – the largest visa category – has regularly had more visas available than it is possible to issue to countries other than China and India. For example, FY2024 had over 14,000 Unreserved visas available. Theoretically, country caps could limit China and India to about 1,000 visas each of these visas (7%), leaving the remaining 12,000 visas available to the Rest of the World. In practice, however, Department of State was only able to issue about 4,000 FY2024 visas to “rest of world” applicants – due to some combination of low ROW demand and scheduling problems. What could Department of State do with the remaining 8,000 FY2024 visas? To avoid wastage, it allocated these extra visas to the oldest applicants waiting from cap-limited countries. Since China has the oldest Unreserved priority dates, China ultimately received over 9,000 FY2024 Unreserved visas.

Can China or India expect more than 7% of Rural or High Unemployment visas? It depends on answers to questions about supply and demand in these categories.

(1) Overall Demand Question: Are there more visa applicants than visas available?

Answer for Rural and High Unemployment: Not yet, but soon.

Through mid-2025, the number of qualified Rural and High Unemployment visa applicants has been low – much lower than annual visa availability. Therefore, visas have been issued through mid 2025 without regard to country cap limits. For example, of the 4,000+ Rural visas available in FY2024, only 331 were issued. Of the 331 visas issued, 60% went to China and 28% to India (reflecting relative demand, not any quota or cap limit).

Through mid-2025, the number of potential Rural and High Unemployment visa applicants has remained large – much larger than forthcoming annual visa availability. Therefore, Rural and High Unemployment visa issuance will predictably be restricted by country caps in the future. For example, investors filed over 4,000 Rural I-526E through 2024.This far exceeds the 2,000 annual Rural visas typically available to investors plus spouses and children.

(2) Country-Specific Demand Question: Will there be enough Rest of World applicants to take the maximum number of visas available to ROW?

Answer for Rural and High Unemployment: Yes for High Unemployment and maybe for Rural

High Unemployment typically has 1,000 annual visas. China and India could each be limited to 7% of these visas so long as ROW can generate demand for the remaining 86%, i.e. about 860 annual applicants. By January 2025, nearly 2,000 Rest of World investors had already filed High Unemployment I-526E. With the addition of spouses and children, this will maximize ROW High Unemployment visa availability for many years to come. China and India only have opportunity to access more than 7% of High Unemployment visas to the extent that (1) slow I-526E processing prevents ROW investors from becoming visa applicants and claiming visas, and/or (2) most ROW investors choose to take Unreserved rather than High Unemployment visas.

Rural typically has 2,000 annual visas. China and India could each be limited to 7% of these visas so long as ROW can generate demand for the remaining 86%, i.e. about 1,720 annual applicants. By January 2025, nearly 800 Rest of World investors had filed Rural I-526E. With the addition of spouses and children, this might be sufficient to maximize ROW Rural visa availability for one year. However, Rural demand up to 2024 is not sufficient to guarantee a large supply of ROW Rural visa applicants for years to come. The number of Rural visas left for China and India will depend on the unknown number of Rural ROW investors who are continuing to enter the pipeline in 2025 and beyond. If ROW Rural demand falls, and/or if many ROW Rural investors choose Unreserved visas, then future years may see some annual Rural visas allocated to China and India above 7%.

USCIS provides data on I-485 Adjustment of Status on two reports on the Immigration and Citizenship Data page.

The “Application for Adjustment of Status (Form I-485) Quarterly Report” includes filing/receipt data, but the data is itemized by filing location (field office or service center), not by visa category. EB-5 adjustments account for some portion of the I-485 filed and processed at the California Service Center. However, the report does not give data specific to EB-5 I-485 receipts.

The “Pending Applications for Employment-Based Preference Categories” report, published monthly, does provide I-485 data itemized by visa category. The Pending Applications report shows the number of EB-5 Unreserved, Rural, High Unemployment and Infrastructure I-485 pending at any given time, for applicants chargeable to China, India, Mexico, Philippines, and Rest of World. Comparing differences between two monthly pending reports can support a rough estimate for the number of petitions filed and processed between the two periods.

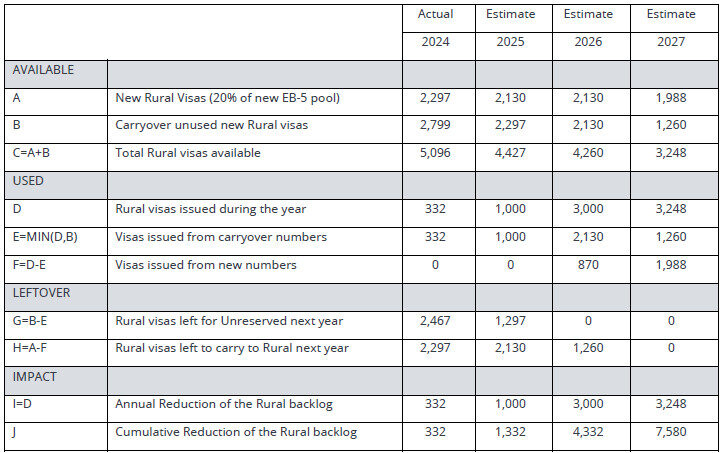

When reserved visas go unused in Year 1, they carry over to the same reserved category in Year 2. If still unused in Year 2, then they are released to Unreserved EB-5 in Year 3.

Table 1 illustrates how each year’s Rural visa supply is calculated as a function of the previous year’s visa usage. High Unemployment and Infrastructure visa calculations follow the same logic. In the near term, annual reserved visa issuance is falling far below available supply due to processing delays, resulting in many visas left to carry over. As more I-526E approvals produce more visa applicants and more visas issued, fewer and fewer visas will be left to carry over.

Table 1. Example Rural Visa Availability and Usage Calculation

When issuing Reserved visas, Department of State will first distribute carryover numbers from the previous year, before using numbers newly-issued that year. As illustrated in Table 1, this policy has the result of maximizing the number of new issue Reserved visas that can carry over in the same category for the following year.

No one official source synthesizes EB-5 backlog information, or predicts future visa wait times. USCIS and the Department of State publish raw data relevant to the EB-5 backlog. People within the EB-5 industry have made efforts to collect and analyze the data, and to draw conclusions.

Sizing up EB-5 backlogs requires tracking how many people are entering backlogs by filing I-526 and I-526E, where people currently are in the backlogs (before or after I-526E approval, in consular processing or I-485 adjustment), and at what rate and in what order people are moving through the process (receiving I-526E approval, receiving visas). It is also relevant to track family sizes, approval rates, and visa supply. Government sources provide data for these factors.

The USCIS Immigration and Citizenship data page publishes data for forms processed by USCIS.

The Department of State Immigrant Visa Statistics page provides links to a variety of reports related to visa supply and visa issuance.