For more than three decades, the EB-5 Program has generated substantial economic benefits for the United States. Between FY2016 and FY2019 alone, the EB-5 Program has created 1.7 million jobs, generated $75 billion in private investment, and paid $122 billion in wages to American workers—all at no cost to U.S. taxpayers. Additionally, economists also found that, on average, each EB-5 investor has created 45 American jobs, and every $500,000 raised through the EB-5 Program has leveraged an additional $1.6 million in private investment. [1]

In recent years, the EB-5 Program faced significant headwinds, including short-term reauthorizations, prolonged processing times, and visa retrogression. These challenges drove a steady decline in EB-5 investment inflows after FY2015, dropping to just $483 million in FY2022.

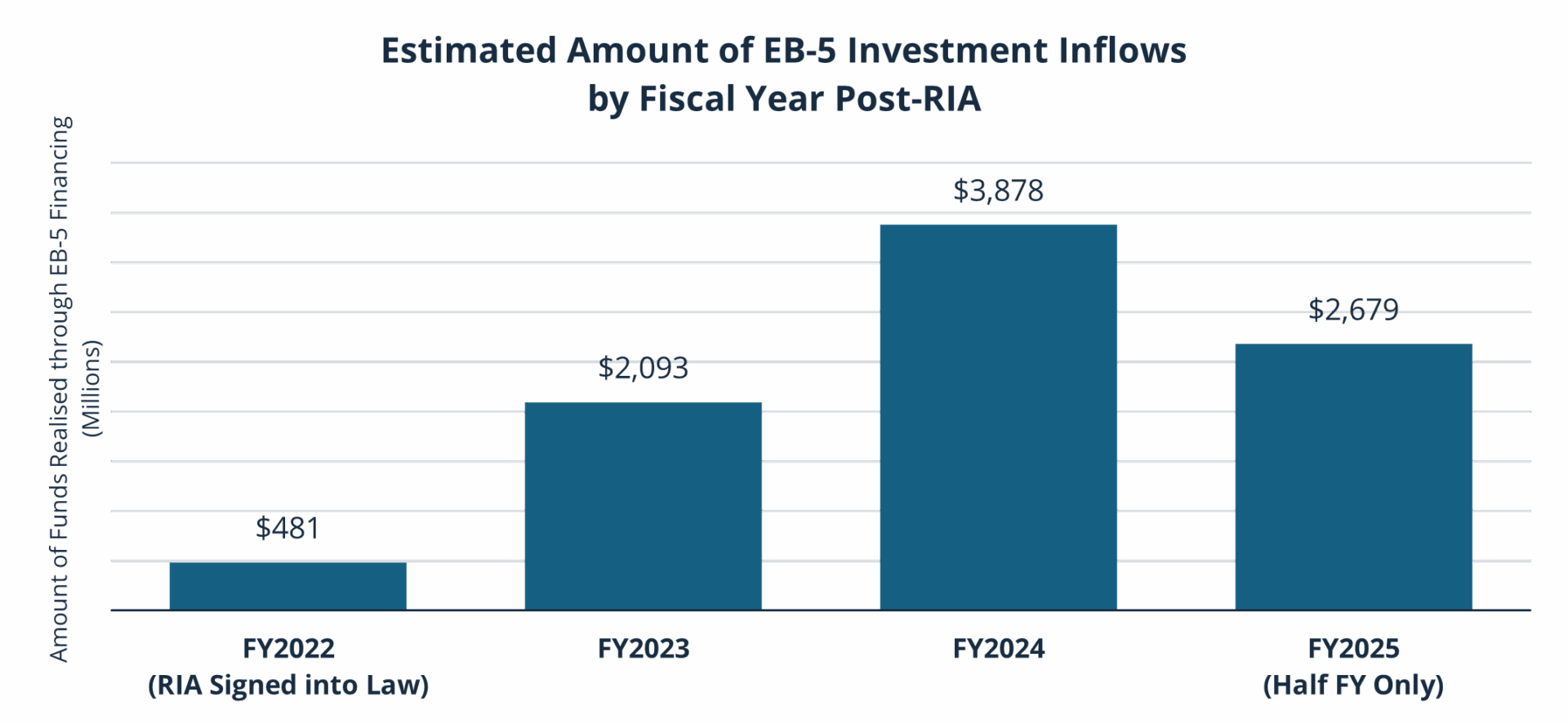

After Congress enacted the EB-5 Reform and Integrity Act (RIA) in 2022, EB-5 investment inflows rebounded significantly. In FY2024, EB-5 capital investment had surged to nearly $3.9 billion, and in only the first half of FY2025 alone, the EB-5 Program had already attracted over $2.7 billion in capital investment, supporting job creation and local economic development across communities nationwide.

The RIA reauthorized the Regional Center Program for five years and introduced meaningful reforms that have revitalized the EB-5 Program — including visa set-asides, priority processing, enhanced integrity measures, and good-faith investor protections. These changes have fueled a strong rebound in demand for EB-5 visas since FY2022, positioning the Program as an even more powerful driver of U.S. economic growth. This resurgence, however, sets the stage for the visa demand and backlog challenges Suzanne Lazicki discusses in a later section. Data from U.S. Citizenship and Immigration Services (USCIS) already confirm the steady increase in EB-5 investment inflows following the RIA. As the EB-5 industry’s national trade association, IIUSA has also collected and analyzed data on EB-5 projects, examining how the RIA is reshaping the Program and channeling investment into different communities across the country.

Rural Investment Surge Following the RIA

One of the biggest developments under the RIA is the significant increase in EB-5 investment for projects located in rural America. According to USCIS data, more than 2,800 EB-5 investors have invested in a rural EB-5 project between 2022 and 2024. In just the first three years after the RIA became law, over $2.2 billion in EB-5 investment has already been raised for job-creating projects in various rural communities.

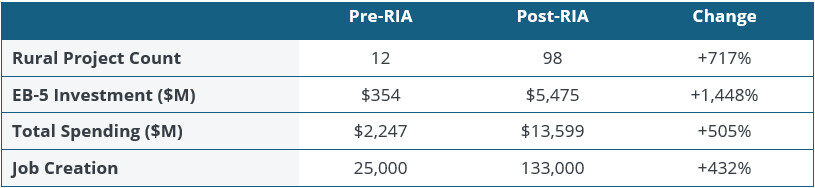

IIUSA’s analysis indicates that the number of EB-5 projects in rural areas has grown by more than 700% since the RIA was enacted, with the amount of EB-5 investment in rural communities increasing by nearly 1,500%. According to IIUSA data, in the first 32 years of the EB-5 Program, fewer than 15 EB-5 projects were located in a rural area. By contrast, in just three years under the RIA, nearly 100 rural EB-5 projects have already been initiated, raising at least $5.5 billion in EB-5 investment and creating more than 133,000 jobs across rural areas that previously saw little EB-5 activity. Furthermore, by leveraging EB-5 capital as part of the project’s capital stack, these post-RIA rural EB-5 projects are generating over $13.6 billion in private investment for rural regions.

Set-aside visas and priority processing for the rural projects, introduced by the RIA, have been vital in channeling EB-5 investment toward unserved rural communities. The surge in rural EB-5 projects has helped create jobs in a variety of industries beyond real estate, including manufacturing, energy, telecommunications, infrastructure, and more. For instance, in Osceola, Arkansas, more than $200 million in EB-5 investment has been raised after the RIA to support the development of a technologically advanced and environmentally sustainable scrap metal recycling steel rebar facility, resulting in 4,600 high-quality, good-paying manufacturing jobs in a community with a median household income of only $40,800. In rural West Virginia, which previously had no EB-5 activity, the Program is now helping to finance a $216 million energy project focused on natural gas production and related infrastructure. In Virginia’s Northern Neck region, EB-5 investment is now also supporting the Accelerated Fiber Deployment Initiative, which aims to bring high-speed internet to 80,000 unserved homes and businesses across 19 counties, creating 1,700 American jobs in these rural communities.

Geographic Redistribution of EB-5 Capital Post-RIA

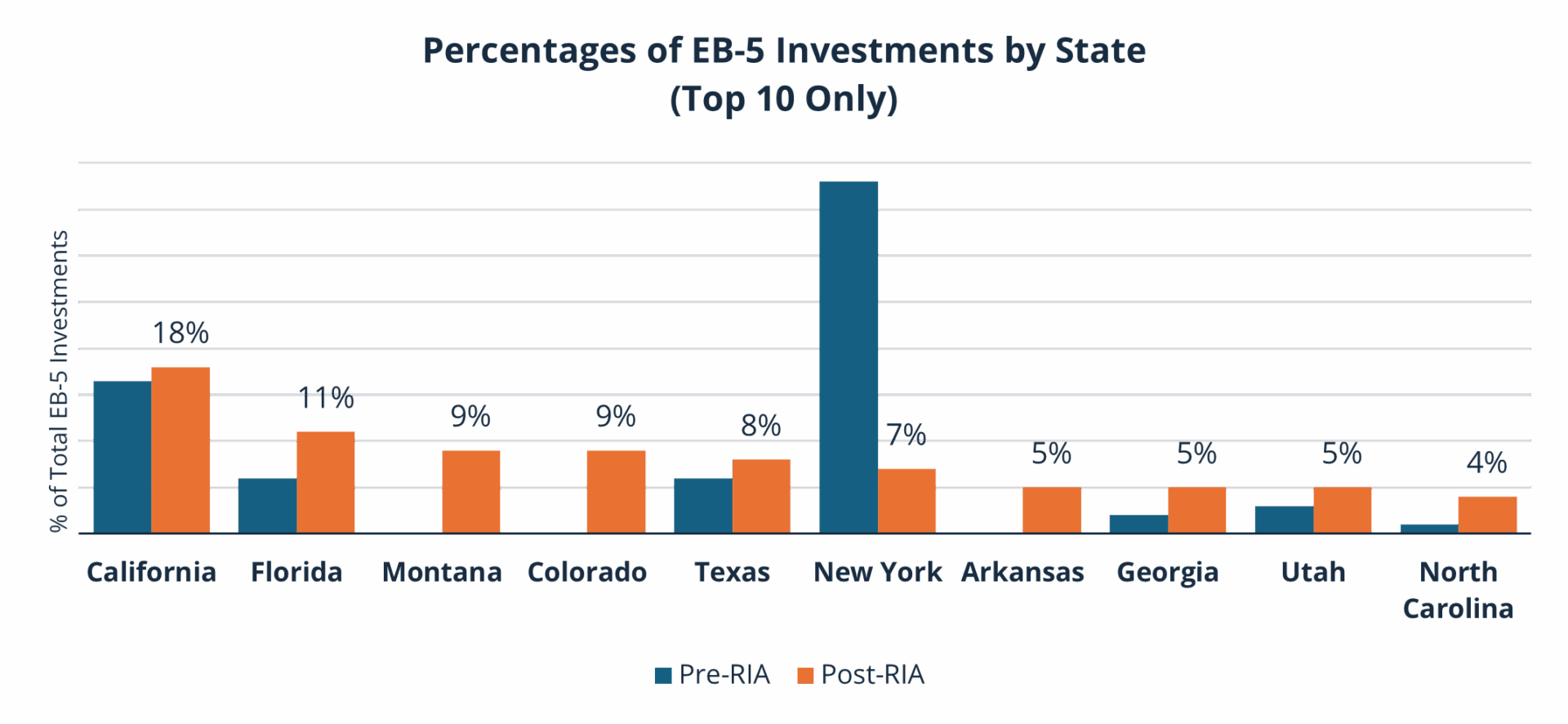

Data from IIUSA also reveals a shift in the geographic distribution of EB-5 projects following the RIA. While traditional hubs like California and Florida continue to host a significant number of EB-5 projects, other states are emerging as new designations for EB-5 capital.

For example, according to IIUSA data, rural states such as Montana and Colorado, which previously accounted for less than 0.5% of total EB-5 investment prior to the RIA, now each represent nearly 9% of post-RIA EB-5 fundraising. Rural communities in Arkansas, Georgia, and Utah have also seen major increases in EB-5 activity, now representing about 5% of total EB-5 investment under the RIA. In contrast, New York, which previously accounted for nearly 38% of pre-RIA EB-5 capital formation, now makes up only 7% of post-RIA EB-5 fundraising.

DownloadEB-5 After the RIA White Paper

Investors aren’t the only ones benefiting from the passing of the EB-5 Reform and Integrity Act (RIA) in March 2022. As the most comprehensive legislative reform in the Program’s history, rural states throughout the United States have seen transformative effects from EB-5 financed projects.

CanAm’s white paper brings together leading voices from across the EB-5 stakeholder community to reflect on the RIA’s powerful effects and measure the Program’s impact to date like never before.

Watch the Webcast: Navigating the Future of EB-5

In a recent CanAm webinar, Chief Operating Officer Christine Chen sat down with Aaron Grau, Executive Director of IIUSA, and Lee Li, IIUSA’s Director of Policy Research and Data Analytics. Their wide-ranging conversation covered everything from the grandfathering timeline to new filing trends, updated adjudication data, rural investment growth, and what the pathway to a permanent reauthorization could look like.

About the Author

Lee Y. Li

Lee Y. Li

Director of Policy Research & Data Analytics, IIUSA

Lee Y. Li joined Invest in the USA (IIUSA) in 2015 and leads the association’s research and data analytics initiatives. He produces regular reports on USCIS processing trends, EB-5 visa usage, backlog forecasts, and investor market analyses, while managing IIUSA’s industry data resource, interactive maps, and dashboards to inform EB-5 policy discussions. Mr. Li also spearheaded EB-5 economic impact studies in collaboration with leading think tanks and academic institutions. He holds a Master of Science degree from Johns Hopkins University and a Master of Public Policy from Loyola University Chicago. Originally from China, Mr. Li speaks Cantonese and Mandarin in addition to English, and now lives in Washington, DC.

References

[1] The EB-5 Program: Driving American Prosperity Through Foreign Investment by Fourth Economy. https://iiusa.org/wp-content/uploads/2025/08/EB-5-Impact-Report_4E_2016-2019.pdf